Written by

Alexandre Synadino, Consultant

Christophe Caers, Senior Consultant

Introduction

On January 24th 2022 the EBA published its final draft implementing technical standards on Pillar 3 disclosures for Environmental, Social and Governance (ESG) risks. This new set of templates falls under the Pillar 3 framework, designed to promote market discipline through the public reporting of meaningful, and comparable, information on key risks to institutions’ financial position, capital and liquidity.

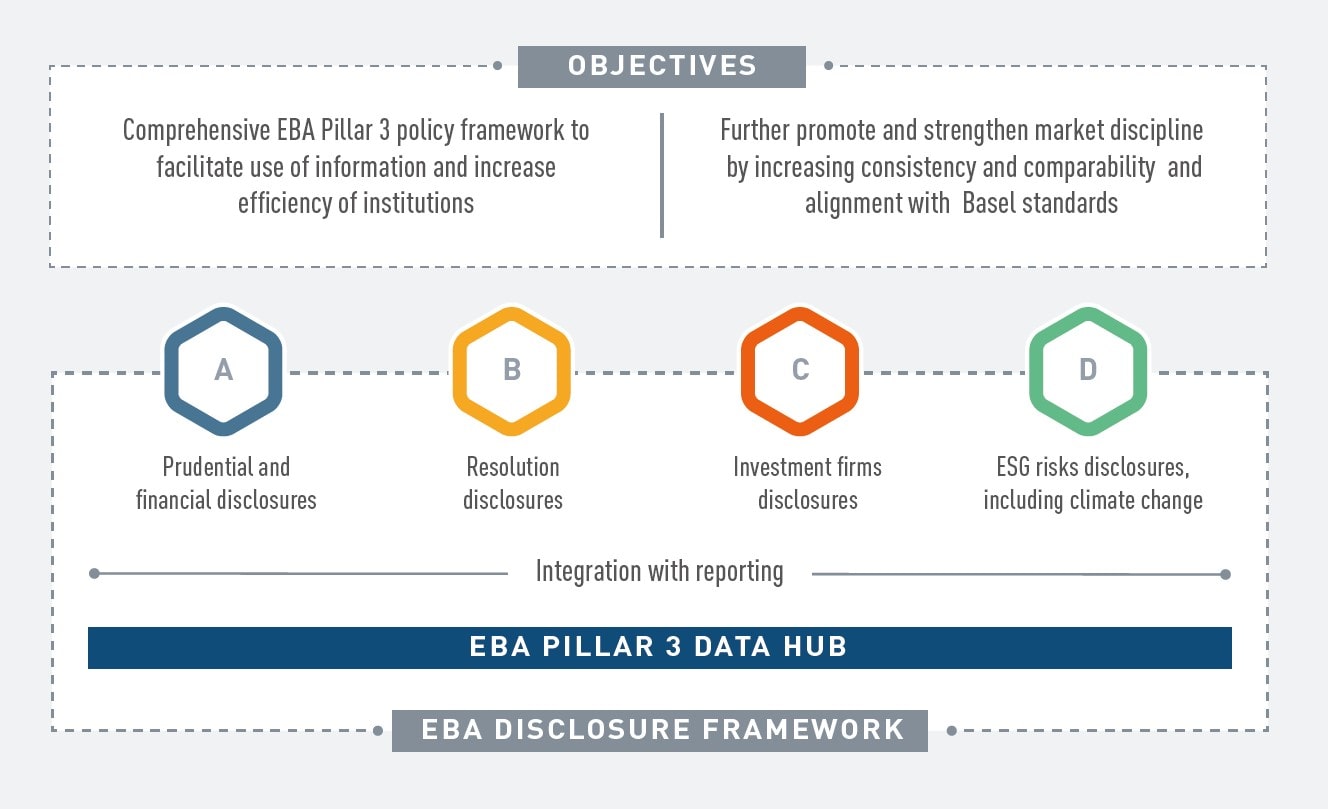

Figure 1: EBA Pillar 3 framework

Due to a growing need for institutions to run themselves responsibility, the EBA’s new set of disclosures pertaining to ESG risks is seen as a “vital tool to promote market discipline, allowing stakeholders to assess banks’ ESG related risks and sustainable finance strategy.” (1) Comparability is a key objective here, as this newly collected data will allow investors and stakeholders to contrast institutions and their activities against each other.

