The 2020 Solvency II review intends to bring about several changes to the Solvency II Framework Directive. It follows the 2018 Solvency II interim review, which amended the Solvency II Delegated Acts. You can find a summary of this review in our blogpost dated 9 July 2019, “A guide to Solvency II review”.

In this article, we focus on the EIOPA’s opinions on technical provisions and SCR. For now, we are excluding Long Term Guarantee (LTG) measures, a topic which deserves an article all to itself.

A. Technical Provisions

Concerning the best estimate calculation, EIOPA wishes to advise the European Commission on how consistency can be achieved across insurers with regard to the treatment of contract boundaries, the definition of expected profits in future premiums and the expense assumptions for run-off business.

Despite the serious concern of many insurers about the calculation of the Risk Margin as it currently stands, and although it has been requested by the European Commission to produce advice on this topic, EIOPA has decided not to do so.

Alignment with IFRS 17

EIOPA has concluded that the alignment of Solvency II with IFRS 17 is not possible due to several reasons; for instance, the IFRS 17 Contractual Service Margin does not exist under Solvency II where all profits are recognised as Own Funds at inception. Other examples put forward by EIOPA on why the two frameworks cannot converge include contract boundaries and granularity.

1. Contract Boundaries

Issues with contract boundaries have been identified in the following topics:

a. Paid-in contract

The paragraph 18 (3) of the Delegated Acts 2015/35 states that future premiums are out of scope if the insurer can cancel the contract unilaterally. However, it says nothing about the treatment of paid-up premiums, which left unnecessary room for interpretation and inconsistencies. EIOPA proposes to amend the paragraph 18 (3) so that it is applicable only to future premiums and not to paid-up premiums. As such, the contractual obligations related to paid-up premiums remain valid even after the date the insurer can unilaterally cancel the contract.

b. Unbundling

There is some doubt whether the paragraph 18 (3), stating that contract boundaries should be applied until the date the insurer has a unilateral right to cancel the contact, should be applied to the different parts of the contract when this contract cannot be unbundled, because the paragraph 18 (4) does not require the ability to unbundle different parts of the contract. It is indeed not clear whether the paid-in and future premiums can be considered as different parts of a contract. This could lead to situations where coverages of the same contract have different contract boundaries as required by 18 (3), although the contract cannot be unbundled. Therefore, EIOPA proposes to amend 18 (4) so that it states clearly that 18 (3) can only be applied when the contract can be unbundled.

c. Exception in Article 18 (3)

18 (c) says that the obligations are within contract boundaries until the date the insurer can amend the premium to fully reflect the risk. In some cases, the insurers cannot evaluate the risk after the inception, so the insurer should evaluate at contract/portfolio level whether the premium is sufficient. Then the contract boundaries are extended until this date, which could increase the own funds thanks to future profits.

This situation can occur for example in group life insurances or in life insurances with death riders where the insurer cannot evaluate every individual risk regularly.

Due to differences in interpretation of this exception, the same risk can be handled differently by two insurance companies depending on whether they can assess or not the risk at the renewal date. EIOPA proposes to restrict the exception only to cases where the insurer cannot perform the reassessment for legal (and nor i.e. for technical) reasons.

d. EPIFP (Expected Profits in Future Premiums)

Currently, the calculation of the EPIFP is considered as not accurate for several reasons:

- All loss-making policies are excluded, while compensation by the profit-making ones is only allowed within the same HRG.

- The EPIFP are calculated gross of reinsurance and SPV.

- The EPIFP are calculated before taxes.

Therefore, three options are being considered to improve the calculations:

- Option 1: No change, i.e. maintain current wording.

- Option 2: Include all future losses and the impact of reinsurance in the EPIFP.

- Option 3: Include all future losses, impact of reinsurance and impact of taxation in the EPIFP.

EIOPA still believes that the non-compensation of profits by losses is still critical for the EPIFP calculation because it allows to see the structure of the EPIFP, so the information about loss- and profit-making policies should be available at least at line of business level.

