Achieving sound, comprehensive, and effective climate-related and environmental risk assessment practices - Thoughts on the results of the ECB thematic review

Written by Alexandre Synadino, Consultant

with contribution from Maciej Smółko, Senior Consultant

Reviewed by Milenko Petkovic, Senior Consultant

INTRODUCTION

In November 2022, the ECB published the “Walking the talk: Banks gearing up to manage risks from climate change and environmental degradation” report. The aim was to inform the market about the results of the 2022 thematic review on climate-related and environmental (C&E) risks. The review was performed to determine the degree of alignment of the banking sector with the supervisory expectations published in the ECB’s 2020 guide on C&E risks.

From a risk measurement perspective, the Walking the talk report concludes that, despite a global improvement of the banking sector’s response to C&E risks, implemented practices do not always reach the desired level of soundness, comprehensiveness, or effectiveness.

This article focuses on climate risk management; we argue that, whilst sophisticated practices are necessary, banks could optimise their approaches based on the structure of their portfolios without compromising their existing Net-Zero commitments. Indeed, the expectations set out by the ECB are wide and require the integration of C&E risk management at all levels of the organisation. Below we discuss how to meet the regulator’s required level of maturity for materiality and credit risk assessments, whilst considering business logic and strategy in selecting the appropriate solutions to implement.

TRANSITION RISKS

On the topic of transition risks, the ECB highlighted some shortcomings linked to data collection, portfolio coverage and reflection of transition scenarios in credit risk assessments. Some banks limited their practices to select segments of their portfolios (e.g. corporates) leaving others out (e.g. retail). Similarly, the report indicated that transition pathways, incorporating counterparty alignment strategies, and granular data collection for individual counterparties were not sufficiently observed in current bank practices.

To respond to those identified weaknesses, banks need to elaborate on their coverage and methodologies. They should also increase the dynamic nature of their materiality assessments and improve on the granularity of the data used to perform those tasks.

CORPORATES (INCLUDING SMES)

Transition risk assessment practices pertaining to corporate exposures within banks require more granular data, better profiling, and stronger identification of future pockets of risk. To reach this conclusion, the ECB performed case study interviews and surveys of client files for counterparties expected to be associated with high levels of transition risk. The general finding highlighted in the report is that banks did not sufficiently collect greenhouse gas (GHG) emissions data and forward-looking trajectory information from their counterparties—leading to a failure to effectively measure risk and determine mitigating actions.

The report notes that collecting granular data at the level of the counterparty is unavoidable. Proxies had been recommended in the past, for lack of a better option. Yet, this time the focus was on the weaknesses associated with such methods for determining transition risk at the corporate exposure level. The average level of CO2 emissions for a given sector provides an indication of the sector’s carbon intensity but could lead to unwanted consequences. The overestimation of an individual counterparty’s exposure to transition risk or the failure to recognise ongoing transition enabling investments, could lead to over-provisioning or de-investment strategies. The former would limit a bank’s lending capacity, the later would limit a borrower’s access to funding, and both would be detrimental to steering each sector of the economy towards a sustainable future. Similarly, underestimating the emissions associated with a given counterparty could lead to a build-up of non-identified pockets of risk, which could materialise under, say, a policy change. Hence, accurate data on a counterparty level, and even on asset level, is a key goal for banks to allow for accurate and effective risk management.

The target is for banks to improve the soundness and comprehensiveness of their approaches without leading to unrealistic resource expenditure. Institutions could perform preliminary assessments of each economic sector’s role in the overall economy and establish how granular and elaborate their estimation of climate risks should be for each category. In effect, the 2022 climate stress test report published last July indicated that, on the 31st of December 2021, a non-negligible average of 21% of the total interest income earned by participating institutions was associated with highly emitting sectors such as mining and quarrying, the manufacture of coke and refined petroleum products, electricity, and so on. [1] It is important to note that those industries are generally the largest emitters in an economy but also the providers of essential inputs to sectors active in the secondary and tertiary industries. Under a disorderly transition scenario, the ill-performance of those sectors could cause major disruptions in the overall performance of our economies and lead to significant losses. Hence, it is paramount for banks that are exposed to those sectors to adapt their data collection and obtain granular data at the asset level. The goal is to build a realistic picture of what is required for such sectors to align to their emissions targets, to allocate exposures and set appropriate prices to finance their transition.

It is necessary for banks to keep funding corporates whilst creating the framework to maintain ensuing risks within the range of their current risk appetite. The aim is to do so with sound measurement that would allow for dynamic portfolio steering and correct pricing, at the individual counterparty level. Taking the example of the steel industry, iron ore reduction using hydrogen has the advantage of releasing water instead of CO2 in the treatment of iron oxides. Such changes in the production process are known methods that could drastically reduce emissions associated with the sector. On the other hand, such methods require a steady stream of sustainably produced hydrogen, which in turn will require a steady stream of green energy to sustainably extract hydrogen from water. [2] The banking sector will, in its role and capacity as a lender, need to turn those initiatives into practice at the global level. Consequently, granular asset level data and sound inclusion of transition pathways on a counterparty level are essential for banks to choose where to allocate their funds.

