Written by Zsuzsanna Tajti, Principal Consultant

Introduction

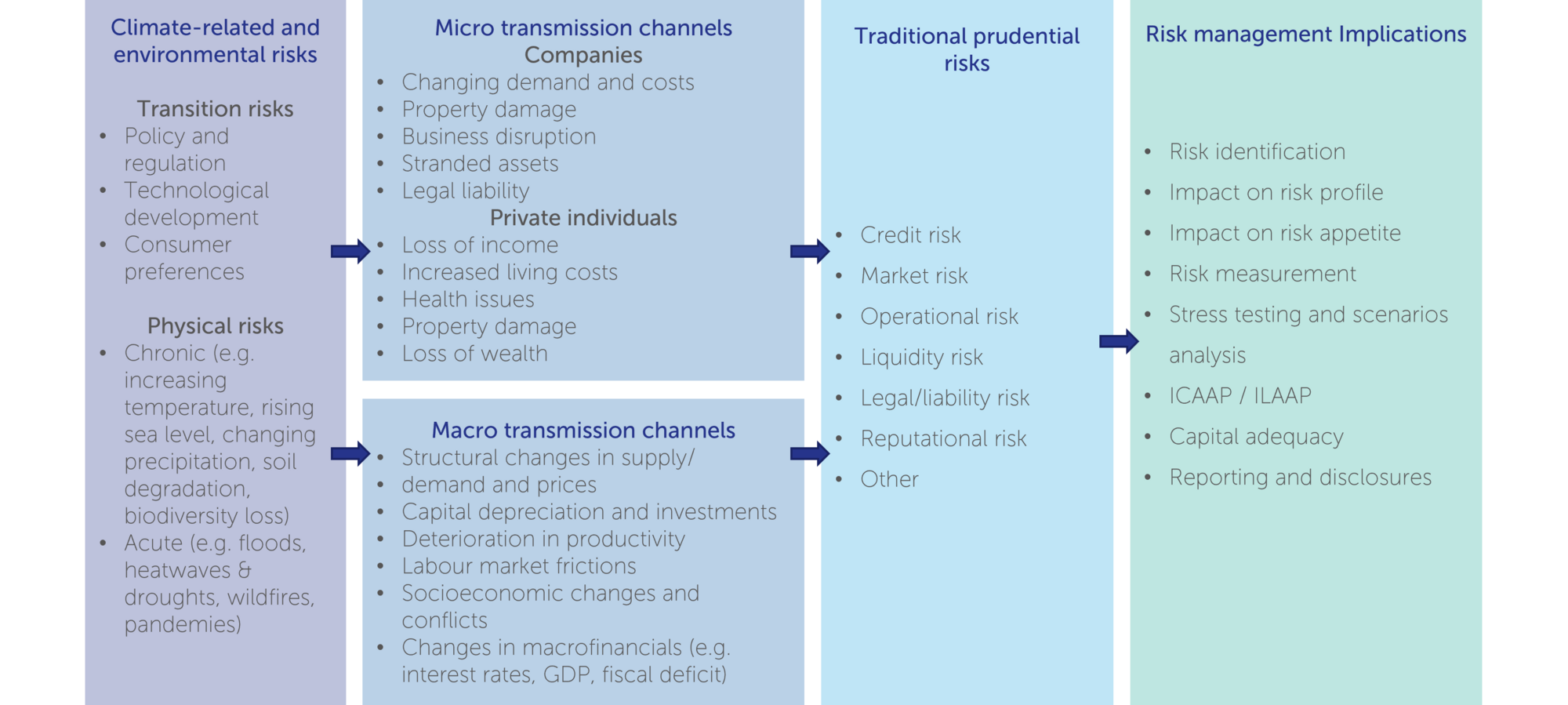

Environmental risks1 and the corresponding challenges, such as transition to a sustainable economy, will have important consequences to various aspects of our lives. For instance due to climate change the frequency and severity of physical risk events are expected to increase, and transition risks will also likely manifest from environmental regulations and policies, technological developments and changing consumer preferences.

Due to the unique features of these risks (such as the combination of short and medium to long-term impacts, nonlinearities and potential tipping points) extensive work is underway both at the European and international levels to assess the extent to which they require urgent regulatory measures in addition to already existing frameworks. In this article we provide an overview of the microprudential framework’s most relevant shortcomings and their potential remediations.