There is still agreement that there should be non-compensation within an HRG, but in practice, it means that the loss- and profit-making policies are never in the same HRG. EIOPA raises the question whether it is practically possible that policies can be part of the same HRG while having different profitability levels.

Reinsurance is considered to provide valuable information. However, a calculation on contract level can be very burdensome, so it should be allowed to calculate the impact at undertaking level. On the other hand, the impact of taxation is believed to be very hard to estimate. Therefore, EIOPA advises to follow option 2 (listed above).

e. Other expected profits

The contribution of profits in management fees and charges for servicing and managing funds can represent a significant amount, but its contribution to own funds has been unexplored.

EIOPA advises to take this into account in the calculation of EPIFP.

2. Future Management Actions

Some companies do not consider actions in the business plan to be management actions in the sense of the article 23, because these actions are already foreseen and not reactive.

EIOPA believes that any action in the future is a management action, regardless of whether it is part of the business plan or not, and proposes to amend the definition of management action accordingly.

3. Expenses

According to Article 31 (4), new business should always be assumed when allocating expenses to the existing business in the best estimate calculation. This assumption allows the expenses to fall gradually in line with the existing business. However, companies which are in run-off are also obliged to assume new business, which would lead to an unrealistic projection of expenses.

Therefore, it is logical to amend the article so that more realistic assumptions regarding the new business are considered.

4. Option and guarantees

Ideally, the surrender rates should be modelled dynamically because the policyholders do react rationally to external factors, such as interest rates, which are dynamic. Nevertheless, many insurers refrain from modelling the policyholder’s behaviour dynamically due to lack of data and therefore, some simplifications of Article 26 are being considered.

However, EIOPA is against any simplification because it will result in most insurers using simplifications by putting forward the absence of data. It proposes to keep the current wording and to introduce additional guidance on the calibration of dynamic models provided by EIOPA.

5. Risk margin

The current approach has been widely studied and questioned by EIOPA. Especially the following points came under scrutiny:

- Comparison between the actual portfolio transfer prices and the portfolio’s technical provisions.

- Use of matching and volatility adjustment in the calculation.

- Use of a fixed CoC (instead of dynamic, i.e. linked to risk-free rates).

- The current calibration of CoC at 6%.

- The level of the current CoC rate.

After a thorough discussion, EIOPA came to the conclusion not to amend the risk market calculation, even though the European Insurance Industry raised strong concerns on the risk margin and notably the impact the current excessive risk margin can have on insurers’ long-term products and their ability to invest long-term.

B. Solvency Capital Requirement standard formula

EIOPA confirms its advice provided in 2018 to increase the calibration of the interest rate risk sub-module. The current calibration underestimates the risk and does not take into account the possibility of a steep fall of interest rate as experienced during the past years and the existence of negative interest rates. The review of the spread risk sub-module and the correlation matrices for market risks, the treatment of non-proportional reinsurance, and the use of external ratings did not result in proposals for change.

1. Interest rate risk

The interest rate risk has been widely criticised for being unrealistic. The common criticism is that the current approach drastically underestimates the risk and has other serious limitations such as the inability to stress negative interest rates.

