Related Articles

How Finalyse can help

Risk data management & reporting factory

In recent years, financial institutions have increasingly prioritized the establishment of an efficient and centralized Enterprise Data Management Framework.

Since 2013, with the introduction of BCBS239 principles and growing requirements from Regulatory Authorities for detailed reporting and calculation specifications, adopting a centralized data management framework and robust data governance has become imperative.

How does Finalyse address your challenges?

Audit

We adapt to the client context, data awareness and level of compliance with BCBS 239

Implement

From source to report, from feasibility study to BaU, we simplify redundant data transfers & manipulations

Focus on Value

We prioritize effort and processes to maximize business value increasing data ownership, commitment and comprehension across departments

Organise

We define clear roles and responsibilities with robust data governance and final reporting based on signed-off data

Strengthen

We bring best practices and hands-on tools at each step

Long term change:

Step by step, we help you to turn into a data-driven organisation relying on better risk management reporting capabilities based on higher data quality

How does it work in practice?

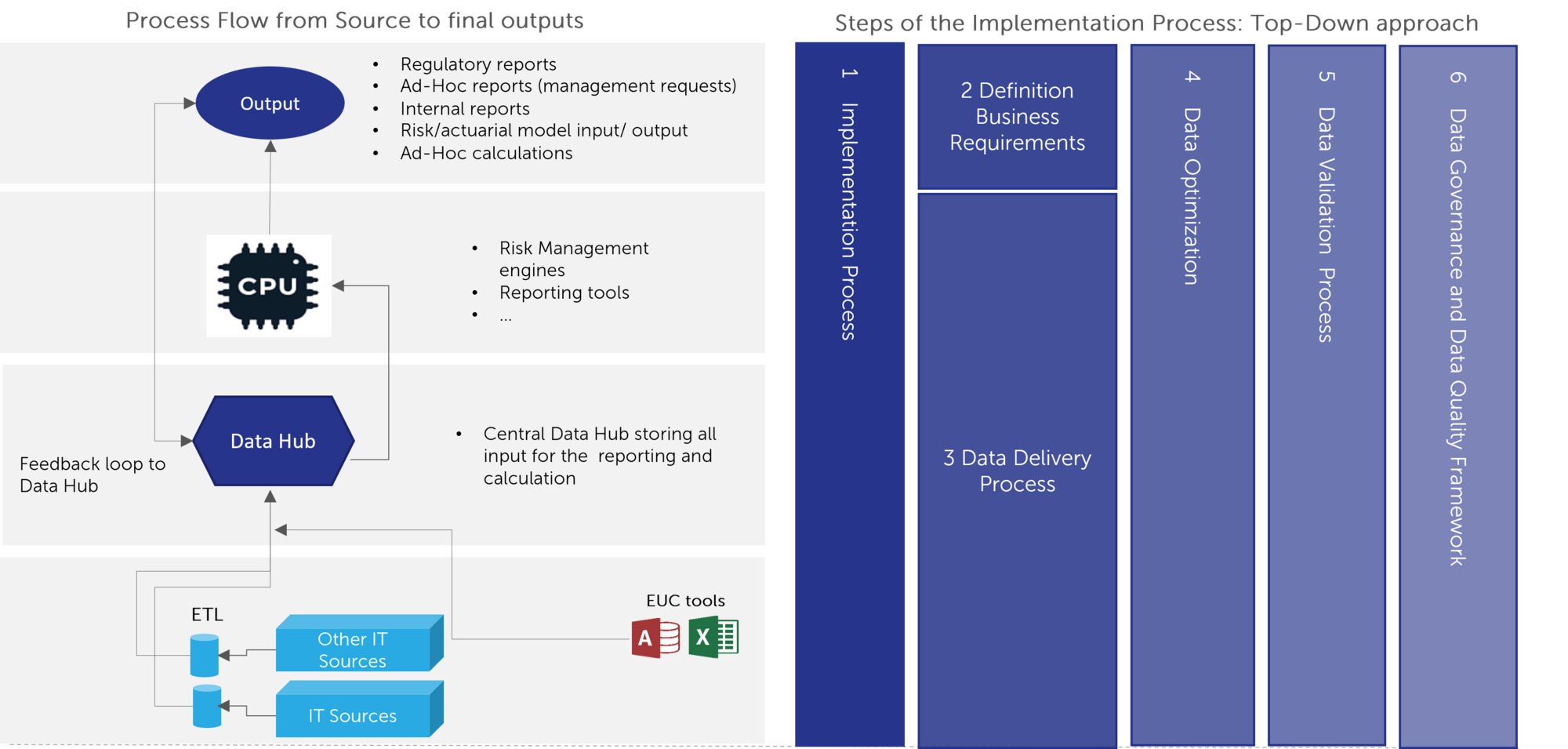

Finalyse recommends a top-down approach, beginning with report analysis, to reveal dependencies among business functions, IT, and Data Offices throughout the project's lifecycle. This is achieved through a set of clearly defined deliverables for each iteration.

