Related Articles

How Finalyse can help

Transition Risk Measurement

We equip financial institutions with advanced, data-driven assessments: ESG scorecards, scenario analysis, and PD model stress testing, to identify, assess, mitigate, and report climate transition risks, while supporting sustainable growth in a transitioning economy.

Transition risk assessment is not just about managing risks, it’s about embracing the future of finance. Let Finalyse help your bank navigate the transition to a low-carbon economy with confidence, ensuring long-term resilience and success.

How does Finalyse address your challenges?

Gap Analysis and Action Plans for Compliance

Detailing differences in the organisation’s current transition risk assessments

Measurement of Transition Risk on portfolio

Assessing the potential financial impact on the portfolio and strategic rebalancing in response to transition pathways

Transition Risk PD Tool

Conductging a fully customizable transition risk scenario analysis and stress testing are conducted based on NGFS scenarios, by adjusting the default ratings (PD) of the counterparties.

ESG Score Card

Development of an ESG scorecard based on the bank’s portfolio, by selecting an appropriate set of factors for the Environmental, Social and Governance Pillar. The factors will cover both qualitative and quantitative aspects.

Regulatory Compliant

Our methodologies match the ECB’s and ESRS requirements in terms of assessment level, time horizon, documentation, and measurement of materiality.

Workshops

Gain an understanding of best practices and methodologies applicable to identifying, assessing, measuring and reporting climate-related and environmental risks considering the upcoming regulatory, supervisory and market pressure.

How does it work in practice?

Transition risk PD tool

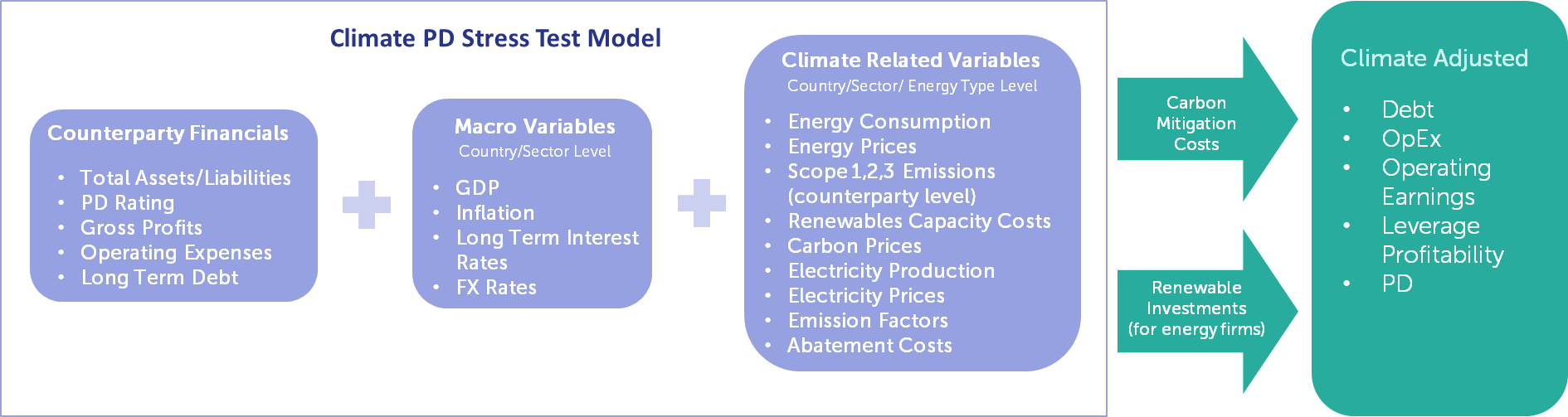

Finalyse has developed a powerful, forward-looking tool to perform transition risk analysis and stress testing. It is designed to compute climate-risk adjusted financials for corporates under multiple climate scenarios and years. The dynamic nature of the tool allows to quantify investments and economic costs associated with transition risk for corporates. The tool assess the impact of transition to a low carbon economy on a counterparty’s probability of default (PD). Results are then aggregated by sector, scenario and country.

Grounded in the methodology of the ECB’s economy-wide climate stress test, our approach has been enhanced to incorporate all NGFS climate scenarios and is applicable globally, beyond Europe. The tool is completely customizable as per any bank’s portfolio.