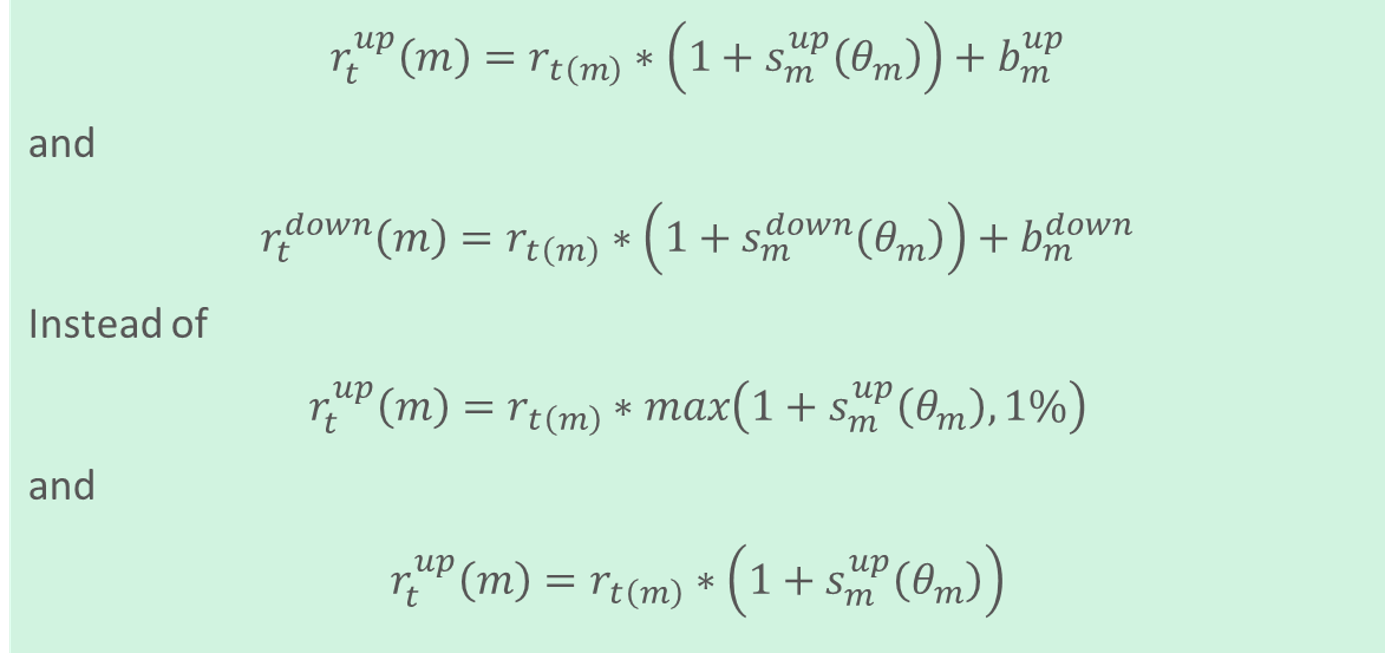

EIOPA proposes a relative shift approach where the interest rate curve is stressed with the formula:

Where m is the maturity and s and b are maturity dependent stress components.