Main deliverables completed in the steps of the Implementation Process ( as in above chart) are briefly detailed hereunder:

- Shift to Agile Methodology

- Strong Program Mgt. through Tools and RACI matrix

- Clear business value-oriented steering

- Involve all departments from an early stage

- Prioritize business requirements for the defined scope (reporting, calculation etc.).

- Shared approach between departments to align on data needs and terminology.

- Scrutinize the overall solution design and data architecture supporting the calculation, transformation and aggregation of in-scope metrics and relevant underlying data elements.

- Clearly identify which data is needed for what purpose and when (e.g. frequency, SLA).

- Specify technical requirements to ensure metrics and underlying data are accurately transformed and aggregated.

- Ensure that data is available at the correct level of granularity for aggregation and reporting.

- Draft strong documentation

- Refine data models and system architecture to simplify the overall calculation and reporting processes, eliminating potential inefficiencies and silos.

- Investigate root cause of Data Quality issues stemming from poor data model design and provide recommendations on remediation plans.

- Establish the single most trusted version of any data that is to be used consistently across multiple systems / applications and/or processes.

- Streamline testing activities to leverage synergies across the data lifecycle.

- Powerful Finalyse inhouse data validation platform ready to use in your organization.

- Define functional and technical test-case to be executed by each participant in all steps of the data delivery.

- Define an overarching control framework that covers the breadth of the reporting process and the entirety of the data lifecycle.

- Build robust risk and finance data reconciliation processes

- Institute forums to ensure effective communication around Data Quality issues and dimensions (accuracy, completeness, uniqueness,..).

- Define what compliance means to you (BCBS239 and DAMA DMBoK principles leaves room for a tailored approach)

- Finalyse hands-on toolkit to assess and monitor data quality framework

Key Features

- A hands-on top-down approach focusing on business value, shared across the departments involved in the project (Risk, Finance, IT, Data Offices).

- Data Governance framework documenting Roles and Responsibilities through a RACI matrix that enable ownership through your entire data life-cycle.

- Providing a holistic assessment of the entire data delivery process ensuring that critical data elements are accurately transformed and aggregated through an optimized reporting stream.

- Build trust in your data by using our powerful inhouse data validation platform to streamline testing activities.

- An efficient Data Quality Framework by shaping our monitoring toolkit and quality risk metrics based on your challenges.

Through his consultancy career, Thomas has developed a sharp expertise in financial products, data quality, processes and (regulatory) reporting. He has gained thorough experience in data modelling techniques and reporting tools when building Data Warehouse / Datamart projects & Reporting Framework for the Market Risk & ALM departments of several banking institutions. He developed a strong experience in BCBS 239 implementation projects, tackling data quality issues and putting in place data governance framework.

Hugo is a Principal Consultant in Finalyse Brussels. He has a wide knowledge and expertise in financial products, valuation algorithms, reporting and regulatory issues. He combines in depth knowledge of banking financial risks and regulations with a wide understanding of the data, IT infrastructure and processes underneath. Hugo has been involved in multiple Risk and Regulatory Reporting implementation projects such as RWA calculation for credit risk, EAD calculation under SACCR, automation of internal reports for ALM and implementation of data governance to comply with BCBS239. Hugo is an experienced Agile project manager who stands-out for his dynamism, adaptability and interpersonal skills.

Maria Nefrou is a Managing Risk Consultant in Finalyse Brussels with extensive experience in Data Management, having recently acted as Program Manager for the BCBS 239 Implementation at a major Dutch bank, steering upon main stakeholders and reporting to management and the regulator. Maria has a more than 10 years of experience in Banking, particularly on Risk and Regulatory reporting. She has taken up different roles related to: Business Implementation Management; QRM Reporting Implementation; Enablement of Credit Risk models (PD, LGD, EAD) for IFRS 9 purposes (ECL, SICR) using SAS while performing quality controls and acting as a Process Manager within the project team.

Manfredo is a Managing Risk Consultant in Finalyse Brussels. He is an expert in Regulatory Calculations and Reporting in the financial sector; he worked in both Banking and Insurance business. He has wide experience with Pillar I (Solvency 2, CRR/CRD IV) and Pillar III solutions (QRTs, COREP, Pillar 3). Manfredo has extensive experience in migration projects and implementation of business driven ambitions within IT integrated architectures. Manfredo has deep knowledge of BCBC239 principles and the RDARR capabilities with a focus on Data Governance. He is a Product Owner and a certified SAFe Agile Scrum Master.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support