Key features of the tool:

- Projected energy consumption of counterparties based on their sector-specific energy mixes

- Country-level energy mix trajectories

- Pathways for renewables adoption and phasing out of brown energy

- Pathways for Macro variables and prices

- Climate-adjusted PDs

ESG Scorecard

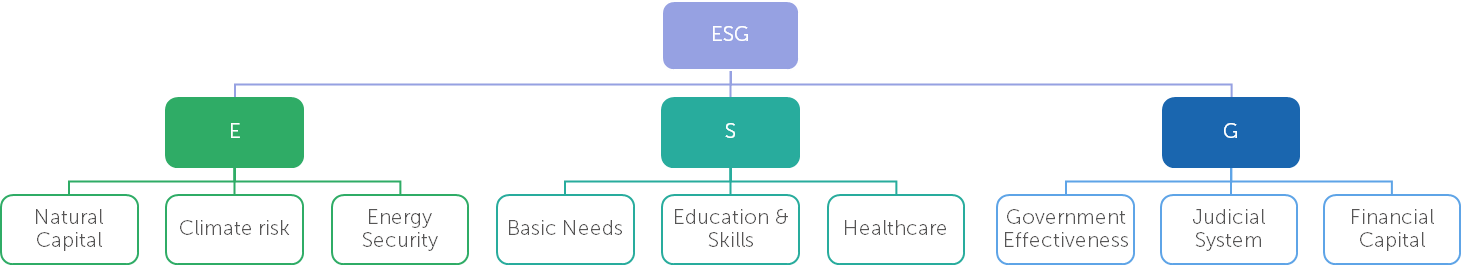

Finalyse has developed a fully customizable ESG Scorecard methodology that selects appropriate set of factors for the Environmental, Social and Governance dimensions.. These factors cover both qualitative and quantitative aspects, and their selection depends on the specific purpose of the scorecard.

Under this methodology, the subfactor performance is translated into a score, by comparing the subfactor of the counterparty to a peer group. This peer group may consist of companies from the same geography, market, industry, or a combination thereof.

Prior Experience

Multilateral Financial Institution in Luxembourg: Development and implementation of a transition risk PD projection tool for the bank’s corporate portfolio, to strengthen their climate risk management

- Developed a tool to model the impact of transition risk on the corporate’s probability of default (PD), and then to aggregate by sector, scenario and country

- Analyzed the portfolio resilience, mitigation cost and investments in-line with climate adjusted PDs

Financial Institution in Brussels: ESG Tagging Project

- Spearheaded the exploration and documentation of sourcing logic for three key ESG tagging variables: ESG Purpose Transaction, EU Taxonomy Aligned Assets, and EU Taxonomy Aligned Transitional Assets.

- Delivered a comprehensive specification document outlining data sources, transformation rules, and business logic to support ESG reporting and compliance.

- Developed an SPSS-based analytical tool to estimate CO2 emissions for Alpha Credit’s car loan portfolio (2020–2023), applying the WLTP (Worldwide Harmonised Light Vehicles Test Procedure) methodology.

- Integrated EEA (European Environment Agency) datasets to map vehicle models with corresponding emission factors, enabling automated ESG tagging and environmental impact assessments.

Managing Consultant

Expert Climate Risk

Senior Consultant

Expert Climate Risk

Key Features

- Finalyse offers extensive experience and expertise in area of ESG and climate related assessment for financial institutions.

- Ensure compliance with the ECB and CSRD recommendations set out by ESRS, by conducting a robust transition risk measurement.

- Benefit from Finalyse’s unique approach, tailored to the specific needs and circumstances of each financial institution.

- Long Term Sustainability: A transition risk assessment aligns banks’ operations with broader societal goals like reducing carbon emissions and meeting the Paris Agreement targets.

Alexandre Synadino is a managing consultant with expertise in risk data analytics, climate risk management and regulatory reporting. He is an active member of the Finalyse Climate Risk Centre. His main area of expertise lies in the research, design and development of physical risk assessments using different tools and methods. Alexandre is involved in the conceptualisation of measurement approaches to cover multiple hazard types, geographies and scenarios to respond to regulatory demands for granular and forward-looking analyses.

Meghna Jain is a senior consultant based in Finalyse Brussels with expertise in identification and assessment of environmental and climate-related risks across portfolios and integrating climate-related risks within the overall risk systems of the financial institution. She has extensive experience with a large European Banks in building scenarios, developing and carrying C&E risk assessments, setting risk appetites, modelling transition risk and physical risks for banks and ESG/climate reporting.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support