How Finalyse can help

Integrating climate change risk into your ORSA, governance and risk-management system

Helping you comply with the regulations as well as optimising your Economic Balance Sheet (EBS)

Designed to incorporate climate-related and environmental risk considerations into your risk management, governance, ICAAP and disclosures

Written by Maciej Smółko, Senior Consultant

About TCFD (Task Force on Climate-Related Financial Disclosures)

The TCFD is arguably the most influential among numerous voluntary frameworks for climate-related disclosures. Established in December 2015 by the G20 Financial Stability Board, TCFD played a key role in popularising framing climate change as a major source of risk. TCFD uses the Paris Agreement’s target of staying well under 2°C (global mean temperature increase compared to pre-industrial level), with the ambition of staying under 1.5°C and aims at creating a set of tools that would allow businesses to align with that goal. Its division of climate risk into physical and transition risks, including defining the subtypes of transition risk (policy and legal, technology, market and reputation risk), is almost a market standard.

TCFD recommendations

The recommendations focus on four key areas:

- Governance: the organisation’s governance around the management of climate-related risks and opportunities.

- Strategy: the current and future impacts of climate-related risks and opportunities on the organisation’s strategy and financial planning.

- Risk management: the processes used by the firm to identify, assess, and manage climate-related risks.

- Metrics and targets: used to assess and manage relevant climate-related risks and opportunities.

UK will be the first G20 country to align disclosing climate-related risks and opportunities with the TCFD recommendations (for largest firms, with gradual implementation until 2025), followed by some other non-European jurisdictions, e.g. New Zealand.

Currently, there are no plans to make TCFD mandatory in the EU. However, some EU directives are embedding these and other standards in a slightly modified form in the EU regulatory framework.

TCFD in 2022 – more companies are on board

Every year, the TCFD Status Report announces the number of companies supporting the framework and discloses the required information. As of this year, 3,800 organisations are complying with the TCFD Recommendations, with a stable increase since its inception. Over 1,500 of these organisations are financial institutions responsible for $217 trillion of assets (TCFD, 2022). Europe remains the leading region reporting 60% on average across the 11 recommended disclosures.

Source: TCFD (2022)

The biggest achievement of TCFD - Companies improved governance over climate issues

The biggest achievement of TCFD is the progress related to the board's oversight of climate-related topics. The TCFD recommendations on governance helped many companies to establish climate risk internal accountability structures and to allocate responsibility to specific senior executives. For climate-related issues, having the support of people on the board makes a difference between Corporate Social Responsibility (CSR) being an integral part of a bank's strategy rather than merely a Public Relations activity. Progress in this area is worth noting. Unfortunately, despite clear improvements, there are also some problematic areas.

TCFD shortcoming: Lack of comparability with different standards

TCFD has a very limited area where it overlaps with other major voluntary (Sustainability Accounting Standards Board (SASB), Global Reporting Initiative (GRI)) or obligatory (Sustainable Finance Disclosure Regulation (SFDR), Corporate Sustainability Due Diligence Directive (CSDDD)) standards.

Similarly to ESG ratings with embarrassingly low correlations to each other (Stackpole, 2021), climate disclosures are another element of the broadly understood ESG universe that suffers from multiple competing methodologies and a lack of strong market consensus. All that makes navigating through different systems a fiendish exercise.

Further increase in interoperability would align with the Financial Stability Board’s (FSB) expectations, whose chair recently emphasised the need for standard setters to work faster to avoid hardwiring differences between their disclosure standards. (Jones, 2022).

TCFD reports are not uniformly treated by companies

The best illustration is that some of them put the disclosures as standalone reports, some embed them within their annual financial statements, and some within sustainability/ESG reports. This diversity of approaches complicates the research and jeopardizes the primary function of these documents – supporting informed, efficient pricing of risks related to climate change.

Moreover, methodologies and approaches to data and reported metrics vary across the companies. Many disclosures still have only qualitative nature, even if the spirit of the standard asks for a mix of quantitative and qualitative data.

Most firms report only partial data which may give the impression of cherry-picking

According to TCFD (2022), "For the fiscal year 2021 reporting, 80% of companies disclosed are in line with at least one of the 11 recommended disclosures; however, only 4% disclosed are in line with all 11 recommended disclosures". It is fair to assume that this fact is not caused by banks' bad will. The lack of data and harmonisation of TCFD with other regulations makes collecting the information from stakeholders all but trivial.