The scope of disclosure is extensive, covering not only ESG-related risks and vulnerabilities but also strategies adopted to mitigate those risks and the actions undertaken to support customers and counterparties in their adaptation/transition to a more sustainable economy. Quantitative disclosures are not limited to outlining balance sheet risks linked to transition and physical risks. A set of templates covering the measurement of the Green Asset Ratio (GAR) are expected to become an integral part of the disclosure by January 2024, in which mitigating actions and transition-enabling investments will be part of standard reported figures.

The goal of this article is to summarise, contextualise and critically assess important aspects surrounding those ESG disclosures that were noticed at Finalyse:

- Situate the EBA’s Pillar 3 ESG disclosures within the larger spectrum of comparable disclosures of environmentally sustainable economic activities presented by other governing bodies in the EU.

- Discuss the different templates included and the timeline provided by the EBA for completing each set of disclosures.

- Provide preliminary methodological recommendations on key aspects of the disclosures based on Finalyse’s internal assessment of requirements:

- Reporting exposures sensitive to impacts of Physical risks;

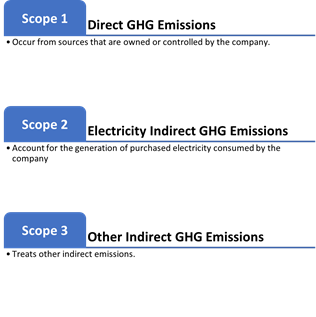

- Reporting financed emissions: Scope I , II , III;

- EPC score estimates.

The abovementioned points will be addressed individually before providing some general concluding remarks on Banks’ challenges related to the disclosure of ESG risks.

Regulatory context

The EBA’s Pillar 3 disclosures on ESG risks stems from a series of regulatory guidelines and reporting frameworks designed to incorporate sustainability as well as environmental, social and governance information within corporations’ disclosures.