The roles of the different pillars

The EU’s prudential framework is based on the Basel framework. Its main purpose is ensuring the sound capitalization of institutions and fostering prudent risk management to mitigate any disruptions to the financial system. Although it includes mechanisms that allow the inclusion of new risk drivers, the forward-looking nature of environmental risks is not explicitly addressed under Pillar 1. However, it is important to recognise that the Pillar 1 own funds requirements do not have to cover all risks. Pillar 2 additional own funds requirements, based on institution-specific analysis performed by competent authorities, together with the Pillar 2 guidance allow appropriate consideration of different business models and specific risks, and can address the idiosyncratic aspects of environmental factors. Furthermore, any systemic aspects of such risks would need to be tackled by the macroprudential framework.

In May 2022 the European Banking Authority (EBA) published a discussion paper on the role of environmental risks in the prudential framework, enquiring whether targeted amendments are necessary and sufficient to effectively address them. The risk-based approach aims to ensure that the prudential requirements reflect the underlying risks and support institutions’ resilience, therefore the EBA’s focus was on exploring whether there are risk differentials of for instance assets associated with green or environmentally2 harmful activities. In parallel, at the international level the Basel Committee on Banking Supervision (BCBS) is also investigating the extent to which climate-related financial risks should be explicitly incorporated in the existing Basel framework, and its findings or policy recommendations will be also considered in the EBA’s final report, together with the conclusions of the European Commission High-Level Expert Group on Sustainable Finance, among others.

Beyond these work tracks, there is a consensus that certain risks, such as risks which are not fully captured by Pillar 1 and risk factors which are external to the institutions, should be treated under Pillar 2 instead. The potential amplifying affects of interactions and interdependencies among environmental risk drivers, their forward-looking nature, the risk concentration at regional and/or sectoral level, among others, certainly call for additional steps outside of Pillar 1 as well. To facilitate their due consideration and integration, both regulators and financial institutions are for instance working on incorporating climate risks into stress testing. For insights into the European Central Bank’s (ECB) recent climate stress test exercise, we refer to the previously published article: ‘The 2022 ECB climate stress test results – a roadmap towards future best practices’.

The ECB’s good practices guidance on developing sound climate risk data infrastructure and stress testing frameworks is expected to be disseminated in December 2022. In parallel with the stress test, in the first half of 2022 the ECB conducted an extensive supervisory assessment of institutions’ practices related to strategy, governance and risk management in the environmental risks’ domain, the preliminary conclusions of which can be consulted in our recent article: ‘2022 ECB Climate and Environmental risks agenda: preliminary indications’.

Additional efforts are being made for integrating environmental aspects into Pillar 3 too. For instance the EBA as part of its 2022 Annual Work Program monitors the implementation of the ESG disclosure standards. The corresponding Pillar 3 reporting requirements are already applicable with first snapshot date of end-2022, requesting institutions to publicly disclose granular environmental information.

In this article we mainly focus on Pillar 1 aspects, and although environmental risks can materialise through various prudential risk types, we address only the ones which are most relevant from materiality viewpoint, namely credit, market and operational risks.3

Credit risk

A Standardised Approach (SA) and an Internal Ratings Based (IRB) Approach are available for institutions to calculate risk-weighted exposure amounts and consequently Pillar 1 own funds requirements for credit risk. The SA allows only limited risk sensitivity, yet it will become relevant for credit risk exposures under the IRB Approach too, as the CRR 3 proposal introduced an output floor which is based on the SA.

Standardised Approach (SA)

The SA operates with supervisory determined risk weights which are in many instances flat per exposure class (or further broken down depending on specific characteristics of the exposure), yet the CRR allows the use of external credit ratings to determine risk weights for certain exposure classes. Environmental aspects are expected to get transparently incorporated into the rating methodologies over time with the development of data, standards, tools and methodologies. Although they are currently not explicitly factored into the mapping between external credit assessments and the prudential scale of credit quality steps either, it may not even be necessary once they got integrated in the credit assessments.

As regards the credit risk mitigation framework, as well as the risk weights assigned to exposures secured by immovable properties, environmental risks may already be embedded through collateral (re)valuation, and their inclusion is expected to improve over time. Additionally, the existing infrastructure supporting factor already includes some environmental criteria which could be mirrored to further integrate such considerations.

Internal Ratings Based (IRB) Approach

Under the IRB Approach, own funds requirements are calculated based on the PD (Probability of Default), LGD (Loss Given Default), CCF (Credit Conversion Factor) and M (Effective Maturity) parameters. If those models are not able to adequately integrate environmental risks yet, application of overrides and/or further differentiation of the risk weight formula can be considered as alternatives, however, any of these options would come with modelling-related difficulties.