The consequences are predictable; if the firm discloses only partial data, a non-informed observer may assume (correctly or not) that the key aspects could be missing. According to research done at ETH Zurich (Bingler et al., 2022), the adoption of TCFD recommendations had no significant impact on the disclosures of supporting companies.

Unfortunately, reports of companies are sometimes inconsistent with each other on a year-on-year basis. There are known cases of firms being praised by non-governmental organisations (NGOs) for the traceability of their targets only to change the metrics reported in the next financial year. Changes like this additionally impede comparability.

It is fair to say that TCFD suffers from a set of defects common for "self-regulating" systems where policies are not enforced: lack of incentives to cooperate, conflicts of interest, insufficient accountability, moral hazard, or even free-riding participants.

Analysis of selected disclosures

Strategy - scenario analysis

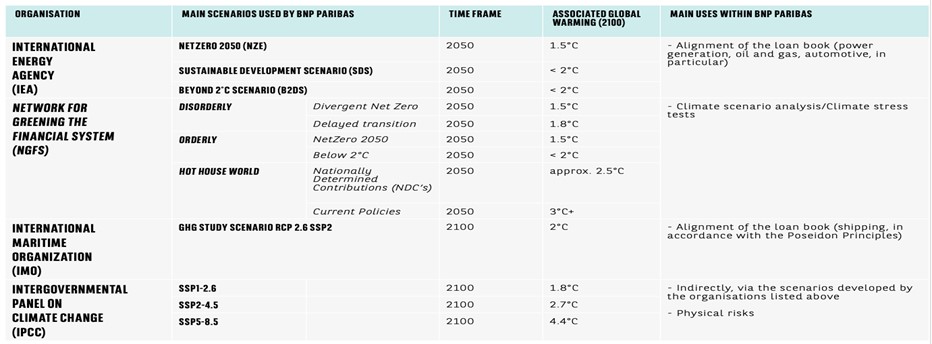

Disclosure C in the strategy part (also referred to as 3.3) asks companies to describe the resilience of the organisation’s strategy, considering climate scenarios, including a 2°C or lower scenario. Additionally, scenarios consistent with increased physical climate-related risks should also be considered where relevant to the organisation.The standard defines additional guidance for insurance companies, especially those with substantial exposure to weather-related events, to consider greater than 2°C scenarios.

Across the 11 recommended disclosures, the scenario analysis remains the least disclosed at 19% for banks and 25% for insurance companies (TCFD, 2022).

These difficulties are in line with the exercise that banks often mention in this section of their TCFD report, that is ECB stress tests (ING, 2022; BNP Paribas, 2022). This exercise highlighted deficiencies in the data acquisition process for climate-related data and methodological shortcomings (Vanweddingen, 2022). Since climate-related scenario analysis is work-in-progress, the relatively lower coverage of this particular element for banks should not be surprising.

Source: BNP Paribas (2022)

