How Finalyse can help

Are you ready for the next regulatory stress test? Are you aware of all your risks – particularly the tail risks?

The regulatory landscape for IRRBB is rapidly changing. Are you up to date?

Designed to incorporate climate-related and environmental risk considerations into your risk management, governance, ICAAP and disclosures

Written by Veronica Mazza, Senior Consultant

Introduction

On the 4th November, the European Banking Authority (EBA) published the final package for the next EU-wide Stress Test, which will be officially launched in January 2023.

As Andrea Enria stated in his speech at the 2019 Annual Conference of the European Systemic Risk Board (ESRB), “the general goal of a stress test is quite simple: to assess how the ship would weather a storm and what shape it would be in afterwards.”

Applying this metaphor to the banking sector, the main objective of the EU-wide Stress Test is to assess the resilience of financial institutions to adverse financial and macroeconomic conditions.

In 2010, the CEBS - Committee of European Banking Supervisors (EBA’s predecessor) - launched its first ‘bottom-up Capital Adequacy EU-wide stress test which covered 91 banks and represented 65% of the EU banking system or more than 50% of the overall banking assets from all member countries. Since then, EU-Wide Stress Tests have been conducted biennially and have become an integrated part of the risk appetite definition process for banks. They moved from a risk assessment tool used by business lines and risk managers to a strategic input into the global business plan of a bank with full visibility from board and executive directors. The EU-wide Stress Test is now a critical element of risk management for banks and a core tool for banking supervisors and macroprudential authorities.

This article outlines how the Stress Test exercise has changed, summarises the approach presented by the EBA Methodological Note for the next exercise’s run and discusses the future of stress testing.

History and objectives of the EU-wide Stress Test

Until the 2007-2009 Great Financial Crisis (GFC), regulatory stress testing practices in financial institutions were limited to banks following the Internal Rating-Based (IRB) Approach for Capital Requirements for Credit Risk under Basel II. Banks were required to stress test their IRB models under different scenarios like economic downturns, market risk events, or liquidity conditions. In May 2009 the Basel Committee on Banking Supervision (BCBS) published its “Principles for sound stress testing practices and supervision” designed to address the weaknesses in stress testing practices as highlighted by the global financial crisis.

The BCBS publication led the CEBS to establish a target date for the implementation of these principles and start defining its own set of stress testing parameters.

Following the GFC, Stress tests were primarily used to gauge the size of the capital depletion in bank balance sheets, and they were key elements in determining how much additional capital should be provided. This helped to reduce uncertainty, calm the markets and provide extensive disclosure, supporting a more consistent assessment of the risks stemming from both the individual banks’ management and the contagion effect implied in the financial sector.

From 2014, stress tests contributed to the assessment that preceded the consolidation of European banking supervision; they helped levelling the playing field for banks from 19 countries with different accounting rules and supervisory practices.

Historically, the EBA EU-wide Stress Test has covered numerous “stress episodes” and served different purposes, always addressing the challenges of the period. The stress testing started during the GFC which, together with the EU Sovereign Debt Crisis, induced a consolidation of the European banking sector. This was followed by a period of low interest rates coupled with lower growth, which caused concerns for banks’ earnings. Then the Covid-19 crisis came and now the Russian invasion of Ukraine.

During these events, the EU-wide stress test helped to identify potential weaknesses of the EU banking sector and to underpin financial stability considerations and policy. It has been an important tool to induce better risk management practices and risk awareness within the banking industry.

A turning point in the EU-wide Stress Test history has been the introduction of the IFRS 9 Reporting Standard on the 1st January 2018: for institutions that have been reporting under IFRS 9 since 2018, the EU-wide stress test started considering the impact of the introduction of the new accounting regime in starting point data as well as in projections.

In terms of risk coverage, the EU-wide Stress Tests requirements have also been evolving: initially (2014) the only risks included were Credit risk and Market risk whilst since 2016 the risks coverage has been enlarged to:

- Credit risk, including securitizations and sovereign risk

- Market risk (including sovereign risk), CCR and CVA

- Operational risk, including conduct risk

- Net interest income

Regardless the specific period and scope of each EU-wide Stress Test, the exercise is one of the essential regulatory tools for:

- Identifying risks vulnerability in the banking system;

- Assessing the resilience of banks to adverse development;

- Supporting the supervisory decisions with regard to capital and mitigation actions;

- Supporting and fostering better risk management capabilities – including models, data quality and risk management practices;

- Strengthening market discipline by enhancing transparency and comparability across banks.

