The 2022 ECB climate risk stress test results – a roadmap towards future best practices

Written by Laurens Vanweddingen, Senior Consultant

Introduction

On 8 July, the ECB published the results of its climate risk stress test (CST). The climate risk is considered one of ECB’s supervisory strategic priorities for 2022-2024. For both banks and the ECB, the CST is a learning exercise. Hence, its main goal was gaining a clearer view of banks’ climate-related vulnerabilities, identifying data gaps and understanding how banks are currently managing climate risk.

The CST is part of the ECB’s broader scope of activities concerning climate risk, such as the ongoing supervisory Thematic review of banks’ climate-related and environmental risk management practices and the Thematic review on commercial real estate exposures, which altogether provide an indication of how well-aligned banks are with ECB’s expectations set out in its Guide on climate-related and environmental risks. So far, there will not be a direct quantitative impact on banks’ capital requirements, but the main findings of the CST will be integrated into the SREP in a qualitative way, with the ECB developing best practices and guidance for banks to overcome current weaknesses in the stress testing frameworks of financial institutions.

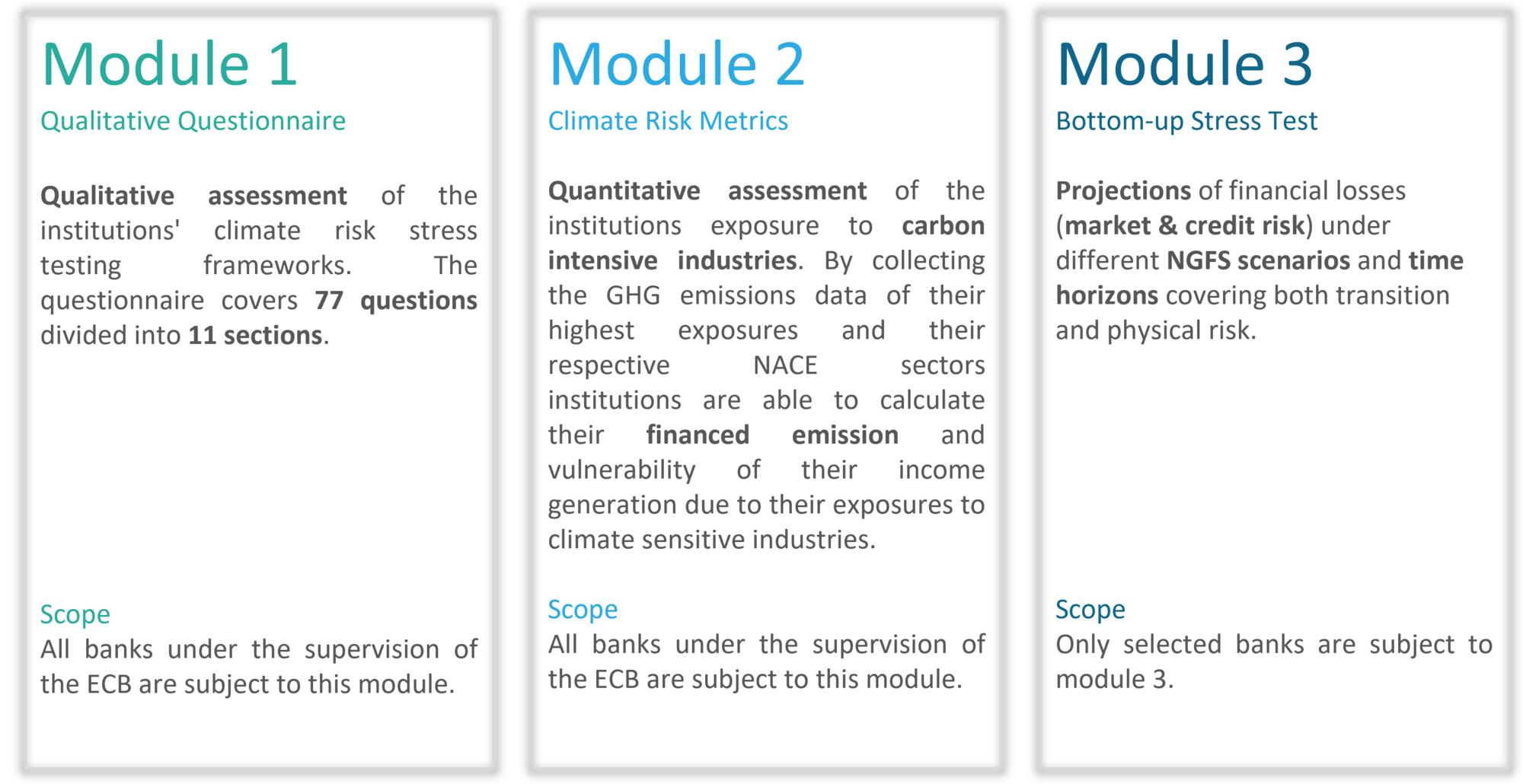

The CST is divided into three modules:1

- a qualitative questionnaire focusing on the inclusion of climate risk within banks’ stress testing framework, governance and overall business strategy, as well as data availability and usage,

- peer benchmarking based on climate risk metrics, providing insights into the sensitivity of banks’ income to transition risk and their exposure to carbon-intensive industries based on NACE two-digit codes, and

- a bottom-up stress test, providing capital projections for a number of scenarios and risk areas

The findings of the CST for each of the 3 modules will be discussed below. For a more detailed discussion on the methodology and macroeconomic scenarios used in the bottom-up stress test, please find an article previously published by Finalyse: Unveiling the clockwork of the 2022 ECB Climate Stress Test.

Findings on banks climate risk stress testing capabilities (Module 1)

Despite some progress, the deep dive revealed that only 40% of banks had included climate risk stress testing into their ICAAP and broader stress testing frameworks. Internal climate stress test results are often not disclosed nor considered in overall business strategy, showing deficiencies in the climate risk stress test governance and inadequate integration of climate risk within firm-wide decision making. Additionally, the stress test methodologies and scenarios used are limited in terms of risks considered, as well as transmission channels used, but this will be discussed in more detail in the next section.