In the rating models’ development one of the main challenges is recognizing the expected increase in the frequency and impact of environmental risks, for instance by using expert judgement. Another important question relates to whether risks which have not led to historical credit losses yet, could still be incorporated into the models, knowing that they would likely result in model performance deterioration. Although subjective inputs may be useful, expected future changes in environmental risks could only be incorporated to the extent that they will likely materialise in a relatively short term.

Additionally, in LGD modelling a special difficulty comes from the requirement that the estimates must be adequate for downturn conditions, while validation of any environmental downturn period may be difficult due to insufficiency of empirical information. Furthermore, the margin of conservatism to address any data-related or methodological deficiencies and uncertainties must be quantified based on existing data, and any adjustments to the risk estimates would have to be complemented by representativeness analysis which could lead to frequent recalibration and instability.

As of today, the available data series may not include adequate and sufficient information about losses due to environmental events or trends, and the lack of observations presents difficulties in identifying relevant risk drivers and uncertainties on transforming them into financial risk indicators, but these problems are expected to get gradually solved by more historical data becoming available, and the first steps can be already taken based on partial information. For instance, collateral valuation, which is an important input of LGD modelling, already often includes certain elements of environmental risks (for instance energy efficiency or location of immovable properties).

Adjustment factors

Considering dedicated treatments for green and/or environmentally harmful exposures, the introduction of risk weight adjustments would be very straightforward if the Taxonomy-based classifications of such exposures were risk-based and reflected the credit quality of exposures. Environmental-related adjustment factors4 would increase/decrease capital requirements for environmentally harmful/sustainable exposures, and thus dis-incentivise/incentivise financing according to their environmental impact.

One of the criteria of applying the current infrastructure supporting factor relates to environmental aspects, which could be strengthened by allowing its application only if the project contributes to at least one environmental objective of the EU Taxonomy and the exposure is of higher credit quality. There are, however, concerns around the potential implementation and application of any adjustment factors, such as the need for clear evidence that certain assets display distinct risk profiles due to environmental risk drivers, overcoming classification challenges and avoidance of double counting in case such risk considerations are already captured through other Pillar 1 mechanisms, therefore they are not considered as preferred options over the integration into rating models.

Market risk

If environmental risks become a source of market uncertainty, they will ultimately impact the value of financial instruments. While they may not introduce new risk factors, they may affect the magnitude of their shocks, leading to a ‘classical’ risk factor (for instance equity price or exchange rate) being more volatile than historically observed, or being subject to severe jumps. However, it is also important to point out that market risk – unlike environmental risk events – is typically characterised by a short time horizon and frequent shocks.

Standardised Approach

Market risk estimations based on historical data may not adequately reflect the impact of environmental risks, because their manifestations were less frequent and/or less impactful in the past compared to what is expected in the future. Although the inclusion of projections based on forward-looking scenarios would be a logical solution, this represents a significant divergence from the existing approach. Other alternatives could be the creation of a specific risk class or a specific risk factor type, or adjustments to the correlations between risk factors.

If the risk related to certain instruments bearing particular residual risks (such as weather options whose pay-off depends on climate/weather-related events) increases in the future, that may require the recalibration of this part of the framework. In principle, the residual risk add-on framework could be used to capitalise environmental risks, but it is not risk-sensitive in its current form, and its scope would also need to be extended to make it effective in this context.

Furthermore, the Standardised Approach also account for default risk in the trading book in the form of a jump-to-default, and because the nature of that risk is basically credit risk, any solution envisaged in the context of credit risk should potentially be replicated here too.

Internal Model Approach

In the Internal Model Approach institutions have to perform the calibrations based on historical data, shocks applicable to risk factors, in order to ensure that the risk measures used for capital purposes reflect a stress period. Environmental risks could be captured by adjusting the historical data to account for potential future dynamics which have not been observed yet, however, it could affect the accuracy at which the non-environmental-risk-related financial risks are measured and may also lead to double counting if some impact of environmental risks is already covered in the volatility.

In principle any environmental risks should be captured within the internal model as soon as those are material, while the implementation of any additional external-to-model solution could interfere with the current regulatory requirements. In a similar vein, the correlation framework also already embeds some conservatism as there is a broad requirement to protect against correlation scenarios different to those historically observed. Going forward fluctuations in prices and other drivers of market risk factors are expected to materialise to a higher extent, leading to better reflection both in the internal model and in the correlation scenarios.