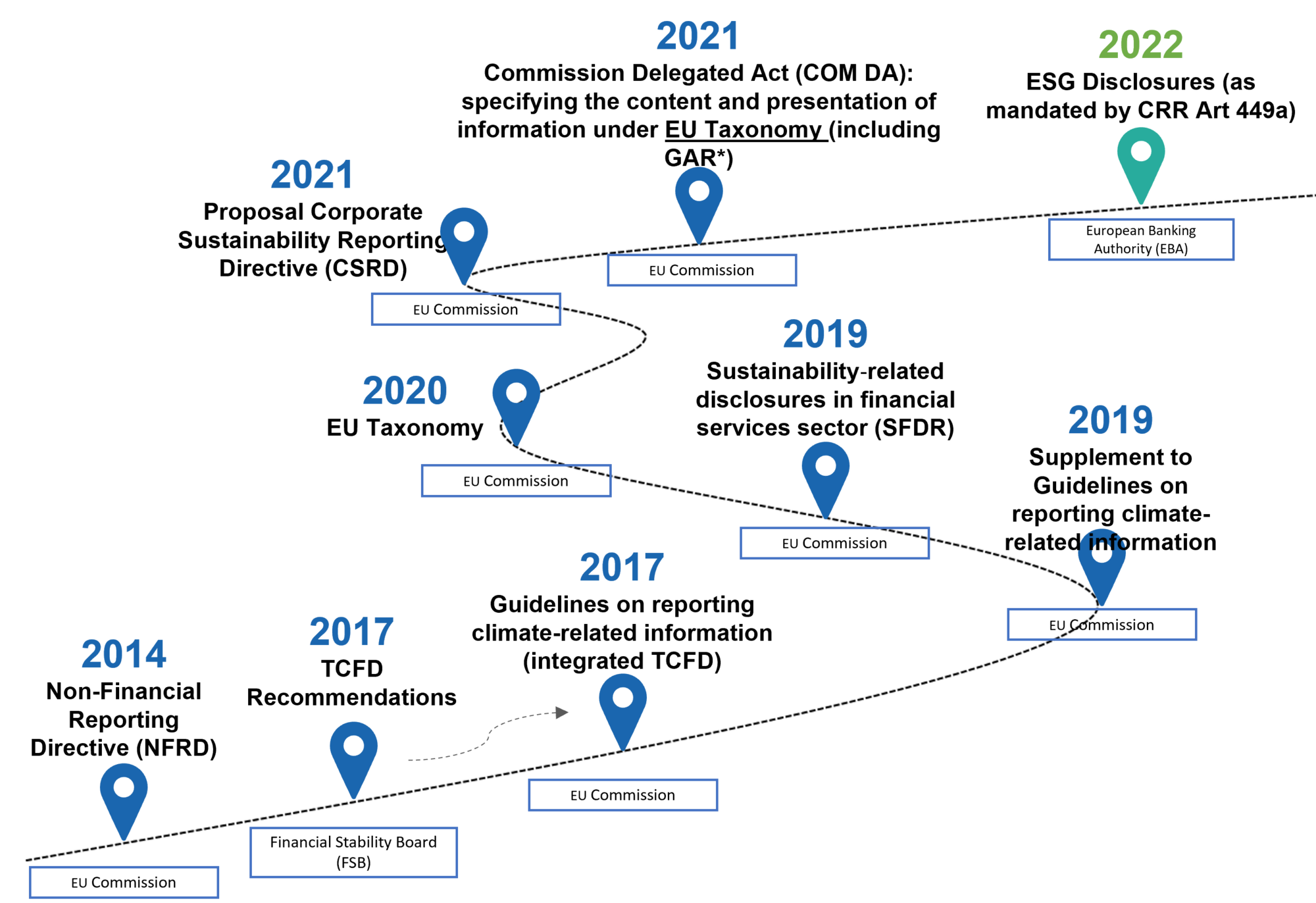

Figure 2: Timeline of regulatory disclosure requirements for sustainability as well as environmental, social and governance information.

The Non-Financial Reporting Directive (NFRD) in 2014 can be taken as a starting point for the development of non-financial and diversity disclosures by large companies within the EU. Following consultations and the publication of the TCFD recommendation by the Financial Stability Board, legislations succeeded each other to broaden the scope of disclosures, the list of concerned institutions and to standardise reported data to achieve comparability of information. Hence, when the CRR was amended in 2019, it included Article 449a stating that large institutions having issued securities in any Member State “shall disclose information on ESG risks, including physical risks and transition risks”. (2) Article 434a in turn placed the responsibility upon the EBA to produce, by June 2021, a uniform definition of ESG risks as well qualitative and quantitative criteria to measure them.

In the same vein, the 2019 Sustainable Finance Disclosure Regulation (SFDR) for the disclosures to end investors on the integration of sustainability risk, also tasked a Joint Committee of three European Supervisory Authorities (ESAs: EBA, ESMA and EIOPA) with producing draft regulatory technical standards (RTS11) on ESG disclosure standards for financial market participants.

The year 2021 also saw advances on the ESG-related disclosures front. The European Commission submitted its proposal for a Corporate Sustainability Reporting Directive (CSRD), effectively broadening the scope of its initial NFRD. Moreover, the Commission published the Delegated Act, where it introduced the Green Asset Ratio (GAR). The GAR is presented as the main key performance indicator for credit institutions that are subject to the disclosure obligations. It shows the proportion of exposures related to Taxonomy-aligned activities compared to the total assets of those credit institutions. (2)

Finally, as per the articles of the amended CRR, in January 2022 the EBA published its final draft ITS on Pillar 3 disclosures on ESG risks. The detail of which is covered in the next sections.

Disclosures: Templates and submission timetable

The disclosures themselves are split between quantitative and qualitative templates which are summarised below.

Quantitative templates

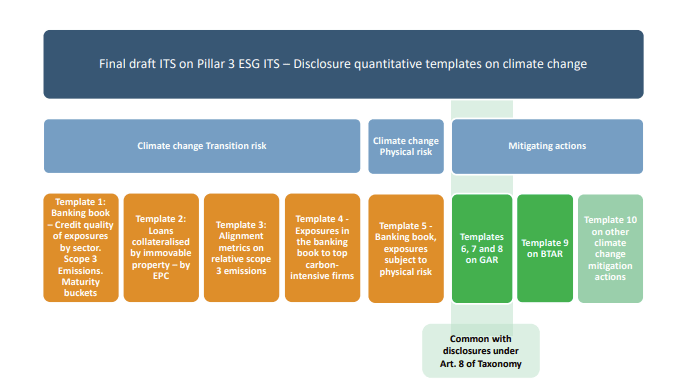

The quantitative templates are themselves split between transition risk, physical risk (banking book templates) and mitigation actions.