Overall, these key objectives help ensuring that banks, supervisors, investors and the public are better positioned for the next challenge.

Methodological Approach

The EBA Methodological Note for the EU-wide stress tests declares that it is “a common analytical framework to consistently compare and assess the resilience of EU banks and the EU banking system to shocks, and to challenge the capital position of EU banks”.

In other words, the EU-wide Stress Test, with its constrained “bottom-up” approach, guarantees a results that are comparable across institutions. The results are then incorporated into the SREP Assessment.1

The methodological notepresents details and constraints that banks should apply when conducting a bottom-up calculation of the impacts. The exercises are conducted based on two macroeconomic scenarios («baseline» and «adverse»).

The EBA provides a set of templates to gather data from the different institutions, capture the starting points and publish the results of the exercise. The standardised templates allow for comparison among all the banks involved in the exercise.

The 2023 EU-wide Stress Test introduces some new features:

- The sample of banks is enlarged covering around 75% of the banking sector assets in the Euro Area, the non-Eurozone Member States and Norway.

- The exercise will start addressing climate topics by including sectoral-differentiation in the provided scenarios and a sectoral granularity in the reporting templates.

Constrained “bottom-up” approach

The EU-wide stress tests involve significant input from banks - a so-called constrained bottom-up approach. This has several advantages: by treating all participants equally, it ensures a level playing field and provides results that are comparable across banks. This is an important element in fostering transparency and market discipline.

Under the bottom-up approach designed in the Methodological Note, banks need to use their own models to calculate the effects of pre-defined macro-financial scenarios (“baseline” and “adverse”) and to generate the stress test projections. The methodological framework assumes several constraints:

- Static Balance-sheet assumption: the total volume, maturity and product mix of the balance sheets of participating banks are assumed to remain constant over the stress test horizon. This also assumes a constant overall portfolio exposures throughout the stress test time horizon via replacing the amortized or matured exposures for each year of projections. This assumption is unrealistic: in reality banks would react, for example by selling certain portfolios or parts of the business, adapting their business model, reducing their work force or branch network size, making additional provisions and looking for alternative sources of funding. However, the upside of the static balance sheet assumption is that supervisors don’t have to determine how realistic is it that these mitigating actions will be available when push comes to shove.

- Perfect foresight: due to the above-mentioned inclusion of the IFRS 9 Reporting Standard in the Stress Test framework, Lifetime parameters and Expected Credit Loss have to be estimated. The perfect foresight assumption demands to reflect the full impact of the macroeconomic scenario in year 1 of the stress test for initial Stage 2 and Stage 3 assets that require recognition of Lifetime Expected Credit Losses. Hence the macroeconomic scenarios should be seen as known when calculating expected credit losses.

- Single scenarios: in contrast with the IFRS 9 requirements as regards forward looking parameters estimation, the EU-wide Stress Test calculations shall be carried out with a single scenario at a time (one simulation for 3 years of Baseline scenario and one for 3 years of Adverse scenario);

- No “cure” from S3: since the IFRS 9 frameworks requires the recognitions of the staging allocation of the assets, the underlying assumption of the Stress Test is that the exposure classified as Stage3 cannot migrate to Stage 2 or Stage 1.

Scenarios definition

The exercise assesses the resilience of EU banks under common macroeconomic baseline and adverse scenario. The scenarios cover three future years of projections.

The baseline corresponds to the most current ESRB and ECB staff macroeconomic projections for the EU27, and the adverse scenario consists of a set of deviations from the baseline over the same period for the main parameters.

The narrative of the adverse scenario for the EU-wide banking stress test draws upon a subset of the main financial stability risks to which the EU banking sector is exposed, as identified by the ESRB General Board. The approach usually chosen by the ESRB is a sequence of adverse macroeconomic and financial events, with an impact on variables such as GDP, unemployment, house prices and interest rates that would materialise over a three-year period.

When assessing the severity of the scenario, both the ESRB and the ECB see it as important to consider the weaker macroeconomic starting point. The 2021 EBA stress test, for example, used the adverse scenario to test the resilience of the banking sector to a further deterioration in economic fundamentals against the background of an economy already weakened by the impact of the pandemic in 2020.

