A Practical View on the ECB’S Guide on Climate-Related and Environmental Risks

Written by

Christophe Caers, Consultant

Kalender Can Soypak, Principal Consultant

INTRODUCTION

As the potential negative effects of climate change are becoming clearer, the governments around the world are taking actions to foster the transition to carbon-neutral economy as set out in the 2015 Paris Agreement.

The financial institutions are expected to play a key role in that transition. Consequently, ECB has published the “Guide on climate-related and environmental risks” in November 2020 to facilitate and expedite this transition. This guide outlines the ECB’s take on the prudent management of climate risk and describes how the institutions are expected to integrate that dimension into their already existing risk management framework, in the form of 13 recommendations. The following section of the article outlines our interpretation of the ECB guide and presents some practical approaches to understanding and implementing those regulatory expectations.

SUPERVISORY EXPECTATIONS RELATED TO BUSINESS MODELS AND STRATEGY

- Expectation 1: Institutions are expected to understand short, medium and long term impact of climate-related and environmental risks on the business environment they operate in, to be able to make informed strategic and business decisions.

- Expectation 2: When determining and implementing their business strategy, institutions are expected to give due consideration to climate-related and environmental risks that impact their business environment in the short, medium and long term.

The EBA guidelines on internal governance (EBA/GL/2017/11 – Paragraph 30) require institutions to be aware of the business environment they operate in. By monitoring the external factors relevant for their scope of operations, the financial institutions can acquire data paramount to the strategic decision when the need arises. Typically, this would require expanding the data collection activities in domains such as the macro-economic environment, competitive situation, regulation, technological developments, and demographic trends. The addition of climate-related and environmental risk brings an additional dimension as they manifest themselves as a transversal risk impacting all the currently monitored and established risk areas (credit risk, market risk, operational risk, etc.).

An additional analysis would be helpful to identify whether the enterprise has material exposures to certain industries and/or geographies, which might be affected by climate change in the short, medium or long term. This could materialise itself in extreme weather events that interrupt the supply chains or the introduction of new regulation that forces a client to increase capital expenditures or to reduce the profitability.

Furthermore, the institutions should monitor legal frameworks in the jurisdictions they operate in, to assess not only the impact on their own operations but those of their clients. Institutions are expected to properly document these assessments, establish a monitoring framework and define the list of potential risk mitigants / action plans. Ideally, a set of KPIs should be introduced into the framework that reflect the level of climate-risk taken in relation to the established business strategy. These KPIs can be used to translate the goals into the strategy of relevant business lines.

SUPERVISORY EXPECTATIONS RELATED TO GOVERNANCE AND RISK APPETITE

- Expectation 3: The management body is expected to consider climate-related and environmental risks when developing the institutions overall business strategy, business objectives and risk management framework and to exercise effective oversight of climate-related and environmental risks.

- Expectation 4: Institutions are expected to explicitly include climate-related and environmental risks in their appetite framework.

- Expectation 5: Institutions are expected to assign responsibility for the management of climate-related and environmental risks within the organisational structure in accordance with the three lines of defense model.

- Expectation 6: For the purposes of internal reporting, institutions are expected to report aggregated risk data that reflect their exposures to climate-related and environmental risks with the aim to enable the management body and the relevant sub-committees to make informed decisions.

The management body’s duties include setting, approving and overseeing the overall implementation of the business and risk strategy of the organisation. In doing so, the management body should allow itself to be assisted by a CSR committee including independent directors possessing an expert knowledge on climate related topics. The committee advises the management by considering the effects of climate change on the business lines over different planning horizons. An exhaustive set of KPIs and KRIs can be used to monitor the progress of the selected climate-risk related targets. Furthermore, the committee can request the assistance of the Company Engagement department, which is able to translate the key strategic targets into more granular operational targets for key departments.

The renumeration policy can also be used as a strong tool to ensure alignment of personal interest with the targets of the organisation. The institution can make a part of the renumeration for the Executive Committee, Senior Management and other key personal dependent on CSR performance. Metrics could cover items such as level of financing for renewable energy and a reduction in the institutions CO2 footprint. While this review can be completed at the discretion of the board, there can additionally be assigned a large role to the performance rating of external agencies as the public image/reputational risk remains a relevant area that is affected by the climate risk due to the broad media-coverage.