Figure 3: ESG disclosures quantitative templates overview

Transition risk

Transition risk templates are further divided into subcategories:

- Credit quality of exposures by sector, emissions and residual maturity: Template 1 in the banking book, Institutions are expected to distribute their exposures according to the counterparty’s NACE sector codes, performing status and to whether the exposure can be characterised as contributing to Climate Change Mitigation. More importantly, it is in this template that the institution is supposed to report the counterparty’s Greenhouse Gas (GHG) financed emissions according to the scope I, II, III classification (see discussion below).

- Loans collateralised by immovable property - Energy efficiency of the collateral: exposures are distributed across types of collateral, energy efficiency score bands (in KWh/m²) and EPC levels. This implies that institutions have this information readily available for their portfolios, if not they are supposed to collect it or revert to modelling (see discussion below).

- Alignment metrics: institutions are supposed to select the correct alignment metric for each economic sector and compute the distance between the actual value of the metric and its 2030 forecasted value presented in the IEA NZE2050 scenario data.

- Exposures to top 20 carbon-intensive firms: gross carrying amounts and other related information linked to activities with the top 20 carbon intensive firms are to be reported.

Physical risk

One template is provided to disclose balance sheet risks associated with physical risk.

- Climate change physical risk: Exposures subject to physical risk (template 5 – Banking book): exposures are split according to NACE code sector denominations, maturity bucket and sensitivity to impact from chronic, acute and chronic & acute climate events. In order for institutions to determine their portfolio sensitivity to physical risk, the EBA suggests data providers and public databases. Nevertheless, the methodological approach to comply with that requirement remains rather open (see discussion below).

Mitigating actions

Mitigating actions templates relate to the KPIs that are currently being defined to measure institutions’ alignment with the EU taxonomy and the degree to which they allocate their resources towards actively mitigating climate risk. Three templates are provided:

- GAR (%): the Green Asset Ratio (GAR) is the KPI designed to measure an institution’s percentage of assets that align with the EU Taxonomy - a classification system, establishing a list of environmentally sustainable economic activities. Institutions are expected to map their exposures and flows according to whether they are taxonomy relevant and further divide them between transitional or enabling investments. Further distinction is made between assets falling climate change mitigation and climate change adaptation categories.

- BTAR (%): the banking book taxonomy alignment ratio (BTAR) has some similarities with the GAR, with the difference that assets excluded from the GAR numerator can on the other hand be included in the BTAR numerator. Moreover, the ratio can be interpreted as the extent to which an institution's activities contribute to EU climate goals and is financing environmentally sustainable activities (split between EU and Non-EU).

- Other climate change mitigating actions that are not covered in the EU Taxonomy: template 10 allows institutions to report gross carrying amounts linked to bonds or loans that have not been reported in the other templates. The information needs to be split between whether the asset is mitigating transition or physical risk and must be accompanied by explanatory remarks.

Qualitative templates

The qualitative part of the disclosures is subdivided into three templates:

- Environmental risk;

- Social risk;

- Governance risk.

For each of the above templates, institutions are expected to write down in plain text what their strategy is for integrating environmental/social/governance risks into their processes (business model, investment strategy, future investment policies). Details are also required about the governance structure (committees, reporting, remuneration policy) put in place to frame, supervise and manage counterparties’ approaches to each of the three risks. Finally, institutions will have to report on the integration of those risks in their day-to-day Risk management (risk framework, methodologies, monitoring of exposures, tools, impact on capital and so on).

Timeline for disclosures

As highlighted in the last section on expected disclosures, the ESG Pillar 3 disclosure templates require a breadth of new information and data. Institutions will have to, on the one hand, use data that is already available internally but had never been used in the context of balance sheet risk reporting. On the other hand, disclosures relating to scope III financed emissions, alignment metrics, the EU taxonomy and KPIs will require new data (not previously collected) as well new knowledge and processes.

