How Finalyse can help

Agile and comprehensive assessment, measurement and management of your market and liquidity risks

Helping you comply with the Solvency II regulations as well as optimising your Solvency II balance sheet

Helping you comply with the regulations as well as optimising your Economic Balance Sheet (EBS)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

Francis is a Principal Consultant in charge of our insurance practice in Dublin. He has 15 years of experience within the life and non-life (re)insurance industry. His expertise covers the areas of financial reporting, prudential regulation, and actuarial modelling. Francis has worked in both industry and consulting with extensive exposure to Solvency II and BMA-regulated clients and a keen eye on new regulatory developments.

Sovereign bonds, particularly US Treasuries, have long been considered the safest assets in the financial system. Their liquidity, stability, and creditworthiness make them a cornerstone of institutional portfolios, especially for insurance companies managing long-term liabilities. But recent market turbulence has exposed vulnerabilities in this traditionally low-risk asset class.

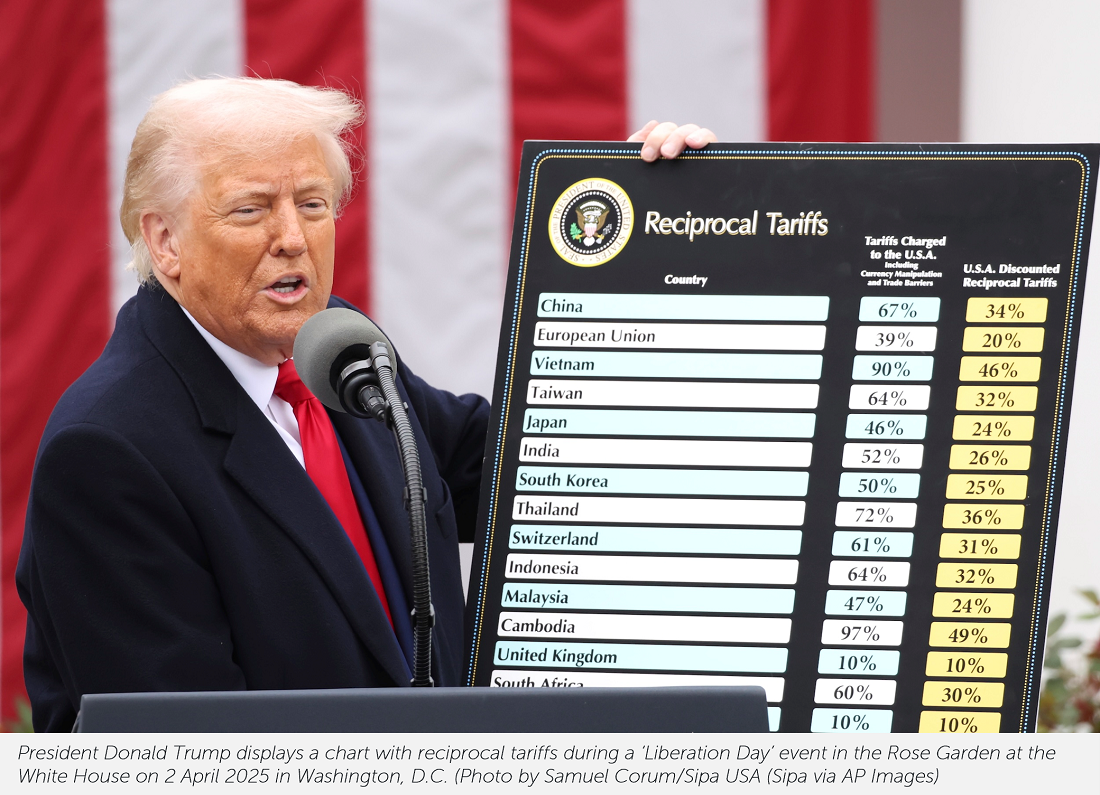

Earlier this month, President Donald Trump announced a surprise 90-day pause on proposed tariffs - reportedly in response to instability in the Treasury market. Yields spiked, auctions underperformed, and volatility surged, prompting concern across global markets. For insurers holding large volumes of Treasuries, this episode offers a timely reminder: even the safest assets can carry significant market, liquidity, and systemic risk.

And it is not just U.S. Treasuries at stake - many other government bonds across advanced economies are also seeing steep price declines, revealing the broader fragility of global sovereign debt markets once seen as near-infallible.

For the purposes of this blog post, the terms “sovereign bonds” and “government bonds” are used interchangeably to refer to debt issued by national governments, including U.S. Treasuries, UK Gilts, and other similar instruments.