The convention for the calibration of adverse scenarios is the “no policy change”. This means that neither monetary policy nor fiscal policy reactions are assumed under the adverse scenario over above what is already embedded in the baseline scenario. Consequently, the economic recession assumed in the adverse scenario is more pronounced than if the policymakers responded with mitigating actions.

Lastly, although in the upcoming run of the exercise the bottom-up approach has been confirmed, following the EBA decision to move to a hybrid framework on a step-by-step approach – decision discussed later in this article - the projections for NFCI2 will be provided to banks based on supervisory top-down models.

2021 EU-wide Stress Test Results

The 2021 EU-wide Stress Test exercise was initially launched in January 2020; however, due to the Covid-19 outbreak and its global spread, in March 2020 the EBA decided to postpone the exercise to 2021 to allow banks to prioritise operational continuity. The adverse macro-financial scenario was designed by the Task Force on Stress Testing of the ESRB in close collaboration with the ECB and draws upon a prolonged Covid-19 scenario in a “lower for longer” interest rate environment. The adverse scenario envisaged that real GDP in the EU would have further declined with a cumulative deviation of real GDP growth from its baseline level by -12.9% (-8.3% in the 2018 stress test exercise). Such decrease in real GDP following the unprecedented decline in 2020 reflected a very severe scenario.