Additionally, climate risk metrics should be adapted into the risk appetite framework as they are a vital part of strategic planning. As climate risk is a relatively new field, the starting point in this process should be to define a coherent taxonomy defining the different factors and aspects relevant for the subject. Afterwards, an appropriate set of KRIs should be defined with the according targets, risk acceptance thresholds and monitoring systems. The metrics should be selected based on the most material climate-risk sensitive business lines and give the management body and external parties a clear picture regarding institution’s status quo and progress in a timely manner. Examples can be exposure to primary/secondary energy mix, Portfolio Warming Potential and Climate Value-at-Risk (CVar).

SUPERVISORY EXPECTATIONS RELATING TO QUANTITATIVE RISK MANAGEMENT

- Expectation 7: Institutions are expected to incorporate climate-related and environmental risks as drivers of existing risk categories into their risk management framework, with an aim to manage monitor and mitigate these over a sufficiently long-term horizon and to review their arrangement on a regular basis. Institutions are expected to identify and quantify these risks within their overall process of ensuring capital adequacy.

- Expectation 8: In their credit risk management, institutions are expected to consider climate related and environment risks at all relevant stages of the credit granting process and to monitor the risks of their portfolios.

- Expectation 9: Institutions are expected to consider how climate-related and environmental events could have an adverse impact on business continuity and the extent to which the nature of their activities could increase reputational and/or liability risks.

- Expectation 10: Institutions are expected to monitor on an ongoing basis the effect of climate-related and environmental factors on their current market risk positions and future investments, and to develop stress tests that incorporate climate-related and environmental risks.

- Expectation 11: Institutions with material climate-related and environmental risks are expected to evaluate the appropriateness of their stress testing, with an aim to incorporate them into their baseline and adverse scenarios.

- Expectation 12: Institutions are expected to assess whether material climate-related and environmental risks could cause net cash outflows or depletion of liquidity buffers and, if so, incorporate these factors into their liquidity risk management and liquidity buffer calibration.

