Related Articles

Solvency II

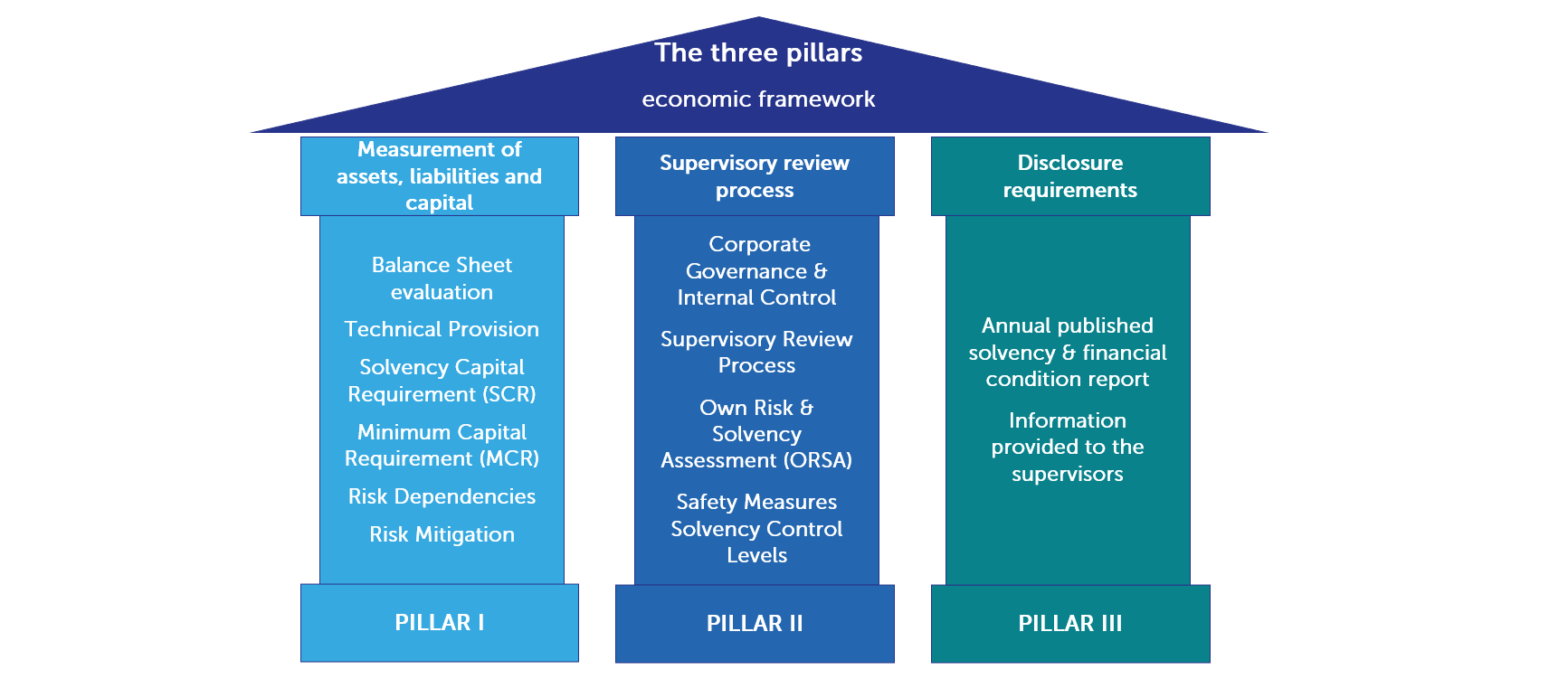

The Solvency II regime introduced on 1 January 2016 is a harmonised, sound and robust prudential framework for insurance firms in the EU. It is based on the risk profile of each individual insurance company in order to promote comparability, transparency and competitiveness.

Finalyse offers you a comprehensive set of managed services and tailored solutions. Partner with Finalyse and let us take care of your compliance with Solvency II regulations.

How does Finalyse address your challenges?

HoAF Support:

Assist with the calculation of technical provisions including assessing appropriateness of the methods, models, assumptions and data and populating QRT's, SFCR and RSRs.

Capital Modelling support:

Production of the Solvency II Capital Requirements and supporting analysis including maintaining capital model is maintained in line with the internal governance framework systems.

ORSA support:

Capital planning and capital optimization, production of ORSA projections and stresses, communicating complex concepts and recommendations to multiple stakeholders and influencing decisions through sound analytical rationale.

SAA support:

Specifying asset classes, defining objectives and constraints, forming capital market expectations, establishing asset class bandwidths, validating the optimal allocation and optimizing the asset mix.

Strategic and operational:

Actuarial support on strategic initiatives, streamline the actuarial process and enhancements to the Actuarial Function including policies, processes and tools.

Peer reviews:

Review of assumptions, methodologies, material uncertainties and potential deteriorations, expert judgement, appropriateness of models and reasonableness of the HoAF’s conclusions.

Key Features

- Finalyse offers extensive experience and expertise on both the asset and liability sides of the balance sheet, which provides the necessary scope of knowledge and skills to help determine the solution that is optimal for your business.

- Leverage on our experience in areas beyond financial reporting, such as actuarial models, IT systems including data management and storage capacities, risk management including ALM and hedging, product design, business strategies and remuneration.

- You can choose from a comprehensive set of managed services and tailored solutions to support you with various elements of Solvency II compliance, such as implementation of the key functions, performing and reviewing technical calculations, actuarial model development, risk management (including ALM and hedging), ORSA production and reporting.

- You can also fully outsource the various key functions required by Solvency II to Finalyse by appointing one of our senior experts with previous experience to fulfil these functions.

Francis is a Principal Consultant in charge of our insurance practice in Dublin. He has 15 years of experience within the life and non-life (re)insurance industry. His expertise covers the areas of financial reporting, prudential regulation, and actuarial modelling. Francis has worked in both industry and consulting with extensive exposure to Solvency II and BMA-regulated clients and a keen eye on new regulatory developments.

François-Xavier is a Principal Consultant with advanced expertise in Financial Markets, ALM and Risk Management, covering both banks and insurance companies. On the banking side, François-Xavier is a practice leader on Valuation, IRRBB, FRTB, VaR, Initial Margin and Counterparty Risk, well acquainted with the regulatory requirements and the market practices surrounding market risks. On the insurance side, François-Xavier has extended experience in the regulatory treatment of financial instruments, ORSA, and hedging balance sheets against interest rate, credit spread and inflation risks.

Divyank is a Senior Consultant with more than 8 years of experience and a part qualified Actuary. He has acquired expertise in Solvency II, IFRS17 and MCEV reporting and has worked for life and non-life business. He has extensive experience in Prophet modelling, DCS, statutory valuation and IFRS17 implementation and his coding skills include Prophet and DCS modelling, SAS, VBA, R.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support