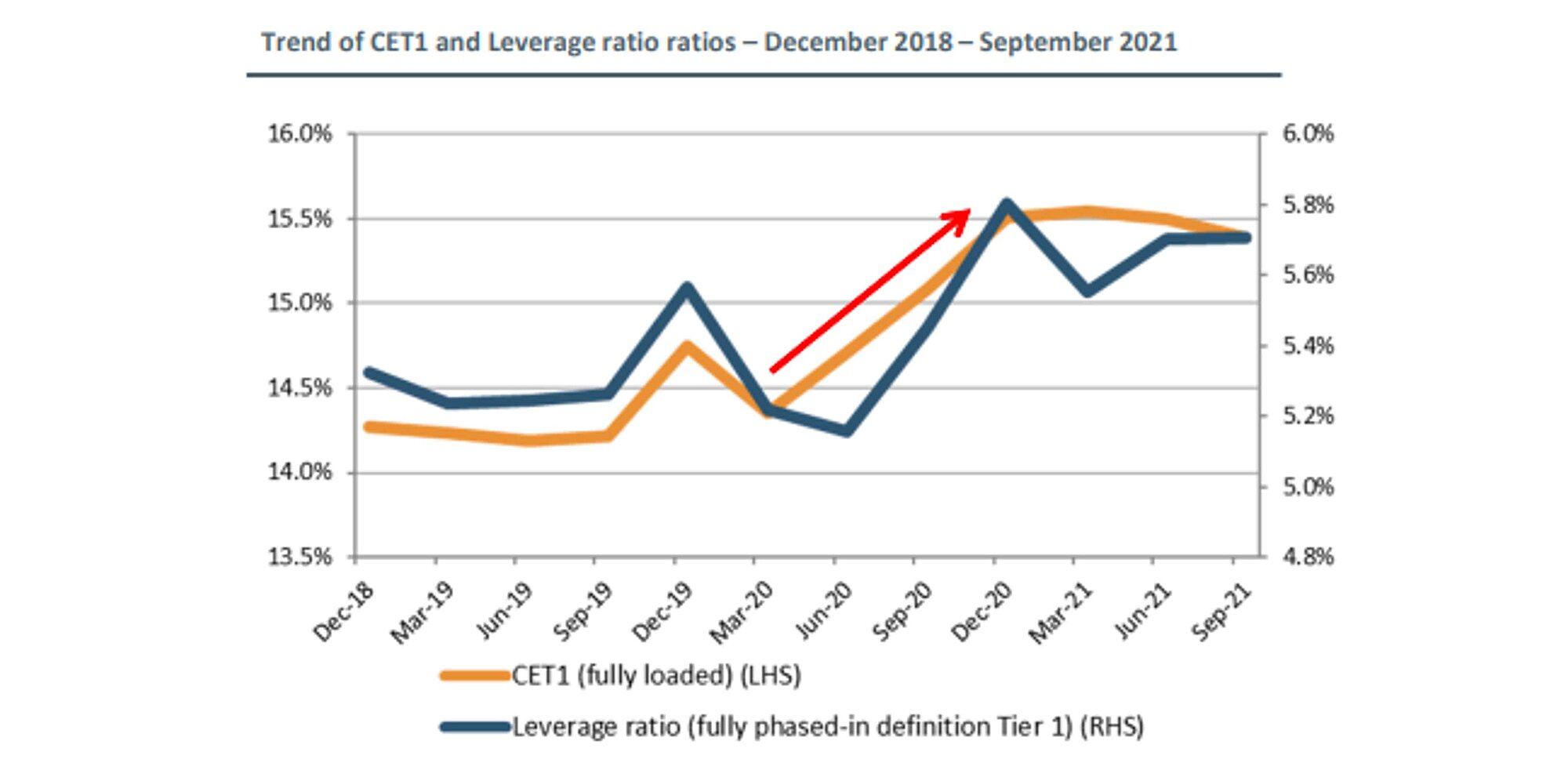

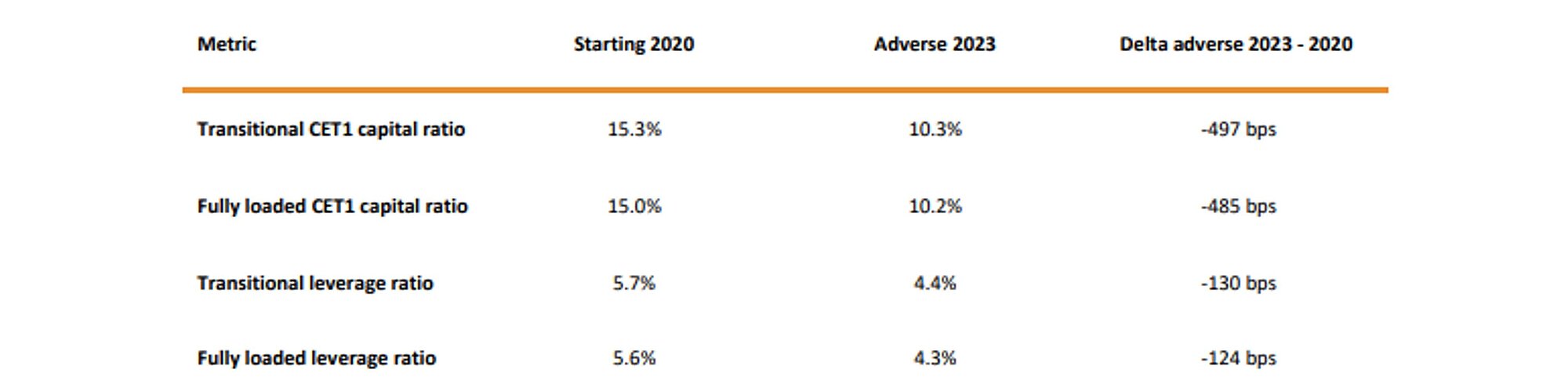

The 2021 EU-wide Stress Test showed that, despite the pandemic, the starting point in terms of the CET1 (15.3%, transitional), was notably above the value reported at the beginning of the previous exercise (14.4%, transitional restated).3