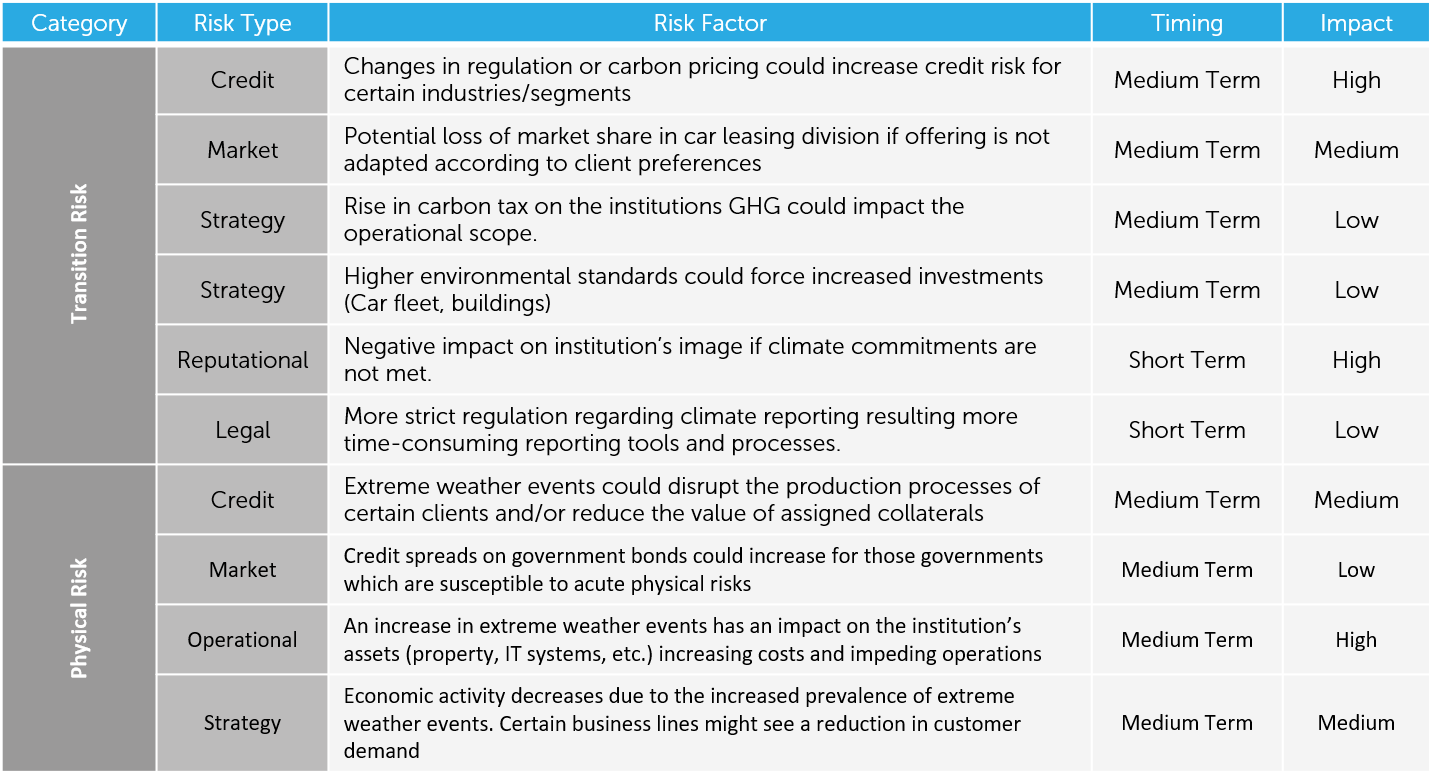

At the early stages of the incorporation of climate risk into the quantitative risk management framework, it might be sufficient to analyse the institution’s climate risk exposure in a quantitative way as described in ‘Business Models & Strategy’ section above. This would entail the definition of the risk areas, the dimension (physical or transitional), timeline and impact as presented in Table 1.

Figure 1: Climate Risk Mapping

Scenario Analysis

However, it is clear - based on the regulator’s expectation - that scenario analysis and stress testing will become the cornerstone of the climate risk framework. The institutions will be challenged to come up with a credible set of transition scenarios and attaching a macro-economic impact to each of them. Modelling the transition to a sustainable economy is not straightforward as the carbon emissions are the output of the complex interrelationship between economic growth, demographic evolution, used energy mix, the energy intensity of the economy and regulatory action. Moreover, these relationships can become unstable due to the potential emergence of new developments such as the advent of carbon capture technology. This being said, IAMs (Integrated Assessment Models) are proving to be quite powerful in mapping the complex dynamics of the above-mentioned drivers of the carbon output and could thus provide a starting point for the quantification of the climate scenarios.

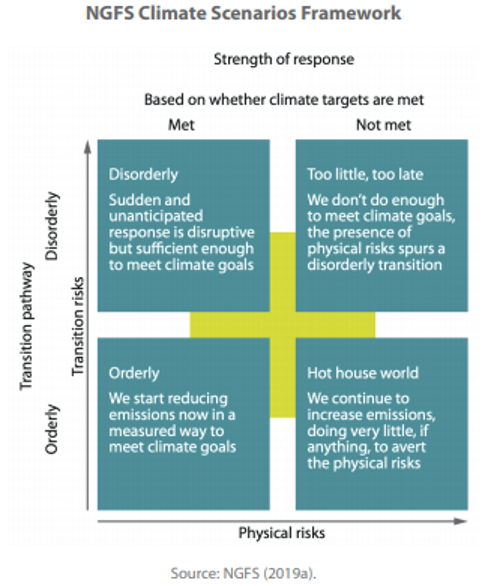

For the second main aspects, the definition of the potential scenarios, NGFS (Network for greening in the financial system) can be considered a great starting point as shown in Figure 1. While these scenarios have originally been developed to supportcentral banks and supervisors, it is easy to adopt them for climate related scenario analysis or climate related stress testing models.

Each of the portrayed scenarios can be linked to Carbon Budget, which is an expression of how much Carbon (Gigatons CO2) will be emitted at each point in time. Explained differently, the scenarios allow us to define a logical evolution of the CO2 emissions (or Carbon Pathway) over the coming decades, which will serve as the restriction during the application of the AIM models. The output will be a set of pathways in terms of economic growth, population and energy usage that all correspond to the carbon budget defined under each scenario. The number of possibilities can be further narrowed down by using the input of both internal and external experts and eliminating the least realistic predictions. Ultimately, the IAM model should provide predictions of macro-economic pathways that can be used as inputs for stress testing.

