IAIS Insurance Capital Standard: the road travelled so far and what is next?

Written by

Francis Furey, Managing Consultant

History of Insurance Capital Standards

This article focuses on giving an overview of the Insurance Capital Standard (ICS), a capital framework which has been developed by International Association of Insurance Supervisors(“IAIS”).

The IAIS received a mandate from the Financial Stability Board (FSB) and G20 leaders to develop common supervisory framework (ComFrame) for the supervision of IAIGs. ComFrame and ICS Version 2.0 were thus adopted by the IAIS on 14-15 November 2019. ICS Version 2.0 is now pending implementation in the EU which, as per EIOPA 2020 workplan, is scheduled to happen throughout 2021.

ComFrame is intended to promote effective and globally consistent supervision of the insurance industry to support policyholder protection and financial stability. ComFrame consists of both quantitative and qualitative supervisory requirements. As part of ComFrame, the IAIS will deliver a risk-based capital standard, ICS, which will apply to all IAIGs including Global Systemically Important Insurers (G-SIIs) at a group consolidated level only.

What does the ICS entail and what powers does it have?

The ICS is being developed as a group-wide prescribed capital requirement (PCR), which is a solvency control level above which the supervisor does not intervene on capital adequacy grounds. The ICS is not intended to replace existing arrangements or capital standards for legal entity supervision in any jurisdiction.

The IAIS has no power to impose the ICS on IAIGs and national legislators will have the discretion to decide whether they are going to implement the ICS. Following six years of annual field testing and three public consultations on the ICS, the IAIS announced the implementation of the ICS in two phases.

- Phase 1 will be a five-year monitoring period starting in 2020 during which IAIGs will confidentially report ICS results to group-wide supervisors (GWSs) annually, noting the basis will not be a prescribed capital requirement during this period. The quantitative element foresees the calculation and confidential reporting of the ICS 2.0 according to the approved technical specifications. The qualitative element expects a discussion of the performance of the ICS 2.0 in international colleges of supervisors.

- Phase 2 would then be the possible implementation of the ICS as a group-wide prescribed capital requirement (PCR), which could trigger supervisory intervention.

How is an IAIG determined?

There is a register of IAIGs publicly disclosed by GWSs. The register has been compiled by the IAIS based on information received from GWSs.

GWSs are responsible for identification of IAIGs, in cooperation with other involved supervisors, after considering whether a group meets both the following criteria, provided in ComFrame:

- Internationally active:

- Premiums are written in three or more jurisdictions; and

- Gross written premiums outside of the home jurisdiction are at least 10% of the group’s total gross written premiums.

- Size (based on a three-year rolling average):

- Total assets are at least USD 50 billion; or

- Total gross written premiums are at least USD 10 billion.

In limited circumstances, described in ComFrame guidance, the GWS has discretion to determine that a group is not an IAIG even if it meets the criteria or that a group is an IAIG even if it does not meet the criteria. As of 1 July 2020, forty-eight (48) IAIGs have been identified by relevant GWSs from 16 jurisdictions. Out of those 48 IAIGs, 30 IAIGs have been publicly disclosed by relevant GWSs from 11 jurisdictions. The public register will be updated at least annually. However, ad-hoc updates may be made more frequently based on disclosures by GWSs that may occur during the year.

ICS 2020 technical reporting releases

Level 1

On 14 November 2019, the IAIS released the Level 1 ICS document. The purpose of the Level 1 document is to set out the overarching principles and concepts (i.e. ICS architecture) for the annual confidential reporting of the reference ICS and, at the option of group-wide supervisors (GWS), additional reporting during the five-year monitoring period.

Level 2

On 13 March 2020, the IAIS released the Level 2 ICS text providing further details on the ICS framework applicable during the monitoring period with a press release on 27 March 2020. Levels 1 and 2 together form ICS Version 2.0 for the monitoring period.

Level 3

On 23 April 2020, the IAIS released the Level 3 ICS document. Level 3 is a technical specification document, and it builds on the information in Levels 1 and 2, with additional information to enable the annual confidential reporting.

The updated ICS framework for 2020 reporting is broadly unchanged from the 2019 field test but some refinements were made to certain components. We will be issuing a separate detailed blog analysing these changes in a greater detail.

It should also be noted that the IAIS has announced that 2020 submissions for these exercises should be completed on a “best-efforts” basis given the current circumstances brought about by the COVID-19 pandemic. Participating firms are required to complete a spreadsheet template and a qualitative questionnaire.