In general, severe data gaps remain to be addressed in the future:

- Use of proxy data for scope 1, 2 and 3 GHG emissions, as many firms do not disclose this information. Specifically for scope 3 GHG emissions, the data is dispersed due to different proxy methodologies, or on counterparty level when different data providers are used for the same counterparty by different institutions. There is a need for harmonization.

- Energy Performance Certificates (EPC) data is derived by many banks from the construction year or energy costs of the building, with a lack of robustness of these estimates.

In conclusion, improvements are needed in both the data acquisition process and data quality. This can be done through two key mechanisms:

- Data infrastructures enabling counterparty assessments: The European Single Access Point (ESAP) will act as a common, digital database that ensures equal and transparent access to disclosed data. Legislative initiatives such as the EU Taxonomy Regulation and the Corporate Sustainability Reporting Directive (which expands the existing Non-Financial Reporting Directive) will supplement ESAP by increasing the amount of audited disclosed data by companies. One should note that both ESAP and CSRD are still pending final adoption.

- Enhancing customer engagement: Where relevant data is currently lacking, financial institutions should interact more with their customers to collect metrics. For retail products such as mortgage loans, banks should request information on EPCs, whereas for consumer finance, relevant data can be gathered through, for example, product descriptions. For small corporations, this will prove to be more difficult. However by using a standardized survey, institutions can keep track of their GHG emissions, combined with information2 on client’s main activities, their customers’ profiles and the regulatory environment they operate in.

Most financial institutions plan to enhance their climate risk stress testing frameworks. However, they need at least one to three years to incorporate transition and physical risks and tackle the following hurdles:

- Collecting data from counterparties and engaging with data providers.

- Increasing staff recruitment to improve climate risk stress testing capabilities.