What This Blog Will Cover

This article explores the evolving risk landscape for insurance companies holding sovereign bonds, including:

- The Role of Basis Trade Unwinding

- The Global Market Sentiment and Sovereign Debt Outlook

- An overview of the specific types of financial and systemic risks insurers face in today’s environment

- Considerations for Long-Term and Short-Term Liabilities

- Practical steps insurers should take within their ORSA and CISSA frameworks to address these risks proactively

The Role of Basis Trade Unwinding

A key contributor to the recent spike in Treasury yields was the unwinding of a popular hedge fund strategy known as the “basis trade” which is a form of “arbitrage”. This trade involves shorting Treasury futures while buying the equivalent cash bonds, capturing the small spread between the two. Because the returns on this trade are minimal, hedge funds typically use significant leverage - sometimes as high as 40 to 50 times - to amplify profits.

However, when market volatility rises or liquidity deteriorates, these trades become vulnerable to margin calls and forced selling. That’s precisely what unfolded in early April 2025 as traders exited basis trades en masse, selling off large volumes of cash Treasuries, pushing yields higher (and prices lower), thus accelerating the market dislocation.

While not the sole cause, this dynamic played a significant role in amplifying the bond sell-off, revealing just how fragile the Treasury market can be when leveraged players are forced to unwind positions under pressure.

Global Market Sentiment and the Sovereign Debt Outlook

Recent market developments are also raising new concerns for insurers exposed to sovereign debt. The unusual combination of rising U.S. Treasury yields, and a falling dollar, suggests investors are pulling back from U.S. assets, despite higher returns - an indicator of growing uncertainty about America’s fiscal and political direction.

One of the key risks for insurers is foreign investor sentiment. Foreign investors hold an estimated $8.5 trillion of U.S. government debt - nearly a third of total debt, with private institutions holding more than half. If these investors lose confidence, large-scale selloffs could push yields higher, disrupting the assets insurers rely on.

Markets are also starting to price-in a fiscal risk premium on Treasuries, once seen as the global risk-free benchmark. Meanwhile, the Federal Reserve’s ability to stabilise markets is constrained by inflation and political interference.

For insurers, this shifting landscape underscores the need to reassess sovereign bond exposure and evolve solvency frameworks accordingly.

Key ORSA and CISSA Risk Areas

Insurance companies are required to assess their risk exposures through frameworks such as the Own Risk and Solvency Assessment (‘ORSA’) under the EU’s Solvency II regime, or in the case of Bermuda, through the Commercial Insurers Solvency Self-Supervisory Assessment (‘CISSA’). Within these frameworks, several key risks related to sovereign debt exposure warrant focused attention.

First, insurers should conduct stress testing for fixed income market shocks. Scenario analyses should incorporate potential shocks such as sharp interest rate increases, widening spreads between government bond futures and cash bonds, and liquidity freezes in the secondary market. These exercises help gauge an insurer’s ability to absorb losses and maintain adequate liquidity under systemic stress conditions.

Asset-liability matching reviews form an essential next step. Many insurers rely on government bond derivatives - such as futures and swaps-to synthetically manage portfolio duration. ORSA and CISSA reviews should evaluate how these instruments perform under stress and to and assess the implications of forced portfolio rebalancing under unfavourable conditions.

Liquidity contingency planning is another critical area. Although government bonds are typically considered liquid, market dislocations can make them difficult to sell at scale. Insurers must have clear contingency plans in place, including alternative funding sources and a quantified understanding of their exposure to potential fire-sale scenarios.

In addition, insurers must address systemic risk and counterparty exposure. The Treasury ecosystem is deeply intertwined with hedge funds, primary dealers, and money-market funds. ORSA and CISSA assessments should account for the indirect exposures created through derivatives and securities lending, as these can become sources of contagion during times of financial stress.

Finally, board and regulator communication plays a vital role. It is essential that boards understand the evolving risk profile of Treasury and other Government holdings, especially given their critical role in balance sheet management. ORSA and CISSA provide structured formats for reporting these risks, and regulators increasingly expect comprehensive, forward-looking disclosures that demonstrate strong risk governance.