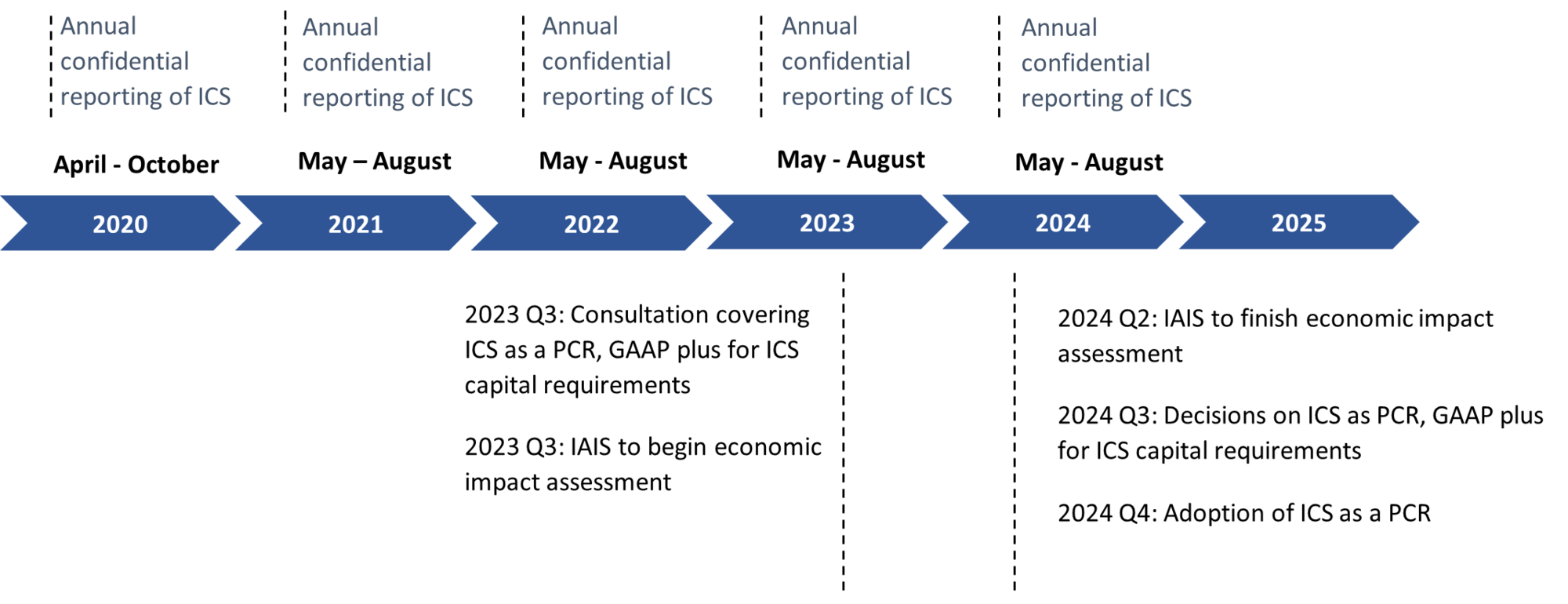

ICS reporting timeline

In response to the COVID-19, the IAIS has deferred the 2020 submission deadline to 31 October 2020. This deadline is c. 2 months later than initially planned. In total this extension provided participating firms with around 6 months to complete these exercises.

The timeline below highlights key milestones in the IAIS’ workplan on the ICS development over the monitoring period

Closing comments

EIOPA and implementation in the EU

The ICS framework is increasing in importance as it is being considered in the development / review of other solvency regimes such as Solvency II. EIOPA has publicly stated its commitment to the ICS development and interestingly some ICS aspects were considered as proposals for some items in the Solvency II 2020 EIOPA review. For example, the revision of the volatility adjustment using a bucketing approach would be similar to that proposed by ICS.

EIOPA issued their “Single Programming Document 2021-2023, including Annual Work Programme 2021” on the 29 September 2020. In it, EIOPA state that “EIOPA's work on the IAIS’s ICS is a high priority with the aim to increase the global convergence and consistency of supervisory practices, through the implementation of a sound risk based regulatory and supervisory framework (ComFrame), from which the Solvency II Directive can become a practical implementation.”

EIOPA go on to say that this “demonstrates EIOPA’s coordination role in developing an international capital standard on a global level and reducing the burden on undertakings of coping with several layers of regulations.”

It will be interesting to see how ICS will progress in the future – the more ICS and Solvency II frameworks converge the more focus will come on whether Solvency II can gain equivalence in order to avoid two effectively same regimes running in parallel.

In the short to medium term, insurance companies should assess how to best utilise the similarities between ICS and Solvency II to complete these IAIS activities alongside other competing business activities in their current operating environment while maximising the insight that can be gained from the ICS figures.

Covid-19

The COVID-19 crisis provides an ideal opportunity for stakeholders to reflect on how the ICS framework responds in practice to extreme events, though the full impacts may not be seen until year-end 2020 or beyond. Finalyse believe it is an ideal opportunity to reflect on how resilient your business is from an ICS perspective and perhaps the 2020 submission will provide some practical and strategic insights for the future.

How Finalyse can help you

- ICS reporting support:

- perform the ICS calculations

- technical assistance or hot desk

- support in submitting the ICS pack

- support in responding to group-wide supervisor on any queries

- monitor regulatory developments and communicating specific issues to your business

- Review of your ICS reporting pack:

- data validation checks

- ensuring calculations are aligned to Level 1, 2, 3 specification documents

- proposing updates to ensure continued alignment to ICS over the monitoring period

- checking reasonableness of approximations and simplifications

- Gap analysis:

- producing a gap analysis detailing differences in the reported ICS figures (done on a best effort basis) to current ICS requirements and proposing a sensible roadmap for implementation over the monitoring period

- Strategic support:

- Strategic support in understanding the ICS figures for your business including on the long-term business strategy

- BAU implementation:

- Implementing ICS reporting into BAU processes and improving the quality of submissions

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support