The 2008 financial crisis has showed that it is vital to have a good recovery and resolution policy. However, unlike for banks there is no harmonised regulation for insurers on that topic, the Solvency 2 regulation and the ORSA don’t address the recovery in a pre-emptive way and don’t prepare for a resolution. Some regulators have adopted national recovery and resolution policies, but this has led to a fragmented regulatory landscape across the EU. Therefore, the European Commission was requested to create a harmonised framework. In the Consultation Paper on Solvency 2 review 2020 EIOPA has given eight recommendations on the future regulation.

Before we start the analysis of EIOPA’s recommendations it is important to understand the terminology:

- Recovery – “going concern”, the undertaking is still viable and in operation

- Resolution – “gone concern”, undertaking is no longer viable and under control of a national authority

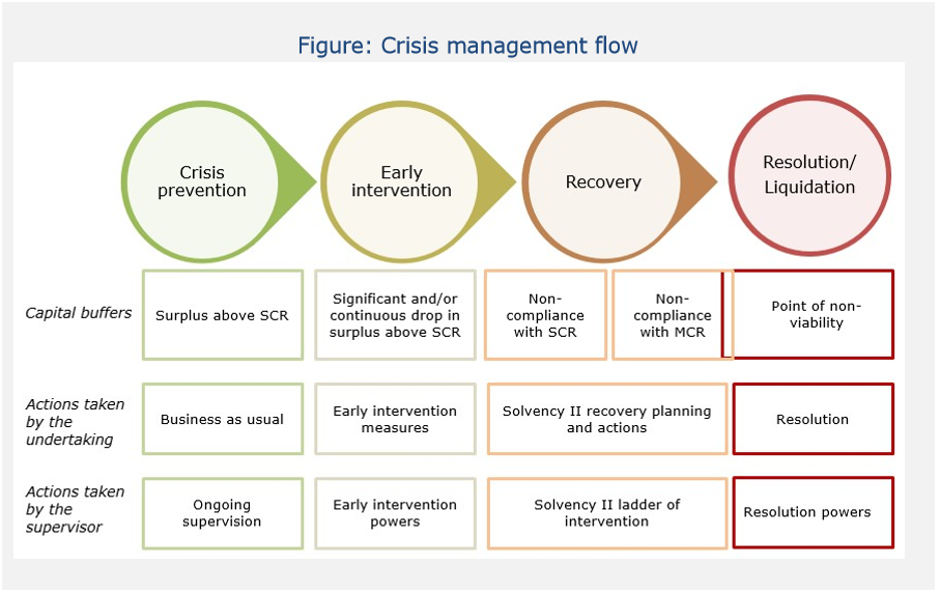

The picture below shows the different stages an insurance company can go through.

EIOPA, 2019. Consultation Paper on the Opinion on the 2020 review of Solvency II. [Online]

Available at: https://www.eiopa.europa.eu/sites/default/files/publications/consultations/eiopa-bos-19-465_cp_opinion_2020_review.pdf

Recommendation 1: Minimum harmonised rules for recovery and resolution

The current situation creates a couple of problems:

- Uneven level-playing field for insurance companies across EU;

- Additional costs of compliance;

- Fragmented regulatory landscape which goes against the supervisory convergence trend; and

- The national regulations may have gaps and inefficiencies

Therefore, EIOPA advises to implement minimum harmonised rules for recovery and resolution. This leaves national authorities with room for additional measures.

IAIS application paper 2019

The International Association of Insurance Regulators issued in November 2019 a paper advising national regulators on the creation of a recovery and resolution framework before a common regulation appears. There is lots of overlap between IAIS’ and EIOPA’s approaches.

Recovery measures

Recommendation 2: To require pre-emptive recovery from undertakings covering a significant share of the national market

The recovery plan should include the possible measures to restore the financial position. They are drafted at normal times and subject to approval by the national authority in all member states on a regular basis.

The recovery plan should contain the following points:

- Strategic analysis;

- Stress scenarios and corresponding recovery options; and

- Asessment of necessary steps and time and the association risks.

The recovery plan should be required only from the most systemically important insurers. The national authorities should decide which company is subject to the recovery plan based on harmonised criteria. EIOPA proposes the following criteria:

- Size;

- Business model;

- Risk profile;

- Interconnectedness;

- Cross-border ability; and

- Substitutability.