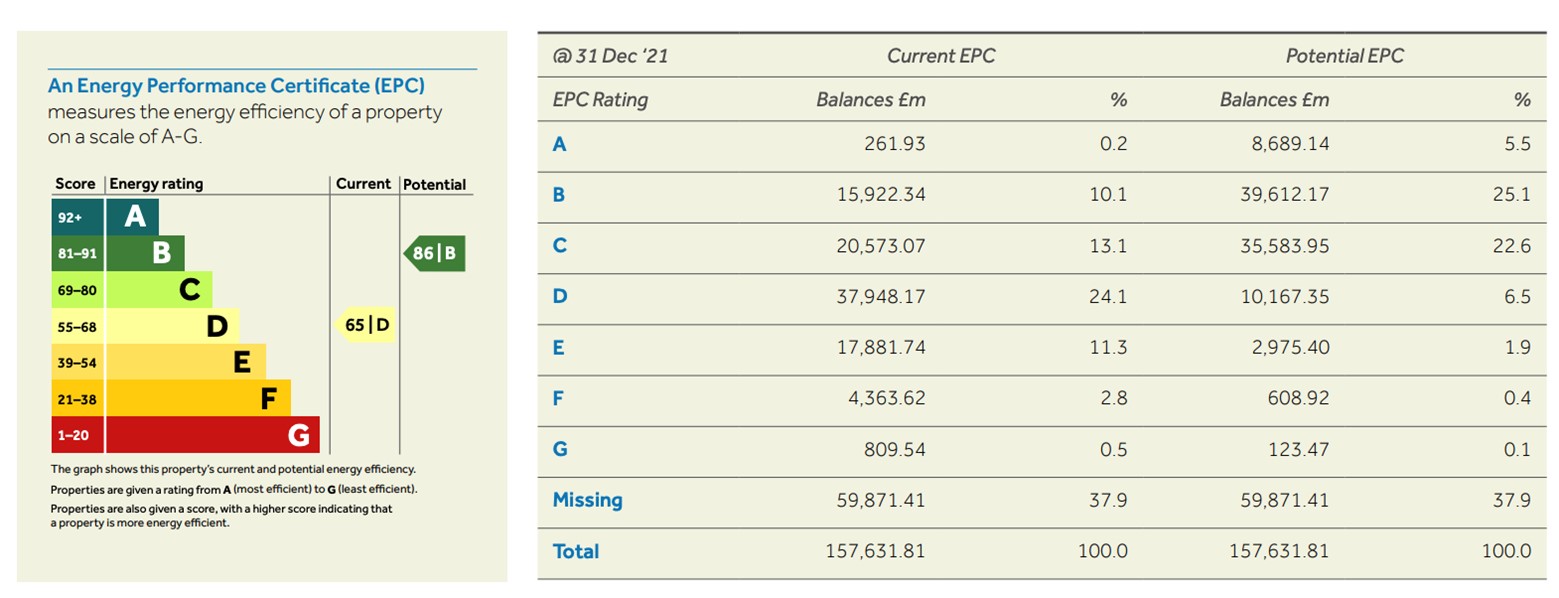

Source: Barclays (2022)

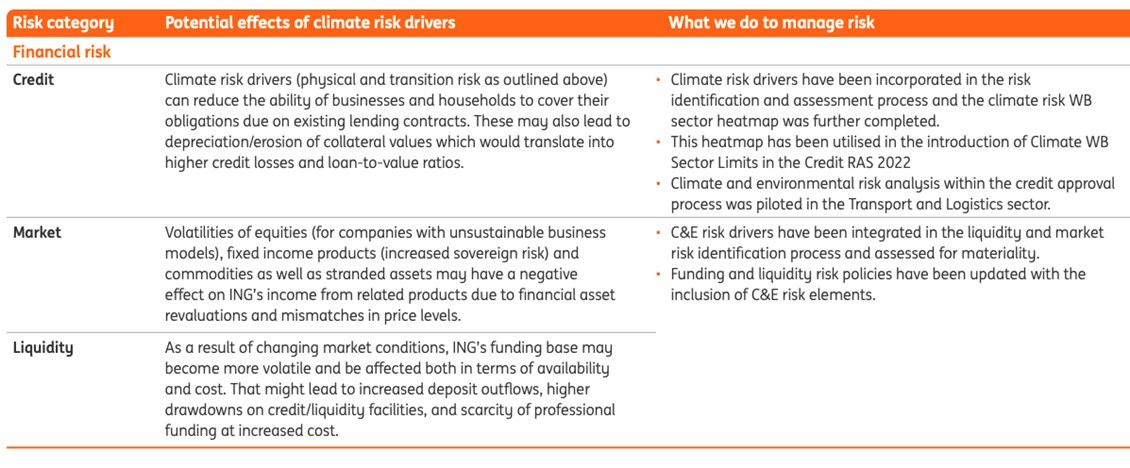

Risk Management – integrating climate change into overall risk management

The latest status report recorded the highest increase of banks reporting this disclosure. It should not be surprising; many regulators, including ECB (2020), in their guidance on climate-related risks, pay attention to the aspect of transmission channels and impacts on the risk profile of financial institutions.

Due to the atypical features of climate risks, their integration into risk management is not a painless task. However, it still has practical consequences, e.g. for the prudential frameworks applied to banks. Basel Committee on Banking Supervision (BCBS) investigates the extent to which climate-related financial risks should be explicitly incorporated into the existing Basel framework (Tajti, 2022).

European regulators consistently emphasize that banks need to speed up the development of climate-related risk models data collection to fill all the existing gaps and to fully integrate climate risks in their risk management framework (Mazza, 2022). Banks that were meticulous in their TCFD exercises should have an easier task ahead as they have already made some progress.