Dependence on income stemming from highly carbon-emitting sectors (Module 2)

Highly carbon-emitting sectors represent 54% of the EU economy in terms of Gross Value Added (GVA), whereas financial institutions derived more than 60% of their interest income from non-financial corporates active in those sectors. Although within this segment, the largest share of their income is coming from sectors with relatively lower carbon intensities, such as wholesale and retail trade, 21% of income originates from the highest emitting entities. It is crucial for counterparties of these sectors to know their transition plans.

In this respect, rather than simply reducing exposures to carbon-intensive sectors and decreasing the income dependence, financial institutions can also help their customers in their green transition by offering specific financing products dedicated to increasing energy efficiency or to aligning their business strategy with a more sustainable profile. This requires frequent monitoring by financial institutions to meet intermediate reduction targets. For individuals, banks can offer their clients green mortgages to finance properties with good EPC values for retrofitting or providing solar panels to gradually improve the energy efficiency of the underlying housing stock.

G-SIBS, custodians and asset managers rely less on income stemming from carbon-intensive sectors compared to smaller retail lenders. However, they are more exposed to counterparties with highly carbon-intensive activities, considering their top 15 exposures per NACE sector. This is because some of the highly carbon-intensive industries have a limited number of key players active in the market, therefore requiring specialized services from large universal banks.

Bottom-up Stress Test (Module 3)

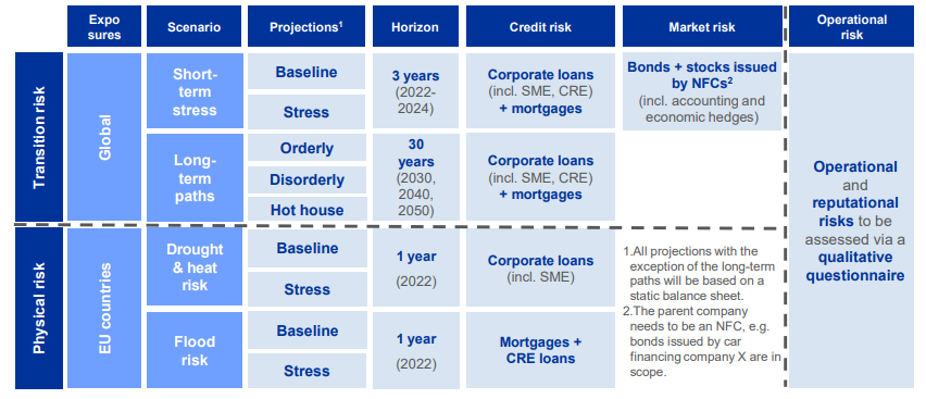

Out of 104 financial institutions participating in the 2022 CST, only 41 were selected to perform the bottom-up stress test due to the required degree of complexity. The 2022 CST scenarios used for the transition risk part of the bottom-up stress test were based on the NGFS Phase II model results released in June 2021, but they were recalibrated specifically for the purpose of the CST. The scenarios and risk types are defined in the table below3. Please note that in the graph below CRE denotes commercial real estate, whereas NFC is used to address non-financial corporations.

Source: 2022 climate risk stress test

Compared to the EBA Stress Tests, no macro-financial downturn scenarios were involved in the 2022 CST, but targeted climate-related shocks to a growing economy were imposed instead. This rendered the scenarios less severe and the loss results not comparable. However, the results of the 2022 CST do indicate that banks are vulnerable to climate-related risks.

In general, the combination of the short-term transition and physical risk scenarios led to a combined credit and market risk loss of around EUR 70 billion for the 41 banks involved in the exercise. It should be stressed that this figure is an underestimation of the total loss projections, due to the benign scenarios, limited climate risk capabilities in existing stress testing frameworks and the exclusion of supervisory overlays. The main results are summarized below.