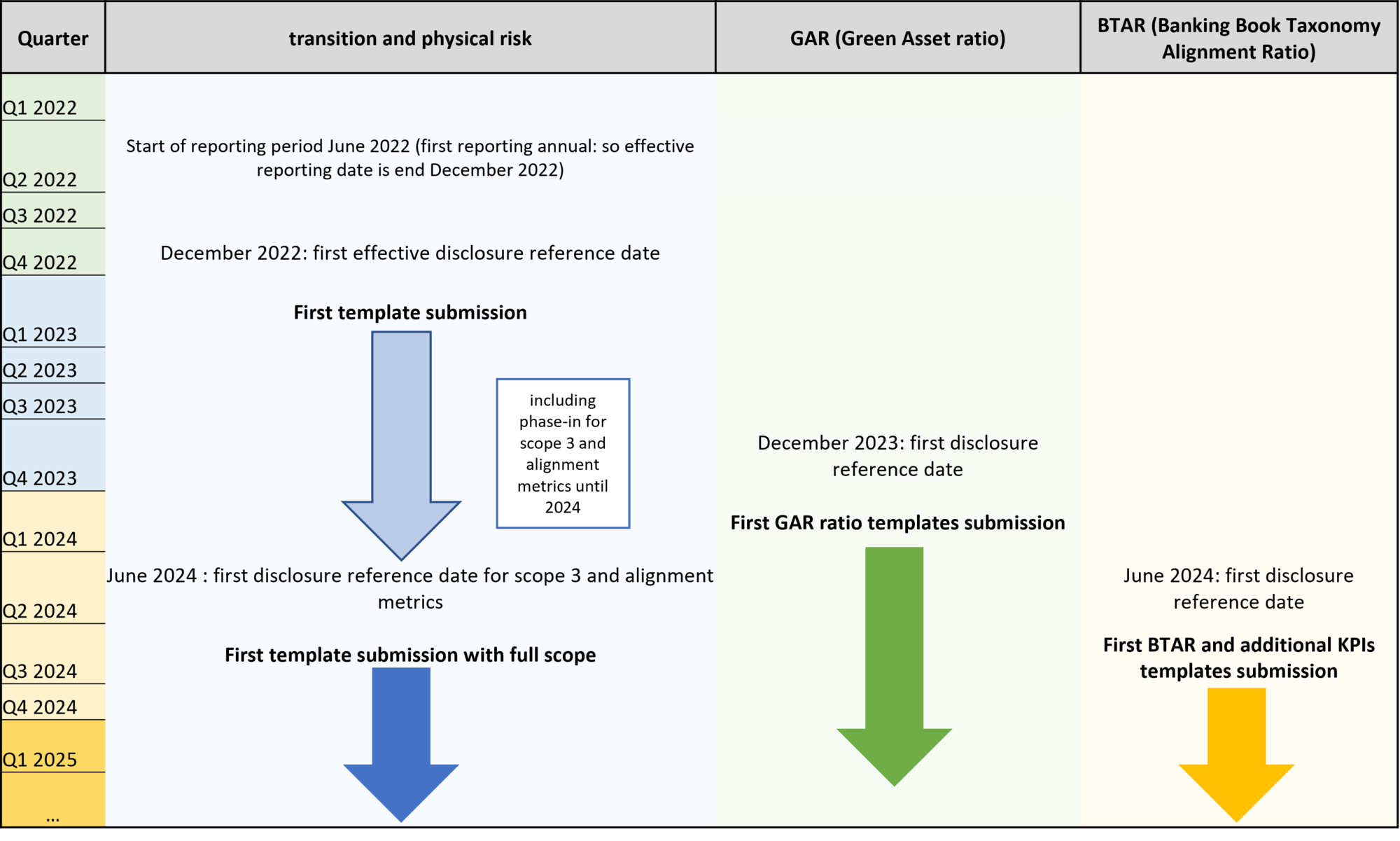

Aware of the pressure that such requirements would put on institutions, the EBA has introduced a phased approach to the disclosures that is described in the figure below. This way institutions are expected to have time to set up new data collection processes and get acquainted with new taxonomies and other similar requirements.

Figure 4: Timeline for disclosures submission

The picture above illustrates that an extra time has been allocated for reporting scope 3 financed emissions as well as the GAR and BTAR KPIs. Nevertheless, institutions should start preparing data and methodology for both.

The section below highlights key areas of interest noticed by Finalyse during the analysis of the banking book templates and reflects upon data requirements and methodological choices that institutions will soon have to face.