Finally, as the market risk framework also accounts for default risk, it can be concluded (in analogy with the Standardised Approach) that any solution envisaged in the context of credit risk should potentially be replicated when capturing default risk in the trading book in the Internal Model Approach too.

Operational risk

The Basel III accord sets out the details of the new Standardised Approach to calculate the own funds requirements for operational risks. Whether and to what extent environmental risks will be already captured by the prudential framework depends on the EU translation, as some of the foreseen EU discretions (most importantly the one setting the Internal Loss Multiplier equal to 1) are expected to limit the approach’s built-in sensitivity to operational risk losses.

Environmental risk factors could function as a risk driver of any of the pre-defined loss type categories because they can materialise and impact institutions in very different ways. Such factors appear most relevant in the case of losses related to liabilities resulting in legal and conduct risks (for instance greenwashing), but ‘damage to physical assets’ and ‘business disruption and systems failures’ could be also triggered (for instance if physical events impact the institution’s offices).

The operational risk framework explicitly excludes both strategic and reputational risks, but those are addressed in Pillar 2 due to their highly institution-specific nature. Concerning the risk events which are in scope of the prudential framework, a fundamental issue is that the taxonomy’s current loss event types do not map the triggers for the losses. Another problem is that the Standardised Approach incorporates historical losses only, while environmental risks may increasingly materialise in the future. Consequently, there are basically two potential directions: identifying environmental factors as triggers of operational risk losses on top of the existing risk taxonomy, and/or introducing forward-looking elements in the framework once clear evidence and robust data become available.

Conclusions and the way forward

The main message concerning Pillar 1 is that environmental risks, as drivers of traditional categories of financial risks, may be already reflected in the current risk assessments to some extent, and the remaining gaps can be addressed through targeted amendments, enhancements and clarifications within the framework, without dedicated treatments such as supporting or penalizing factors. Moreover, the prudential framework should be viewed holistically, assigning important roles to Pillar 2 and Pillar 3 processes as well.

Studies on assessing the existence of risk differentials between green and environmentally harmful assets already provide some findings which are worthwhile to consider by institutions when starting explicitly integrating environmental factors for instance in model development and stress testing:

- Real estate properties’ energy efficiency has been found to impact either the collateral value (LGD) or the solvency of the borrowers (PD). Certain weather events also appear to lead to long-lasting negative effects on property prices.

- In terms of impacts of environmental risks on corporates’ PD, credit rating and/or yield spreads through decrease in profitability, potential relevant factors are the companies’ carbon footprint (emissions, intensity), energy consumption, environmental rating/score, carbon risk awareness and the prospect of stranded assets. The green/non-green use of proceeds is also considered to be a relevant factor in project finance loans’ PD, furthermore government transition policies and the companies’ emission reduction commitments also tend to influence the overall risk level.

The prudential framework’s built-in mechanisms will allow gradually improving recognition of environmental risks going forward, therefore at this stage the main emphasis should be on

- collecting environmental-risk-related data to allow robust assessment of risk differentials or specific risk profiles for green or environmentally harmful assets, and

- integrating environmental risk considerations into institutions’ risk management tools and practices, including stress testing and disclosures.

Although the EBA’s final report on the prudential treatment of environmental risks in Pillar 1 (which will allow the European Commission to take policy decisions as necessary) will be published in mid-2023 only, important steps can already be taken by institutions, such as developing ‘climate-adjusted’ (shadow) PD and LGD models and enhancing climate stress testing capabilities. Capturing the impact of environmental risks (prospective financial losses) by identifying future patterns and modelling their potential magnitude is indisputably a major challenge and requires granular data and innovation in forward-looking modelling, but there are ample opportunities for integration into ‘shadow’ models, stress test scenarios and methodologies, depending on the circumstances of each institution, the level of expertise present and the availability of granular data and advanced techniques.

1 In this article we interpret climate-related risks as a subcategory of environmental risks.

2 Social items and their potential correlation with environmental risks will be considered by the EBA in the next phase of the analysis.

3 The analyses have been conducted on the expected future prudential framework, considering the final Basel III standards and the CRR 3 (CRR: Capital Requirements Regulation – Regulation (EU) No 575/2013) proposals, the latter of which is still in the legislative process.

4 These adjustment factors are often referred to as (green) supporting factors and (brown) penalizing factors.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support