In order to reduce the administrative burden, the proportionality principle1 should be applied based on harmonised rules.

Existing regulation on recovery

Solvency 2 – recovery foreseen only after the breach of SCR

ORSA – process designed to avoid breaches of SCR – > no need for recovery

1. Bigger and more systemically important institutions face stricter and more stringent requirements than smaller and less systemically important institutions do.

Recommendation 3: To introduce early intervention powers

The current Solvency 2 framework gives national authorities the right to intervene after the insurer cease to be compliant with SCR and MCR rules. This implies that the regulator cannot intervene when the situation is seriously deteriorating, and the insurer is at a clear risk of breaching the rules in the near future. EIOPA wants the authorities to be able to intervene early enough.

In the 2020 Solvency II review currently under consultation, EIOPA proposes that the regulator should be able to intervene pre-emptively, for example they should be able to:

- Impose more frequent and more exhaustive reporting;

- Require implementing measures from the recovery plan or to update the plan in accordance with the situation;

- If no recovery plan is in place, they can require identifying and implementing measures to recover from the potentially problematic situations;

- Limit variable renumeration and bonuses; and

- In case of life insurance, suspend or limit the surrender rights.

The last point should be carefully considered and the policyholders should be informed about this possibility. The regulator should resort to it only when there is no other way to guarantee financial stability.

The interventions should be subject to the proportionality principle.

Resolution measures

EIOPA advises to have a designated authority for handling resolutions. The authority should be operationally independent.

The objectives of the resolution should be among other things, the protection of the policyholder and the stability of the financial system.

Recommendation 4: To require resolution planning from undertakings covering a significant share of the national market

The resolution planning falls within the responsibilities of the resolution authority. The pre-emptive resolution planning consists of two elements:

- Resolution plan: reduction of the impact of the potential failure; and

- Resolvability assessments: identification of any impediments to the resolution.

The resolution plan should contain the following elements:

- Stress scenarios;

- Resolution strategy (actions for each scenario);

- Funding;

- Critical shared services, group structure or intra-group transactions; and

- Communication.

The resolvability assessment should cover the following topics:

- Feasibility (structural, financial or operational); and

- Credibility (impact on policyholders, third parties and the financial system).

The resolution planning should be subject to the proportionality principle.

Recommendation 5: To Grant resolution authorities a set of harmonised resolution powers

EIOPA is in favour of a setting up common set of resolution powers, i.e. entire or partial sale of the undertaking, prohibition of writing new business, restriction of variable renumeration or taking over the control.

At the same time EIOPA stresses that the hierarchy of claims should be respected, and the creditors should be in the resolution process not worse off than in an insolvency.

Recommendation 6: To establish cross-border cooperation and coordination arrangements for crises

The recovery planning can concern several members states authorities if the insurer is active outside of its home jurisdiction. Therefore, it is important that there are arrangements in place for cooperation and coordination among supervisors.

Triggers

It is crucial that the regulator can intervene before it is too late. The trigger for early intervention is currently not defined and every member state has its own policy. EIOPA proposes to harmonise the triggers for recovery and resolution interventions.

Recommendation 7: Judgment-based early intervention triggers

Currently the Solvency 2 defines a trigger for the recovery: insurers should immediately inform their supervisory authority when they don’t comply with the SCR or there is a risk of non-compliance within three months.

EIOPA considers this trigger to be appropriate, but also sees the need for other triggers unrelated to SCR. The triggers should be a mix of quantitative and qualitive considerations.

Recommendation 8: Judgment-based triggers for entry into resolution

The trigger should be designed to avoid the instances where the undertaking becomes economically non-viable:

- Balance sheet insolvency (liabilities > assets);

- Cash flows insolvency (inability to pay out the policyholders); and

- Breach of capital requirements.

The resolution should also be commenced when all the actions from recovery plan have been exhausted or are considered as non-applicable.

A resolution should be also in the public interest so that the outcome is better than in the insolvency. That can be the case in an illiquidity situation.

Conclusion

As there is currently either no or insufficient recovery and resolution planning (depending on the member state), these standards, if adopted, will create new obligations for insurers and national authorities that may be quite cumbersome. However, unified a framework of resolution and recovery requirements is highly necessary considering experience drawn from the financial crisis. A single EU regulation would increase the policy effectiveness, reduce the implementation costs and create a level-playing field for insurers.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support