Methodological discussion and recommendations

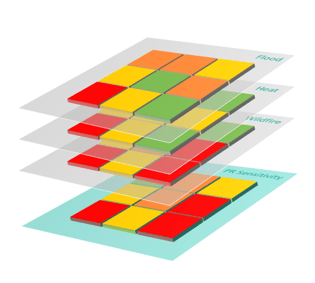

Reporting exposures sensitive to impacts of Physical risks

One of the main challenges for the completion of Template 5 is the assessment of sensitivity to chronic and acute climate change events for different sectors. In general, exposure to physical risk can be broken down into 3 components:

- Operations risk which measures the exposure and sensitivity of a company’s assets to climate events. The metric is determined by the geographical location of the assets and the prevalence of extreme events in the area.

- Supply chain risk explains to what extent global supply chains can be disrupted by climate change. The output of industries can be severely hampered if one of the regions struck by extreme events is responsible for critical inputs in the production process.

- Finally, physical risk can express itself as a market risk when patterns of purchasing power and consumption preferences might change based on acute and chronic climate events.

However, to measure physical risk in a broad sense based on the dimensions listed above, a financial institution would need to acquire extensive information on not only the location of a counterparties assets but additionally, the location of their main trade partners and customer base. To reduce the burden of the data collection exercise, template 5 puts an implicit focus on the operations risk component of physical risk by shifting the attention towards the geographical area of the considered assets.

Nonetheless, while the ESG disclosure standard do stipulate that financial institutions should indicate which exposures are considered sensitive to physical risk, no metric or threshold is proposed that would clearly define the differentiating factor between sensitive and non-sensitive exposures. The data sources such as ThinkHazard! (4), do provide a qualitative assessment of low, medium, high sensitivity to different climate events per geography. Financial institutions can leverage on this information by building a physical risk grid as demonstrated in Figure 5.

The approach links risk assessments of different climate events to geographical locations. In a pragmatic and prudent approach, financial institutions could consider that if any of the physical risk factors is high the entire region should be considered as high risk. Regardless, different aggregation approaches could be calibrated based on the composition of the considered portfolio. Moreover, specific grids could be built on an industry level as the sensitivity to climate risk events is unlikely to be parallel across industries. Enterprises active in the agricultural industry are more sensitive to extreme drought as their crops wither due to the lack of hydration. However, a similar event will not be as impactful in the transportation industry. By building adjusted physical risk grids on an industry level, financial institution will be able to perform a more granular assessment of the physical risk sensitivity of their exposures.

Reporting financed emissions: Scope I , II , III

An important aspect of several templates in the disclosures (notably template 1: Transition risk – Banking book) is the requirement to report Financed GHG Emissions. Also featured in the EBA climate stress testing exercise, those metrics are expected to be more challenging as banks typically have not been collecting emission data in the past. This section provides more detail on what is intended by scope 1, 2, 3 emissions and gives a high-level overview of the options available for measuring scope 3 emissions.

The final aggregated figure consists of the percentage of GHG emissions reported that were derived from company specific reportings. In other words, financial institutions are expected to gather Scope 1, 2 and 3 emissions for the counterparties in a very granular way, through annual reports, sustainability reports or from third party providers. The definition of the operational boundaries is aligned with the definitions set out in the GHG Protocol. While Scope 1 and Scope 2 data is generally more available, Scope 3 is challenging to calculate for most corporations. Consequently, the EBA has included a transition period running up to 2024 allowing institutions to develop their own methodologies. The methodologies in question can include a proxy approach.

For proxies, guidelines have been created by the Partnership for Carbon Accounting Financials (PCAF) in the ‘The Global GHG Accounting & Reporting Standard for the Financial Industry’. (5) The PCAF distinguishes 3 different options to calculate the emissions:

- Option 1 – Average Sector based Emissions: Emissions are estimated using industry average data. Data on the corporate’s unit of goods sold needs to be collected and multiplied with cradle-to-gate emission factors from industry average data.

- Option 2 – Physical Activity based emissions: When no direct information is available for the counterparty, but the institution has more detailed information on the production cycle, energy usage for the physical activities in the company, the emissions can be estimated using the energy intensity of said activities (for example tCO2/ton of steel).

- Option 3 – Economic Activity based emissions: If no granular information is available, the institutions can use the emission intensity of certain industries and or regions to calculate the emissions by counterparty using for example tCO2/€ of revenue or tCO2/€ total assets.