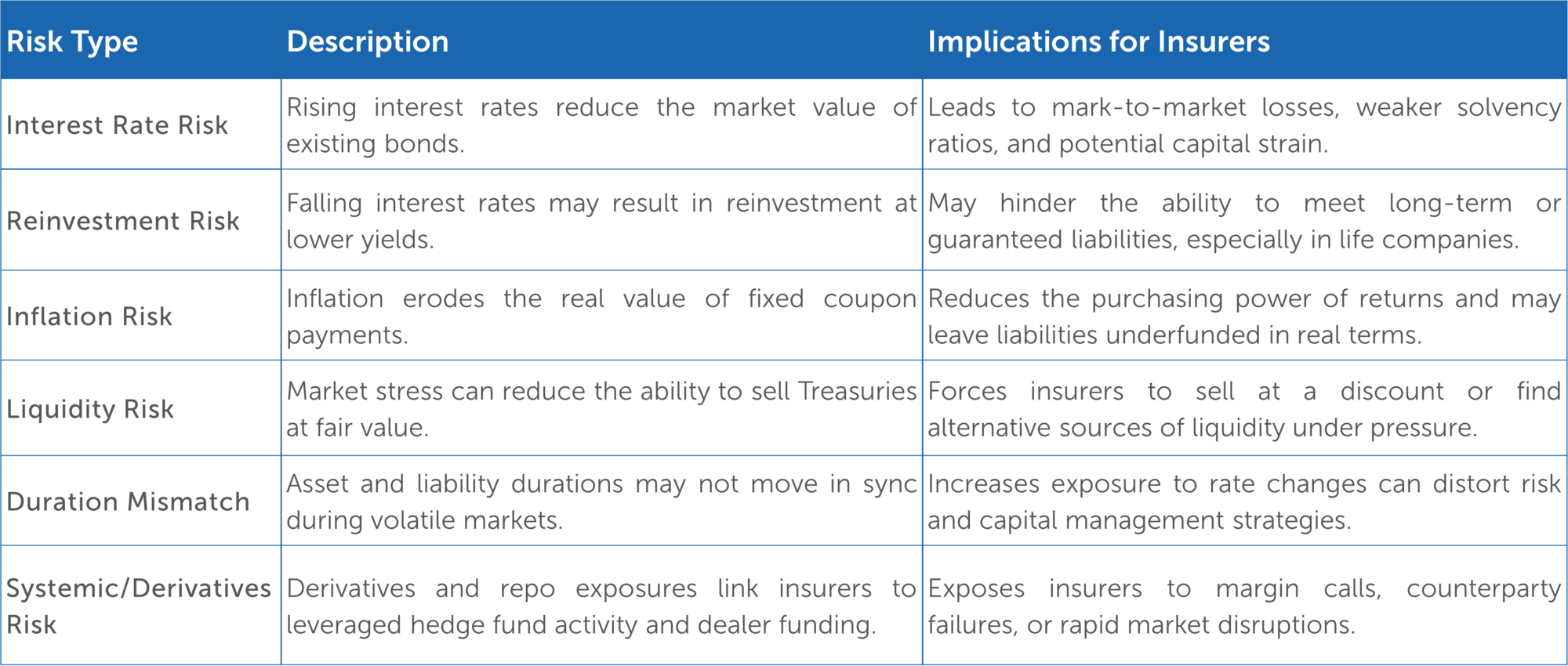

Overview of the Risks for Insurers Holding Sovereign Bonds

The table below summarises the key financial and systemic risks insurers face when holding sovereign bonds in today’s evolving market environment.

Considerations for Long-Term and Short-Term Liabilities

Insurers typically manage both long-term and short-term liabilities, each presenting unique challenges when backed by U.S. Treasuries.

For long-term liabilities, such as annuities or whole life policies, interest rate risk, duration matching, and reinvestment risk are primary concerns. These require careful asset-liability matching and monitoring of how derivative strategies behave under market stress.

Short-term liabilities, such as claims, policyholder withdrawals, and operating expenses, demand a strong focus on liquidity. Even though sovereign bonds are highly liquid under normal conditions, market disruptions can temporarily reduce their tradability or force sales at unfavourable prices.