Source: European Banking Authority

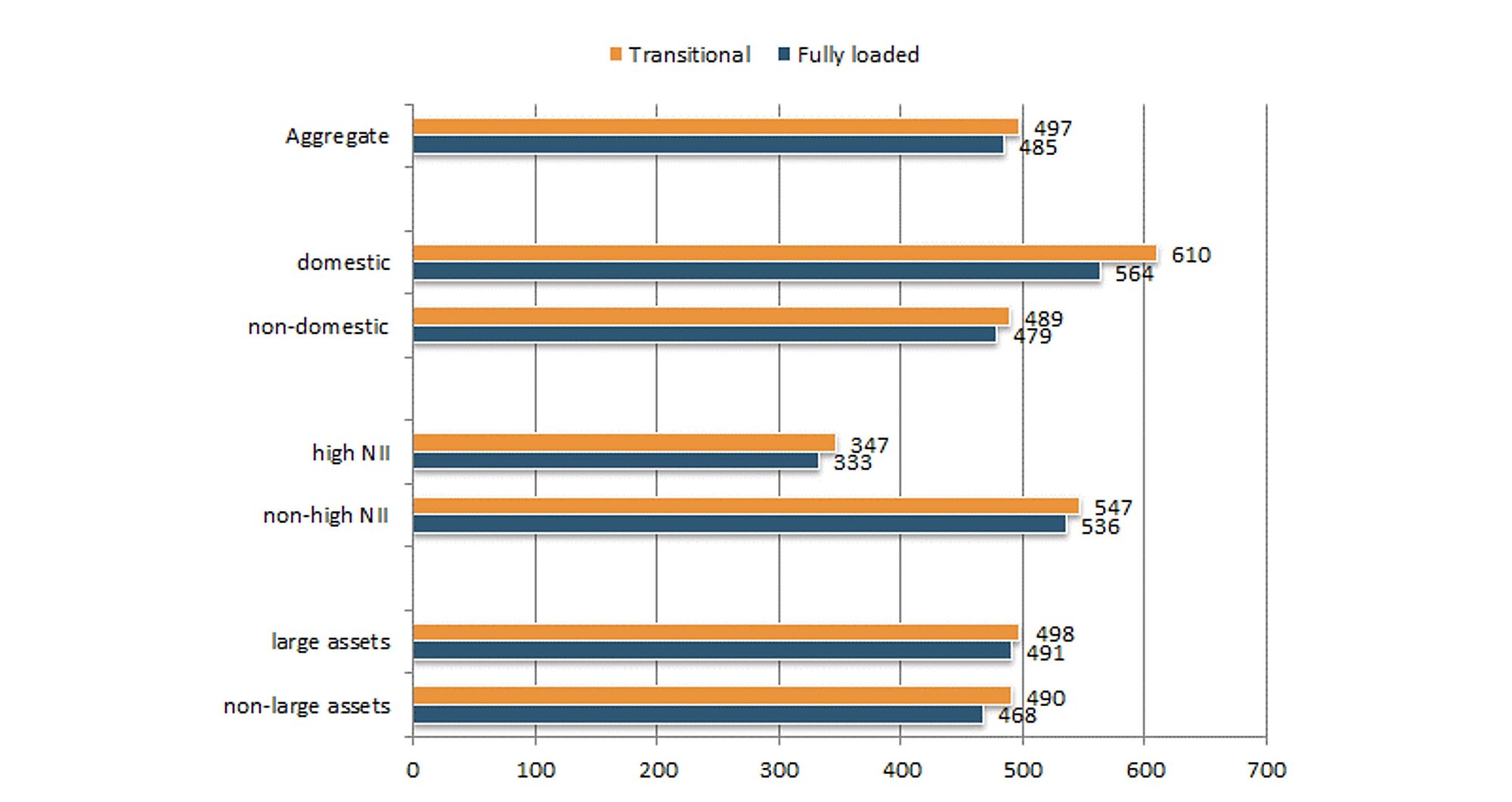

The 2021 adverse scenario's severity and a specific narrative focus on the impact of the Covid-19 pandemic resulted in a capital depletion close to 500bps.

At the end of the stress test horizon, under the baseline scenario, all banks had a CET1 capital ratio in excess to the overall capital requirement (OCR) (with reference to the portion to be held with CET1), with a median excess capital of 704 bps.

Source: European Banking Authority

Credit risk losses had been the main contributor to the stress impact and detracted 423 bps from the CET1 capital ratio as of end-2023 in the adverse scenario. Other relevant direct drivers of banks’ capital depletion were market risk and operational risk losses. The impact of market risk on CET1 capital ratio was -102 bps on a 3-year cumulative basis; following the methodology, market risk losses (recognised in the first year of the stress test horizon, i.e. in 2021) lead to an impact of -163 bps, however the positive contribution of client revenues in the three years of the adverse scenario compensated for part of the 2021 losses (see section 4.1.3). In addition, operational risk losses drive banks’ CET1 capital ratio further down by 68 bps. Banks’ capital ratios are impacted not only by the capital depletion, on the numerator side, but also by the increase of the REA, with an aggregate impact of -121 bps on CET1 capital ratio.

Source: European Banking Authority

The further analysis shows that capital depletion was lower for banks with high NII and for banks less concentrated on domestic markets.

The 2023 EU-wide Stress Test will provide an insight on how the European banks are positioned following two years of Covid-19 pandemic and the outbreak of the Russia-Ukraine war.