Unfortunately, the vast majority of the banks’ disclosures concerning the integration of climate factors into existing processes are still mostly qualitative, which contradicts TCFD's recommendations of having an appropriate balance between qualitative and quantitative information (TCFD, 2017). However, even with qualitative disclosures, it is possible to distinguish some good practices.

Source: ING (2022)

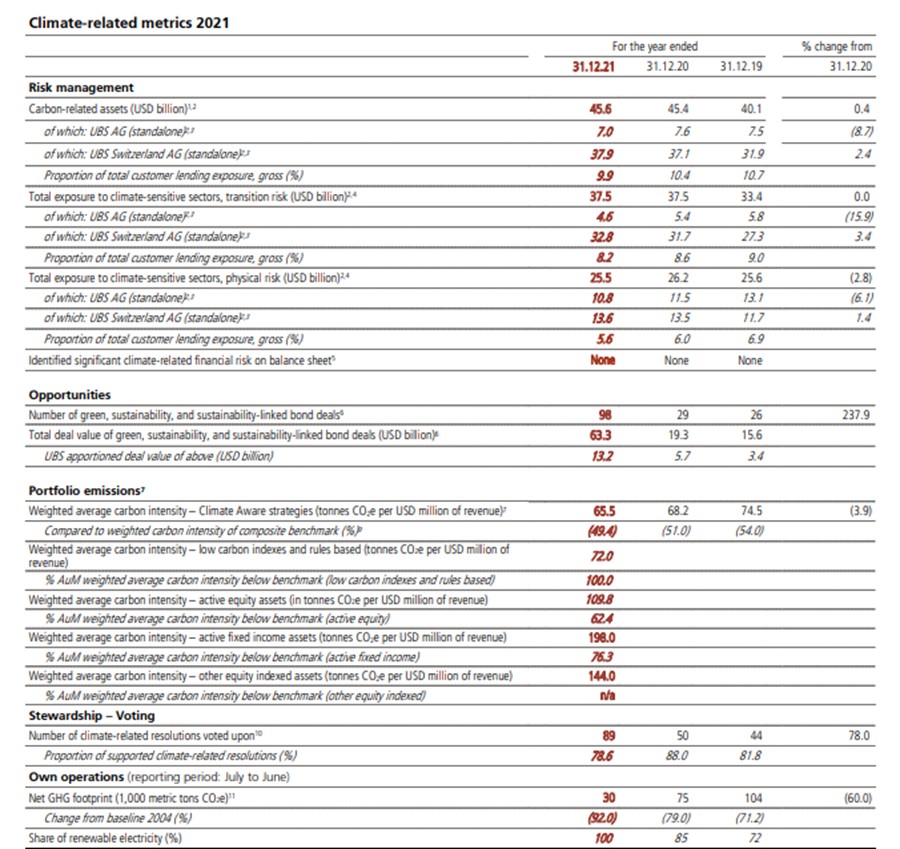

Metrics and Targets – measuring the impact

The heart of the TCFD is the Metrics and Targets section, that should allow the reader to assess the changes in capital allocation to carbon-intensive sectors and assess whether climate-related risks and opportunities are in line with company strategy and risk management processes disclosed earlier.

The analysis of metrics published by the biggest banks exhibits the problems mentioned above, with some key dimensions not being reported. The selection of metrics is often based on what is available rather than what is the most relevant; It is commendable that a bank has reduced its paper consumption but that is a relatively insignificant information compared to how the bank allocates billions of euros it manages. Moreover, even the part that is almost by definition quantitative often lacks traceable data. Again, lack of data and harmonisation with other regulations is not making delivering crucial metrics easier, so too big criticism towards banks would not be fair.

Source: UBS (2022)

Changing the nature of the reports from voluntary to obligatory (e.g. including TCFD metrics in Pillar 3 Basel disclosures) and harmonising other regulations applying to banks could solve some of those issues. Earlier this year, we covered EBA’s technical standards on Pillar 3 disclosures for Environmental, Social and Governance (ESG) risks published on January 24th, 2022, by the European Banking Authority (Synadino & Caers, 2022) — half of the templates published by the EBA relate to physical or transition risks. The standards were developed in alignment with the TCFD recommendations and integrated metrics included in the Task Force’s supplemental guidance (TCFD, 2017). Under the EU’s Capital Requirements Regulation (CRR), large financial institutions are required to disclose information on their ESG risks, including climate-related risks, with gradual implementation starting from 2022 (first reporting snapshot date December 31st 2022) (TCFD, 2022).