To sum up, the introduction of Financed GHG emissions within the EBA ESG disclosures will lead to unprecedented data collection and measurement challenges. Institutions have until 2024 to find a suitable approach to calculate their scope 1, 2, 3 disclosures. Hence, we recommend regulated entities to start investing towards this goal soon. The options described above provide a short summary of the available avenues to measure scope 3 emissions, yet elaborate processes will be required to integrate those disclosures in institutions’ current way of work.

EPC score estimates

Template 2 “Loans collateralised by immovable property” requires institutions to classify their collateralised exposures by type of collateral and by the collateral’s energy efficiency (in kwh/M²) score as well as EPC label.

Nowadays this data has become a legal requirement and is actively used in modern day real estate transactions. Indeed, EU Member States had by January 2009 as a final deadline to implement a mandatory labelling scheme for new and existing buildings (6) Since then the EPC label has become one of the factors determining real estate prices and has become a standard piece of information available during transactions.(7) Nevertheless, lending institutions with a mortgage portfolio including loans issued prior to the systematic introduction of energy performance scores and labels may have a sizeable portions of its portfolio for which such data was never collected.

The EBA draft ITS on Pillar 3 ESG disclosures states the following regarding EPC scores :

“Information on the energy consumption of the underlying asset will be that indicated in the EPC label, when the EPC label is available, or as estimated by the institution in the absence of an EPC label and if the institution is using internal models to produce these estimates.” (8)

This indicates that internal estimates for energy consumption (from which EPC can then be derived) based on internal data and models will be accepted by the regulator when disclosing collateralised loan information. Little additional information is provided in the ESG paper on detailed requirements regarding those internal approaches to producing energy consumption estimates. Nevertheless, we expect the requirements to remain open-ended leaving institutions with the choice of their own approach to produce estimates. We could expect models including variables such as such floor area (m²), availability of double glazing and type of real estate to provide satisfactory estimates of energy consumption for this type of regulatory reporting. Simpler approaches involve mappings based on building construction date, floor area and other such criteria which can lead to an EPC estimate, even though that would probably require a degree of conservatism.

The text also appears to stipulate that if an EPC label can be collected, which in European Member states should be a given, then institutions should do so. In other words, for all EU based collaterals if an institution does not possess the EPC labels at hand, it could attempt to set up vast data collection exercises to retrieve such information from its client base and integrate it in current data flows. Of course, such actions require resources and client voluntary collaboration. Nonetheless, for institutions with the means to perform such an exercise, it would reduce the need to rely on conservative EPC score estimates produced by an internal approach.

Conclusion

To conclude, the goal of this article was twofold. First, to summarise the EBA’s recent Draft ITS on Pillar 3 disclosures on ESG risks. Second, to provide a preliminary methodological discussion on some challenging aspects of the templates in terms of data and measurement approaches. The analysis covered the topics of GHG emissions (especially scope 3), sensitivity to physical risk and finally EPC score estimations. For all three subjects, we have shown that some options are already present for institutions to tackle the disclosures requirements both in terms of data availability and methodology. Of course, the first round of disclosures is only to take place after the close of the year 2022 (with 31st of December 2022 as reference date) and that also includes a transition period for some of the most demanding aspects of the templates. Nevertheless, it is of strategic importance of institutions to start readying themselves, especially in terms of data requirements, for important changes to come in the nature of credit institutions disclosures.

*For more detail see our past article on Climate stress testing.

Sources

- https://www.eba.europa.eu/eba-publishes-binding-standards-pillar-3-disclosures-esg-risks.

- https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:02013R0575-20210930&from=EN, page 644.

- https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv:OJ.L_.2021.443.01.0009.01.ENG

- https://thinkhazard.org/en.

- https://carbonaccountingfinancials.com/files/downloads/PCAF-Global-GHG-Standard.pdf.

- https://ec.europa.eu/energy/sites/ener/files/documents/20130619-energy_performance_certificates_in_buildings.pdf, page 17.

- Ibid, page 121-122.

- https://www.eba.europa.eu/sites/default/documents/files/document_library/Publications/Draft%20Technical%20Standards/2022/1026171/EBA%20draft%20ITS%20on%20Pillar%203%20disclosures%20on%20ESG%20risks.pdf, page 18.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support