Future changes

In the above-mentioned speech on the future of stress testing, Andrea Enria outlines the proposal on how to make the tests both more realistic and more relevant, with fewer resources required. This proposal has been materialized in the “Discussion Paper on the future changes to the EU-wide stress test” published by the EBA in January 2020.

The areas of concern, which should ultimately lead to fundamental changes in the EU-wide Stress Test framework are:

- The lack of clarity and prioritisation of the EU-wide stress test objectives: one example of such a conflict is the microprudential purpose of having the stress test results feeding each bank’s SREP concomitantly. This contrasts with the macroprudential objective of assessing systemic risks;

- The usage of results and their link to the supervisory process: Since the static balance-sheet assumption does not consider management actions, it is difficult to convert the stress test capital depletion into a meaningful supervisory capital add-on (i.e. Pillar 2 Guidance);

- The application of methodological constraints for some risks, even though the banks’ internal capabilities for projecting them might have improved;

- The ownership of the results: although banks are asked to confirm the figures before publication, they do not need to agree with them, and their consent is not legally required for the publication of bank-specific results by the EBA;

- The resource-intensive nature of the exercise for all parties involved and the length of the process.

The identification of these deficiencies drove the proposal of methodological changes through four criteria, some of which may conflict:

- Relevance: the stress test projections should be as close as possible to the impact on capital in an adverse scenario. This can in part be achieved by relaxing some constraints, allowing banks to leverage on their own models and business practices;

- Comparability: the comparability of the results is essential for ensuring a level playing field across banks. Unfortunately, it can only be reached by implementing common constraints and market discipline;

- Transparency: the information from the supervisory stress test should be publicly accessible. This fosters market discipline by enabling market participants to review the stress test results of banks and the actions of supervisors;

- Cost-efficiency: the stress test objectives should be achieved with reasonable investments from both supervisors and banks.

Some of the above-mentioned criteria can conflict with other, therefore the challenge in designing the new stress test framework is finding the right balance. The aim is to maintain the comparability and transparency established by the current EU-wide Stress Test while increasing its relevance and improving the cost-benefit ratio of the exercise.