Figure 2: NGFS Climate Scenarios Framework

Credit Risk Management

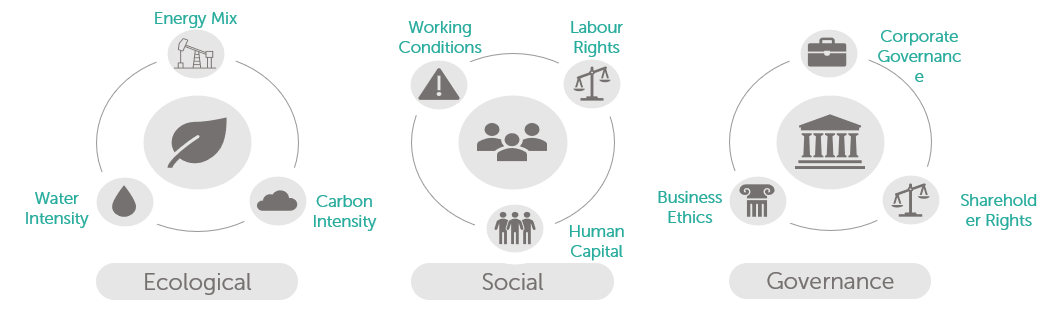

Institutions may consider enhancing the current credit rating model by incorporating qualitative and quantitative ESG factors for clients. These are compared to peer groups across the region and industry dimensions. Regarding transition risk, the model should be able to compare the relative impact of regulatory changes and consumer preferences on the creditworthiness of the client. Changes in carbon pricing can seriously affect the cost structure of a company reducing profitability. The agility with which the client will be able to align its operations in line with the sustainability goals will become a major factor in the company’s resilience. The assessment of physical risk will be closely tied to the geography in which the client’s operations are located. Asset closely located to the waterfronts or forest areas subject to drought are bound to be more vulnerable. The company’s ability to relocate and insure the assets on top of the local government’s speed to take action will be the major factors in determining the exposure to physical risk. While doing the assessment, the modelling team needs to consider the materiality and time horizon of these added risk drivers and different alternatives can be considered for integrating climate risk into the credit decision process:

- Develop climate-informed shadow credit risk models to be reported alongside the regular PDs: the climate-informed shadow PDs would take into consideration a detailed analysis of physical and transition risks for higher risk counterparties identified in a screening process.

- Develop a scorecard for sustainability risks comprising qualitative aspects: the output from the scorecard would get a fixed weighting within the model.

- Add environmental variables in internal credit-scoring models: the environmental valuation has been introduced for sectors where such an assessment was found to be relevant.

Figure 3: Credit Risk - ESG Factors

Market Risk Management

The institutions are expected to consider that environmental and climate-related risks can lead to potential shifts in supply and demand for financial instruments (e.g., securities, derivatives), products and services, with a consequent impact on their values. In line with the nature of the ICAAP perspectives, institutions are expected to assess the risks arising in both the banking and trading books.

Given the specificities of a given institutions’ market activities, internal stress testing could be a promising approach to assess the relevance of climate related risk for an institution’s trading and banking book (CSRBB[SS(1] [CC(2] ). This approach is furthermore in line with the expectations from the ICAAP to supplement historical distributions or hypothetical assumptions.

CSRBB can be defined based on credit spread shock scenarios resulting from climate risk:

- Historical time series for credit spreads need to be prepared for each risk profile separately.

- Credit spread shock scenarios to be estimated based on time series in line with climate risk scenarios.

- Using the discounted cash flow method, changes in the value of CSRBB-instruments are calculated for different shock scenarios.

Liquidity Risk Management

As the climate risk is generally considered to be the risk that will be visible in the long run, the effect on liquidity risk will be harder to quantify. Theoretically, the liquidity risk could manifest itself through physical risk in the case where a certain area is struck by an extreme weather event. Large amounts of money could be withdrawn to fund repairs. Additionally, a sudden policy change or asset stranding could result in an abrupt repricing of securities. Within the scope of scenario analysis, the effect of these events on LCR & NSFR could be measured. However, due to the short-term horizon of these measures and the low probability of occurrence of the aforementioned events, the effect on LCR and NSFR will likely be non-material.