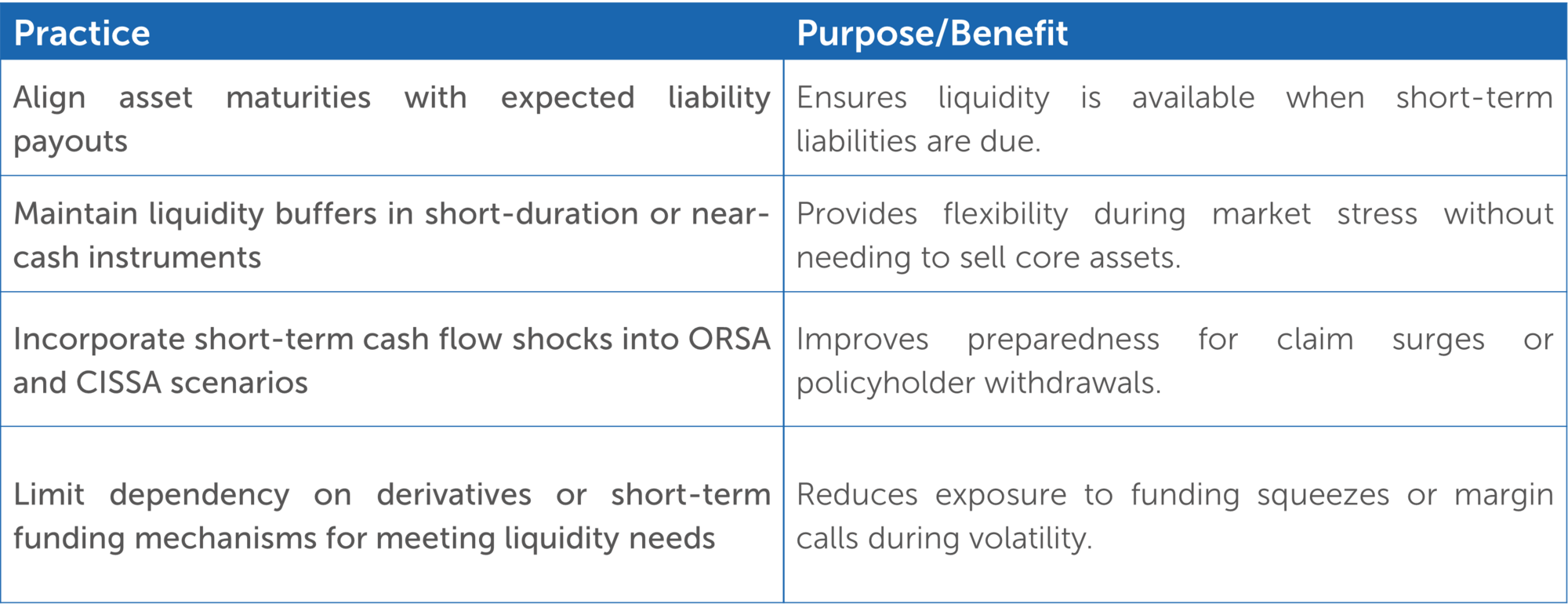

Best Practices for Managing Sovereign Bond Exposure

Conclusions

Government bonds remain central to insurers’ investment strategies. But recent market movements - triggered in part by geopolitical developments, including policy decisions by figures like former President Trump - have shown that the assumption of safety must be balanced with an understanding of market function, liquidity, and systemic interdependence.

By enhancing their ORSA and CISSA frameworks to reflect these sovereign bond-related risks, insurers can improve both internal resilience and regulatory confidence. As the financial system becomes more interconnected and policy-sensitive, managing the full spectrum of sovereign bond-related risks is not just prudent-it is essential.

In a world where even the safest assets demand scrutiny, insurers must move beyond compliance-toward proactive foresight and integrated risk governance.

How Finalyse Can Help

Navigating the evolving risks associated with sovereign bonds requires more than reactive compliance - it demands strategic foresight, technical depth, and robust modelling capabilities. Finalyse is uniquely positioned to help insurers adapt with confidence.

We support our clients by:

- Enhancing ORSA and CISSA frameworks with forward-looking stress testing and scenario design, incorporating macroeconomic and geopolitical risk factors.

- Building dynamic asset-liability management (ALM) models that account for duration mismatch, market volatility, and derivative exposures.

- Quantifying liquidity and systemic risk exposure, including simulations of fire-sale scenarios, basis trade unwind impacts, and funding pressure sensitivity.

- Advising on regulatory engagement, helping insurers clearly communicate their risk posture to boards and supervisors using best-practice documentation and disclosures.

- Embedding ESG and governance overlays into solvency planning, recognising the growing relevance of fiscal policy and sovereign stability in capital frameworks.

With our deep regulatory expertise, actuarial modelling capabilities, and cross-border experience, Finalyse helps insurers turn today’s uncertainty into a platform for resilience and smarter capital management.

Contact us today to explore how Finalyse can help you strengthen your sovereign bond risk management. Whether it's enhancing your ORSA/CISSA framework, designing robust stress scenarios, or assessing liquidity under extreme conditions — our experts can tailor solutions to fit your unique liability profile and regulatory environment. Be prepared not just for compliance, but for resilience in an increasingly complex market.

Frequently Asked Questions

While sovereign bonds have historically been viewed as safe due to strong credit ratings and liquidity, recent market volatility — including events like leveraged basis trade unwinds and geopolitical uncertainty — has exposed vulnerabilities. These include interest rate sensitivity, liquidity constraints during stress, and systemic interdependencies with hedge funds and money markets.

Insurers should account for interest rate shocks, liquidity stress, and counterparty exposures within their ORSA (Own Risk and Solvency Assessment) or CISSA (Commercial Insurers Solvency Self-Assessment). This includes conducting stress tests, evaluating derivative strategies, preparing liquidity contingency plans, and assessing potential systemic impacts from market dislocation.

Best practices include aligning asset maturities with liability timelines, maintaining liquidity buffers, limiting reliance on derivatives for short-term funding, and incorporating macroeconomic and geopolitical risks into scenario analysis. Enhancing governance frameworks and communication with regulators and boards is also critical for resilience.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support