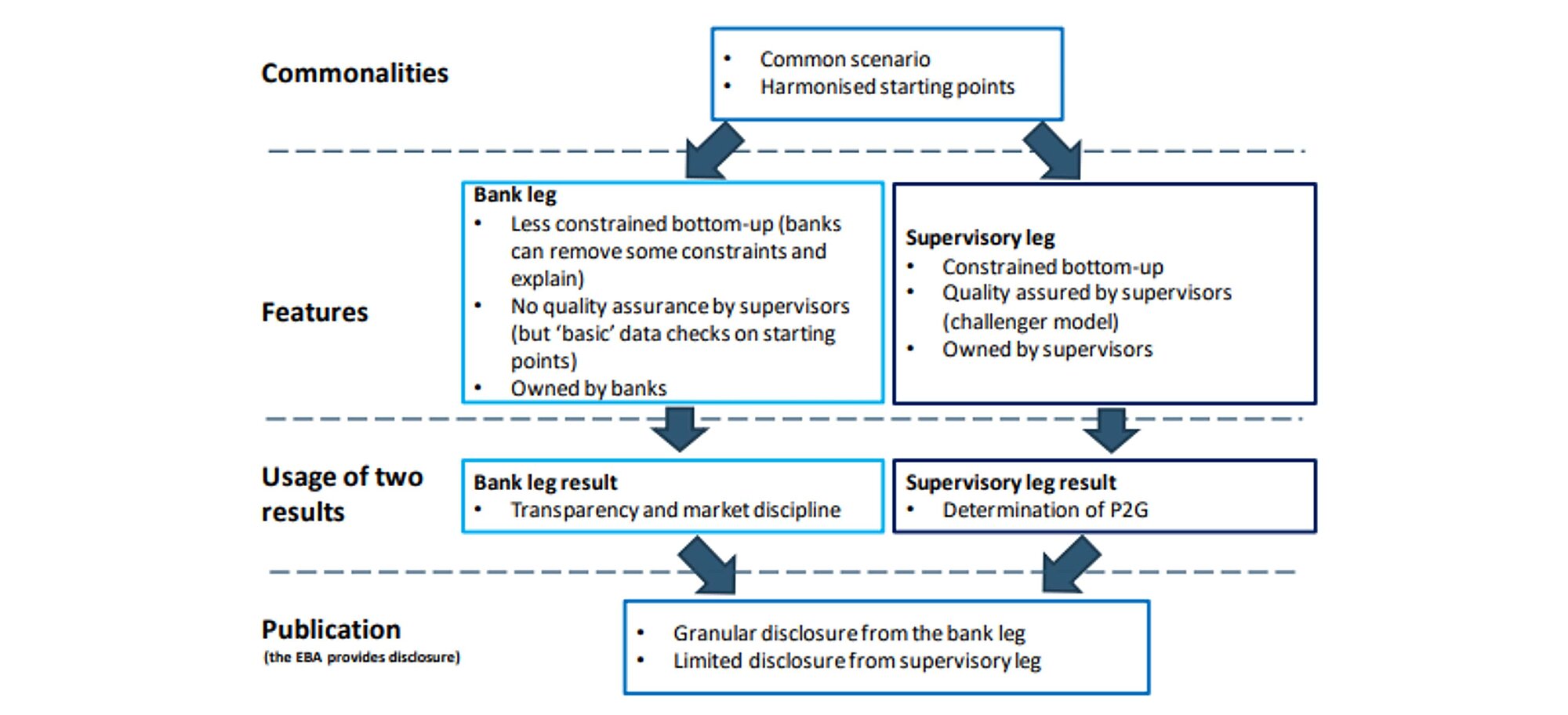

The proposed new framework of the EU-wide stress test is based on two legs: the supervisory leg and the bank leg. The supervisory leg would be a basis for supervisory decisions, directly linked to the Pillar 2 Guidance setting, and a constrained approach. The bank leg would allow more flexibility and focuses on providing disclosure and fostering market discipline. Both legs use the same common scenarios and starting points for projecting the stress test results.

Source: European Banking Authority

Supervisory leg

The supervisory leg is based on a constrained bottom-up approach similar to the current framework, where banks’ projections are challenged and quality is assured by supervisors using various challenger models and benchmarking tools.

Supervisors are the owners of this leg and will form their view on the capital impact of the scenario. Banks will not need to sign the results from the supervisory leg, and the overall Quality Assurance interaction between banks and supervisors would be lighter, with potentially only two data submissions from the bank side and one iteration with supervisors. The publication of the supervisory leg would be limited to a basic set of data points focused on capital depletion and its main drivers.

Bank leg

The bank leg is obtained using a flexible bottom-up approach. The methodology is less prescriptive but still based on the scenarios and templates common for all banks in for comparability.

The results will not be quality assured by the supervisor, giving the institution full ownership of the results. Nonetheless, supervisors may conduct basic checks of starting point data that are also a starting point for the supervisory leg and hence there is no reason for them to deviate between the two legs. The EBA considers to allow banks to use their ICAAP models for producing the bank leg results. This would allow banks to use a common scenario and common starting points and apply only limited guidance and constraints in their projections.

Regardless of the degree of relaxation of the methodological constraints, the reporting to the competent authorities should be based on common templates.

Disclosing the Results

Since two different results would be disclosed, one derived from the supervisory leg and another from the bank leg, an explanation of the differences between the two would have to be provided. Banks would need to quantify and disclose each component that drives the differences between the CET1 capital depletion in the bank leg and in the supervisory leg, except for the changes that are due to supervisory adjustments. However, the starting point for the competent authorities to determine Pillar 2 Guidance should be the CET1 capital depletion from the supervisory leg.

The EBA will disclose, individually and on aggregate level, the results derived from the supervisory leg. These disclosures would be limited to the capital ratios relevant to capital distribution and key drivers for each scenario. The banks’ disclosures should be carried out at granularity level of the current exercise based on common disclosure templates similar to the EBA transparency templates.

Due to the outbreak of the Covid-19 pandemic, the discussion about the future changes of the EU-Wide Stress Test has stalled. However, several associations and institutions have already commented on the proposed framework: the general concern is that the changes could lead to lower transparency in the banks’ resilience outcome (due to two different results) and increased cost of the exercise due to the needs to analyse and explain the potential discrepancies between the supervisory and the bank legs.