Long-term transition risk projections

In general, the Disorderly transition scenario led to higher losses compared to the Orderly transition, highlighting the importance of timely policy action. The aggregate results are difficult to interpret due to heterogeneity in the loss projections in the long run. Certain institutions distinguished between the three scenarios with increasing loss projections until 2050, whereas others had constant or even reverse loss projections after 2030 with limited distinction among scenarios.

Similar considerations can be made for portfolio allocation strategies, with only a limited number of banks actively differentiating between the different scenarios. Most banks reduced exposures to carbon-intensive industries in the Hot House Word scenario due to the forecasted decline in GDP. This dynamic balance sheet approach led to the counterintuitive result that under the Disorderly transition scenario the cumulated loss would be higher than in the Hot House World scenario, however only for carbon-intensive sectors.

The main challenges identified for banks are the following:

- Constructing loss projections over long time horizons and linking the scenario assumptions to credit risk parameters such as PD and LGD.

- Anticipating changes in customer behaviour and technological developments, as well as incorporating extreme weather events into projections.

These challenges can be observed in the CST results, as the PDs remained relatively insensitive to the scenarios chosen, despite the variation in GVA growth between the Disorderly and Orderly transition scenarios over different sectors. Only in the case of the mining sector was the correlation between the change in GVA and PD remarkable. In the Hot House World scenario, an increase in chronic physical risks led to a GVA decrease, but this was not translated into significantly different projected LGD figures either. This came with no surprise, as many banks only applied impacts on a macro-financial level such as cumulative GDP growth, which showed little difference between the three scenarios ranging from 57% in the Hot House World scenario to 65% in the Orderly transition scenario.

Climate-related credit risk modelling therefore clearly needs improvements, with the most important deficiencies corresponding to the following aspects:

- Transmission channels: Improvements are needed in incorporating direct transmission channels (carbon price shocks and emissions pathways) and indirect channels (macroeconomic variables) affecting the credit quality of counterparties.4

- Differentiation: Sectoral and geographical heterogeneities are often not present in credit risk models, as asymmetric shocks in sectoral GVA growth are not translated into notable differences in PD and LGD as mentioned above.

- Detailed counterparty analysis (as mentioned by BoE5 : For large corporate exposures, banks should ideally consider factors such as the capital investments required for the transition and price elasticity estimations of the products and services offered by them (which has a direct impact on the cost pass-through ratio), and analysing the impact of climate risk on their competitors. Additionally, information on the supply chain and the location of the operations of large counterparties would allow to better gauge the impact of physical and transition risks.

Short-term transition risk projections

In the case of the short-term transition risk projection based on a frontloaded Disorderly transition scenario between 2021 and 2024, the cumulative impairments increased by 0.73% compared to the base scenario, mostly driven by the most carbon-intensive sectors having an impact of more than 2%. Due to the overall benign features of the frontloaded Disorderly transition scenario, the impact on loss figures remained low. Corporate exposures not secured by real estate drove the impairment losses, but also exposures secured by real estate with bad EPCs happened to be more prone to credit losses.

In terms of market risk, only a small reduction in the net fair value of trading portfolios was projected. It should be noted that this was only the one-year materialisation of a transition shock in 2022, and given the absence of volatility shocks and due to the simplified market risk methodology, the scenario was very benign and not comparable to the usual EBA stress test assumptions. Given the negligible impact on the net fair value of trading portfolios, it can be concluded that climate risk is not yet integrated into stress testing models for market risk.

1. Drought and heat risk

The transmission channel for drought and heat risk impacted the profitability of firms through a decrease in productivity, mainly affecting sectors with outdoor activities such as agriculture, mining and construction. But apart from the sectoral decomposition, the geographical location of counterparties is also important, albeit on a less granular level (country break-down) than for flood risk. It should be stressed that risk mitigants such as insurance coverage and disaster relief schemes were not taken into account by most of the banks.