Operational & Reputational Risk

Institutions are expected to implement policies and process to evaluate the exposure to operational risk. The frameworks should be able to assess the operation risk across all business lines and determine how they can materialise. In the scope of operational risk, physical risk is a major factor. Extreme weather events can affect assets such as buildings, IT and datacentres resulting in impeded operations. While performing the assessment, the institution should not only investigate the likelihood of such an event occurring in the own physical area of operations. Additionally, the process should include the geography of key providers and mitigating actions taken by them.

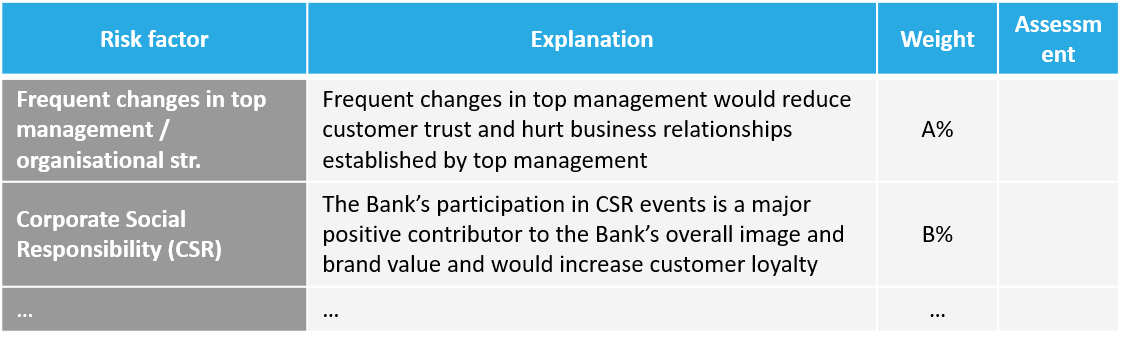

Reputational risk is the risk to earnings arising from negative public perception resulting from loss of reputation or public trust and standing. Sustainability, being a popular topic, is widely covered in media sources. When institutions fail to reach predefined goals or are involved in operations, which do no align with the sustainability goals, this will likely be reacted to by investors, governments and consumers.

Reputational risk can be quantified with a scorecard and scorecard points are calibrated to capital add-ons (in line with industry benchmarks).

Figure 4: Reputational risk scorecard

SUPERVISORY EXPECTATIONS RELATED TO DISCLOSURES

- Expectation 13: For the purposes of their regulatory disclosures, institutions are expected to publish meaningful information and key metrics on climate-related and environmental risk that they deem to be material, with due regards to the European Commission’s Guidelines on non-financial reporting: Supplement on reporting climate-related information.

Articles 431 of CRR states that institutions shall publicly disclose institution- specific material where its omission or misstatement could change the decision making of investors. While the effects of climate risk are still difficult to quantify, the European Commission has advised to not disregard climate risk in terms of materiality, recognizing that these risks can have significant impact on profitability and business strategy of each institution in the long term. Moreover, the disclosures should clarify the institution’s commitment to climate goals by for example stating and clarifying to which industries/projects they will increase or decrease financing with the related targets and requirements. Finally, the KPIs or KRIs should be clearly reported along with the actual performance against the targets for these metrics.

CONCLUSION

In the current form, the ECB Guide and other regulations only provide high-level guidance on qualitative and quantitative management of climate-related risks. However, the importance of the publication needs to be recognized as it makes the first step in integrating climate risk into the general strategy and risk management framework of financial institutions. The ECB will follow up the “Guide on climate-related and environmental risks” in early 2021 with the request to self-assessment in light of the aforementioned expectations followed by a stress test in 2022, which focuses on climate-related risks. We expect that the resulting input received from financial institutions, research groups and academics will push the sustainability agenda forward and more tangible in the years to come.

SOURCES

- NGFS, “A call for action: Climate change as a source of financial risk”, 2019.

- ECB, “Guide on climate-related and environmental risks”, November 2020.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support