Conclusion

The regulatory stress testing framework has evolved from being a crisis management tool to cover the multiple needs of supervisors, markets and banks themselves. It still is an evolving exercise which tries to adapt itself to the emerging needs of all the financial sector’s participants.

Nevertheless, the upcoming EU-wide Stress test remains a challenging practice for any institution as well as an important internal tool to identify the relevant risks and to provide adequate disclosure to the markets.

The new sectoral features require institutions to leverage on their existing sectoral models or to build adequate framework. This newly required level of granularity is becoming the crucial challenge in risk management, particularly as it will probably lead to an integration of climate and environmental risks in future Stress Test exercises.

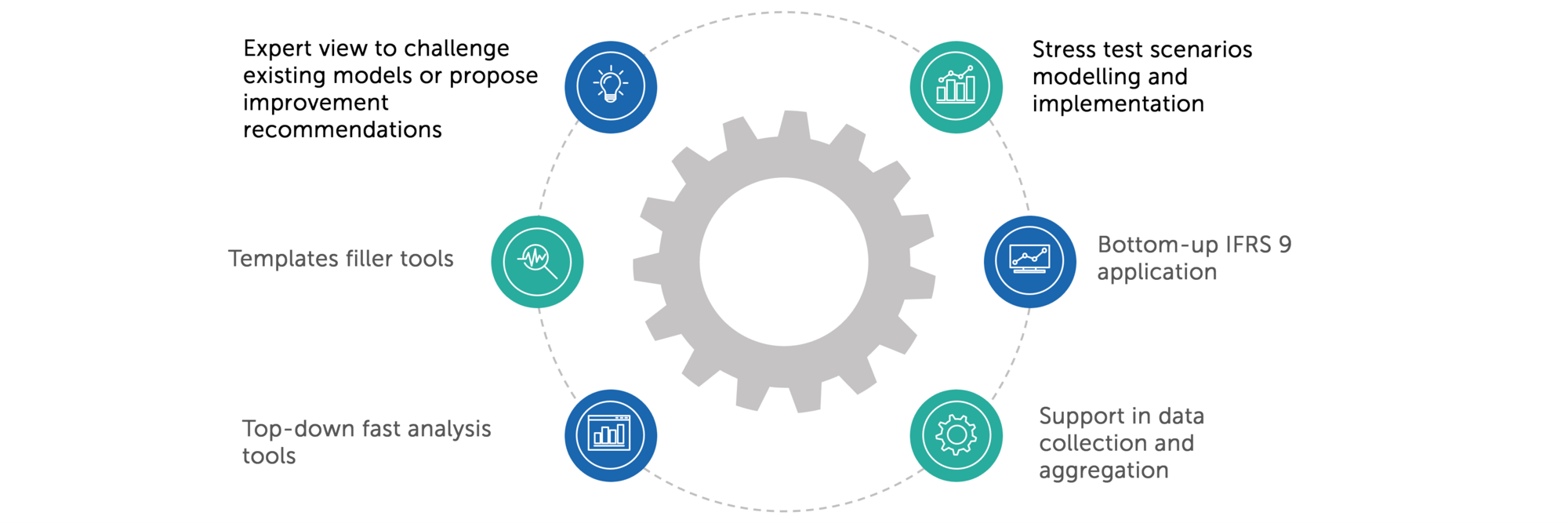

Given the amount of data, models and forward-looking strategies required to carry out an end-to-end EU-wide Stress Test, a wide range of tools and expertise are needed: templates filler tools, high-level credit risk view, bottom-up IFRS 9 application (which requires a greater demand on forecasting methodologies and data quality), and top-down fast analysis tools.

Finalyse Risk Advisory team provides support to financial institutions across the full spectrum of risk measurement and modelling strategies, including the development, deployment and validation of key models and risk measurement methodologies in regulatory capital, Stress Testing and IRB, IFRS 9 and bank risk modelling. Leveraging on this expertise, Finalyse is ready to support its clients to build reliable stress testing frameworks and to analyse their tail risks and hidden vulnerabilities.

References

1 Until 2016, the EU-wide Stress Test was a “pass or fail” exercise: CET 1 thresholds were to be met in order to correctly complete the exercise.

2 Net fee and commission income

3 The CET1 capital ratio at the starting point is higher in current exercise than in 2018 EU-wide stress test. This is still the case if we consider only those banks that took part in both exercises.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support