Conclusion

TCFD is incredibly influential. Some of its metrics became a standard glossary for climate-related risks. However, a high level of discretion left by the standard limits incentives to report potentially damaging data. Lack of consistency in structures and metrics limits the usefulness of TCFD reports for third parties.

Voluntary disclosures may be insufficient to incentivise financial companies to change their behaviour. Despite that fact, those exercises are still worth doing.

Working on TCFD reports is beneficial as it prepares for other regulatory and supervisory requirements. TCFD is referenced in regulatory documents in many jurisdictions. The developed solutions are embedded in local policies even if the framework is not applied directly (like in the UK).

Banks that seriously treat TCFD have a head-start to adapt to regulatory, business and market needs in terms of data collection, stakeholders’ engagement and calculation methodologies.

Some initial signs suggest that we may observe further unification of climate-related disclosures standards, with TCFD being one of the building blocks. Considering the increasing ambition of the European Central Bank’s climate agenda (see ECB, 2022) and limited human resources available on the market, banks using a wait-and-see approach may soon find themselves in a disadvantageous position.

If the institutions are uncertain about further development of the supervisory expectations, TCFD may be a good start for building strong reporting capabilities.

References

- Barclays (2022) Barclays PLC Climate-related Financial Disclosures 2021. Available at: home.barclays/content/dam/home-barclays/documents/investor-relations/reports-and-events/annual-reports/2021/Barclays-TCFD-Report-2021.pdf (Accessed: October 29, 2022).

- Bingler, J. A. et al. (2022) Cheap talk and cherry-picking: What ClimateBert has to say on corporate climate risk disclosures. ETH Zurich. Available at: doi.org/10.1016/j.frl.2022.102776 (Accessed: October 26, 2022).

- BNP Paribas (2022) In A Changing World, Let’s Accelerate The Energy Transition And The Incorporation Of Climate Related Issues. Available at: cdn-group.bnpparibas.com/uploads/file/tcfd_report_2021_eng.pdf (Accessed: October 29, 2022).

- ECB (2020) Guide on climate-related and environmental risks Supervisory expectations relating to risk management and disclosure. ECB. Available at: www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.202011finalguideonclimate-relatedandenvironmentalrisks~58213f6564.en.pdf (Accessed: November 4, 2022).

- ECB (2022) Walking the talk. Banks gearing up to manage risks from climate change and environmental degradation. European Central Bank. Available at: www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.thematicreviewcerreport112022~2eb322a79c.en.pdf (Accessed: November 4, 2022).

- ING (2022) 2021 Climate Report. Available at: www.ing.com/web/file (Accessed: October 29, 2022).

- Jones, H. (2022) G20 watchdog tells climate standard setters not to hardwire differences. Reuters. Available at: www.reuters.com/business/sustainable-business/g20-watchdog-tells-climate-standard-setters-not-hardwire-differences-2022-10-11/ (Accessed: November 4, 2022).

- Stackpole, B. (2021) Why sustainable business needs better ESG ratings, MIT Sloan. Available at: mitsloan.mit.edu/ideas-made-to-matter/why-sustainable-business-needs-better-esg-ratings (Accessed: October 27, 2022).

- TCFD (2017) The Use of Scenario Analysis in Disclosure of Climate-Related Risks and Opportunities. Technical Supplement, Task Force on Climate-Related Financial Disclosures. Available at: assets.bbhub.io/company/sites/60/2021/03/FINAL-TCFD-Technical-Supplement-062917.pdf (Accessed: October 26, 2022).

- TCFD (2022) 2022 Status Report, Task Force on Climate-Related Financial Disclosures. Available at: assets.bbhub.io/company/sites/60/2022/10/2022-TCFD-Status-Report.pdf (Accessed: October 26, 2022).

- UBS (2022) Climate Report 2021. Available at: www.ubs.com/global/de/sustainability-impact/net-zero/_jcr_content/mainpar/toplevelgrid_2069146059/col3/tile_copy_copy.1278436393.file/bGluay9wYXRoPS9jb250ZW50L2RhbS9hc3NldHMvY2Mvc3VzdGFpbmFiaWxpdHktYW5kLWltcGFjdC9kb2MvMjAyMi91YnMtY2xpbWF0ZS1yZXBvcnQtMjAyMS1lbi5wZGY=/ubs-climate-report-2021-en.pdf (Accessed: October 29, 2022).

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support