2. Flood risk

Flood risk impacted the real estate collaterals, leading to higher loan-to-value (LTV) ratios and, therefore an increase in LGD and expected loss for loans secured by real estate. The results, however, presented a lack of differentiation between the impact on LTV ratios and different flood risk zones. High and medium flood risk zones accounted for more than half of the losses, but only 31% of exposures. And similar to drought and heat risk, the banks rarely included mitigants such as insurance coverage in the calculations.

Banks’ plans for financing the green transition

When it comes to financing the transition towards a carbon-neutral economy, the main outcomes of the CST revealed:

- Information provided by banks on key risk indicators (KRIs), the criteria for counterparty selection to support the transition and outstanding amounts of green finance instruments were heterogeneous.

- Sectoral information was rarely provided by banks for green assets, neither for KRIs. Mitigating actions remain very high level, and banks often refer to overarching initiatives without setting concrete targets. The ECB further assesses this deficiency in its ongoing Thematic review on climate-related and environmental risks

In terms of the long-term balance sheet projections, the key takeaways are the following:

- Banks’ strategies showed little differentiation across climate risk scenarios. The strategies for the most polluting sectors were reported by many banks as “mostly reduce” and for the less polluting industries as “passively adjust” or “mostly support”, regardless of the transition scenario.

- The balance sheet growth was approximately in line with the GDP growth under different transition scenarios, with exposures growing most in the Orderly transition scenario. On a sectoral level, mining and refined petroleum showed the least exposure growth.

- Banks treated their exposures different to carbon-intensive counterparties, with some willing to assist their green transition, whereas others would reduce their exposures

Supervisory follow-up

As mentioned, both the 2022 CST, as well as the Thematic review on climate-related and environmental risks will be integrated into SREP, with the joint supervisory teams considering climate risk together with other risk drivers. As the results of the 2022 CST show clear deficiencies in data quality, modelling, governance and capital planning, the ECB will provide further guidance for best practices which should be finalised by the end of this year. The main emphasis is expected to be on the following topics:

- Customer engagement to retrieve counterparty level data (GHG emissions and EPCs). Future EU disclosure requirements will partially bridge this gap.

- Integration of climate risk within ICAAP and decomposition of income and exposures per sector, country and emission intensity (using counterparty level data).

- Enhancing exposure transition plans using KPIs and KRIs based on actual targets.

- Granular modelling of climate risk on a sectoral or counterparty level for credit risk, in order to improve the sensitivity of existing PD and LGD models, integrating physical and transition risks, and using actual data on emissions, investments in energy efficiency and transition plans on counterparty level.

Conclusion

The ECB has considered the CST as a mutual learning exercise without direct quantitative impact on banks’ capital requirements this year. The exercise highlighted deficiencies in the data acquisition process for climate-related data and methodological shortcomings, which at this point is more important than the actual numerical outcomes of the stress test results.

The CST revealed two major points of attention for financial institutions in the data acquisition process, namely (i) enhancing existing data infrastructures which can be done through the creation of a common database containing climate-related data (ESAP) and (ii) actively searching for customer engagement to fill data gaps on a counterparty level, rather than relying on the current proxy measures used by most banks.

From a methodological point of view, the CST shows deficiencies in current credit risk models, which could be improved mainly by accounting for both direct and indirect transmission channels of climate risk, and by applying detailed counterparty assessments, at least for counterparties with large credit exposures, to better understand their business environment and therefore potential impacts on their profit and loss accounts under a range of climate risks and scenarios.

These findings will serve as a basis for the ECB to provide further guidance and best practices to financial institutions later this year.

1 Please note that operational and reputational risks were also in the scope of the CST as part of the qualitative questionnaire.

2 Network for greening the financial system (NGFS): Progress report on bridging data gaps (May 2021)

3 European Central Bank (ECB): Climate risk stress test 2022, methodology (October 2021)

4 Basel Committee on Banking Supervision - Climate-related risk drivers and their transmission channels: April 2021

5 Bank of England – Results of the 2021 Climate Biennial Exploratory Scenario (CBES): May 2022

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support