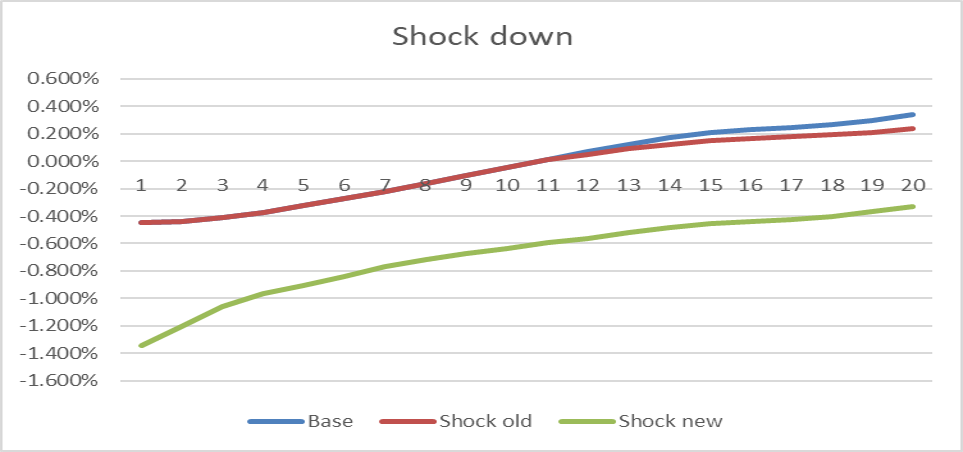

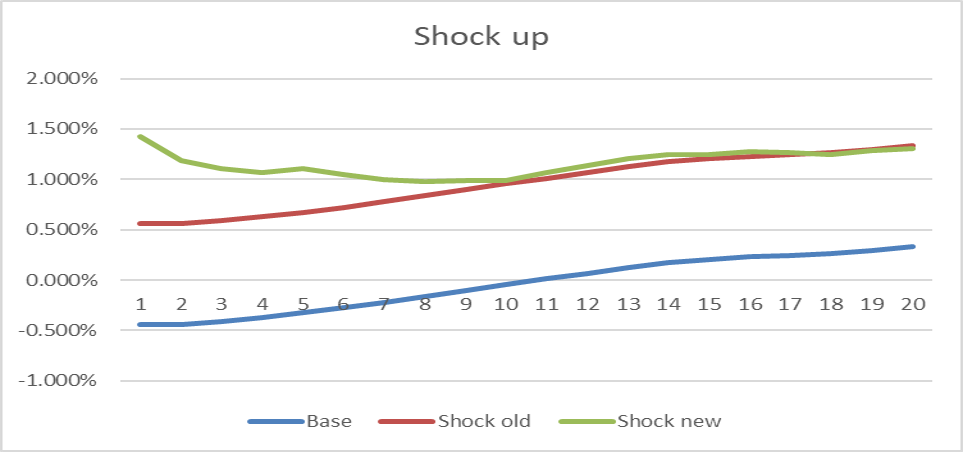

The new interest rates were backtested by comparing the number of times the interest rates exceeded the 99,5%-confidence interval with the expectations. The exercise showed a significant improvement to the current model without being too conservative.

EIOPA provides a set of calibrations for different extrapolation starting points (20, 30 and 50 years). The charts below show how the new proposal would change the stress for EIOPA November 2019 rates.

2. Underwriting risk

EIOPA is not aware of any reason why a recalibration of current shocks would be necessary. EIOPA has also sent surveys to insurance companies but hasn’t received any information justifying changes in the current approach.

3. Catastrophe risk

The calibration of the CatNat risks was performed by averaging contractual limits and deductibles over all insurance companies. Therefore, in the previous review, EIOPA advised to add an ex-post adjustment considering companies’ contract specifications in the CatNat SCR calculation.

In order to better understand the possible application of the adjustment, a survey was sent to insurance companies, where they were asked to fill in the contractual limits and deductibles at the moment of calibration.

This survey demonstrated that it is still too early to introduce this adjustment, because EIOPA is not in a position to thoroughly assess the use of this option. A decision is expected for 2020.

4. Risk mitigation techniques

a. Non-proportional reinsurances in non-life underwriting risk

Some insurance companies complained that not all popular non-proportional reinsurance covers are considered in the standard formula. A new USP method was introduced for the stop-loss reinsurance in the premium risk calculation as from July 2019. After a deep analysis, no further modifications are considered necessary.

b. Adverse development covers and finite reinsurance covers

During the last review, some stakeholders made a proposal to recognise specific types of non-proportional reinsurance for premium and reserve risk. However, EIOPA is not yet satisfied with the discussed proposal and prefers to stick to the current approach and to continue working on a possible solution.

C. Conclusion

Since its start in 2016, Solvency II has indisputably proven its qualities as a regulatory framework. However, nobody is perfect and in the past years a number of shortcomings, often caused by ambiguity in the wording or by the design and calibration of the calculation, have been identified as needing to be fixed. These deficiencies can lead to an inconsistent interpretation of the standard and notably to an over or under estimation of technical provisions or capital requirements.

Therefore, EIOPA was asked by the Commission to propose a review of Solvency II.

As part of the 2020 Solvency II review, EIOPA has proposed a large number of modifications which aim at restoring the level playing field and reinforce the stability of the insurers. However, some of the amendments proposed by EIOPA (i.e.interest rate risk, EPIFP or risk margin) will probably leave the insurance industry wanting more, and the European Commission most likely proposing to meet half way once again.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support