Models need to be designed to integrate such dynamic forward-looking perspectives. Metrics such as the probability of default are to be measured as a function of the borrower’s or the project’s distance from its net-zero emissions target. It should also factor in the assets and disruptive technologies in which the counterparty invests in to reach that target. The same applies to collaterals where energy performance or GHG emissions have an impact on valuation. Of course, such an exercise cannot be performed at the same level of granularity across all portions of a bank’s portfolio. The present recommendation is for banks to perform in depth data collection and develop forward-looking approaches proportional to the carbon intensity and the share of total exposures associated with a given sector.

RETAIL

From the perspective of retail client portfolios, the ECB noted that several surveyed institutions have few measures in place to quantify transition risk in a thorough and comprehensive manner. Currently, the best indicator available in the context of residential properties is their energy performance certificate (EPC). However, this information had not, until recently, been systematically collected by banks. Therefore, thorough data collection exercises or estimations based on observable property criteria are the two viable options for banks to perform sufficiently robust transition risk assessments for their mortgage retail portfolios.

Of course, according to the regulator, leading institutions were those that had effectively collected real EPC data from their clients. Indeed, the obtention of collaterals’ energy performance certificates in a retail (and in a corporate) context was considered necessary to reach the desired level of granularity in a systematic way.

Nonetheless, practical limitations stand in the way of complying with these expectations. Such undertakings call for additional resources to collect, store and develop methods to utilise the data. Moreover, collecting EPC data for existing loans requires active client cooperation. Consequently, other methods for estimating a property’s energy performance should still be used in tandem with regular data collection exercises, to fill immediate gaps in the data. A building’s construction year is the simplest approach for assigning a specific energy performance score. However, this method fails to consider renovation following the time of construction and, therefore, tends to underestimate the real energy efficiency of a building. Other methods, using web scraping on public sites or external data providers, could provide additional variables to produce better estimates of energy efficiency. All in all, sound and comprehensive measurements are obtainable without relying solely on client cooperation for data collection. Still, it is recommended to opt for the most granular approach, if possible, for more robust results.

Finally, methods are available to respond to the expectation for transition risk assessments to be forward-looking, even in a retail context. It is known that energy performance does have an impact on property prices. Hence collateral values could be computed by considering the property’s EPC score to introduce, for example, a haircut for low energy efficiency properties. Under transition scenarios that include growing energy prices caused by carbon taxes—which itself is a function of a country’s energy mix—transition risk for retail exposures could therefore be made forward-looking.

All in all, on the topic of retail portfolios and transition risk, the ECB identified some shortcomings in terms of soundness and comprehensiveness. Data gaps are still significant in that area and methodologies will have to follow to implement sophisticated transition risk assessments for banks’ retail portfolios.

PHYSICAL RISKS

Physical risks are associated with potentially significant materiality in the event where they would have an impact on a bank’s balance sheet. The ECB highlighted that banks’ physical risk assessments had several shortcomings:

- Limited to only a set of physical hazards (e.g. floods)

- Not sufficiently granular

- Not applied systematically to all portfolios and geographies

- Not sufficiently forward-looking

This list of identified necessary improvement points shows that banks seem to have not yet devised an institution-wide approach to deal with physical risks. Whilst several institutions have developed multiple initiatives within multiple risk teams, those lack in granularity, coverage and in their integration of future climate scenarios.

With the state of advancement of physical risk methodologies and tools currently in the market, it is difficult to imagine a one-stop-shop solution that could respond to all the shortcomings identified by the ECB at once. Some solutions provide wide geographical coverage but low granularity, whilst others are precise but limited to certain zones. Similarly, forward-looking assessments are usually specific to a type of physical hazard (e.g. flood, drought, storms) and do not systematically offer the same underlying scenario assumptions. Moreover, many tools provide standardised outputs, such as Low/Medium/High scores, with little to no information as to the assumptions that have been applied in the production of such data. In other words, finding sufficiently precise and exhaustive solutions that are not “black box” to the end user is a challenge.

As a recommendation, banks should focus on identifying the correct design of their physical risk assessment according to criteria such as proportionality, the end-goal of the assessment and the type of physical risk in question. Granularity is maybe more essential in an assessment of flooding compared to storm risk or drought. On the other hand, the damages caused by a drought (impact on agricultural production, wildlife, transport, households) are more far-reaching than those associated with one flooded riverbed. A drought could affect entire regions and thus severely impact agricultural production, leading to a food supply shock and price disruptions in the whole economy. Still, a retail mortgage bank with exposures close to rivers should develop a more elaborate flood damage assessment compared to a bank with a strong historical exposure to farmers. Consequently, banks should perform such high-level qualitative exercises, to assess the materiality of each hazard type, and only then invest in the implementation of practical quantitative physical assessment methods.

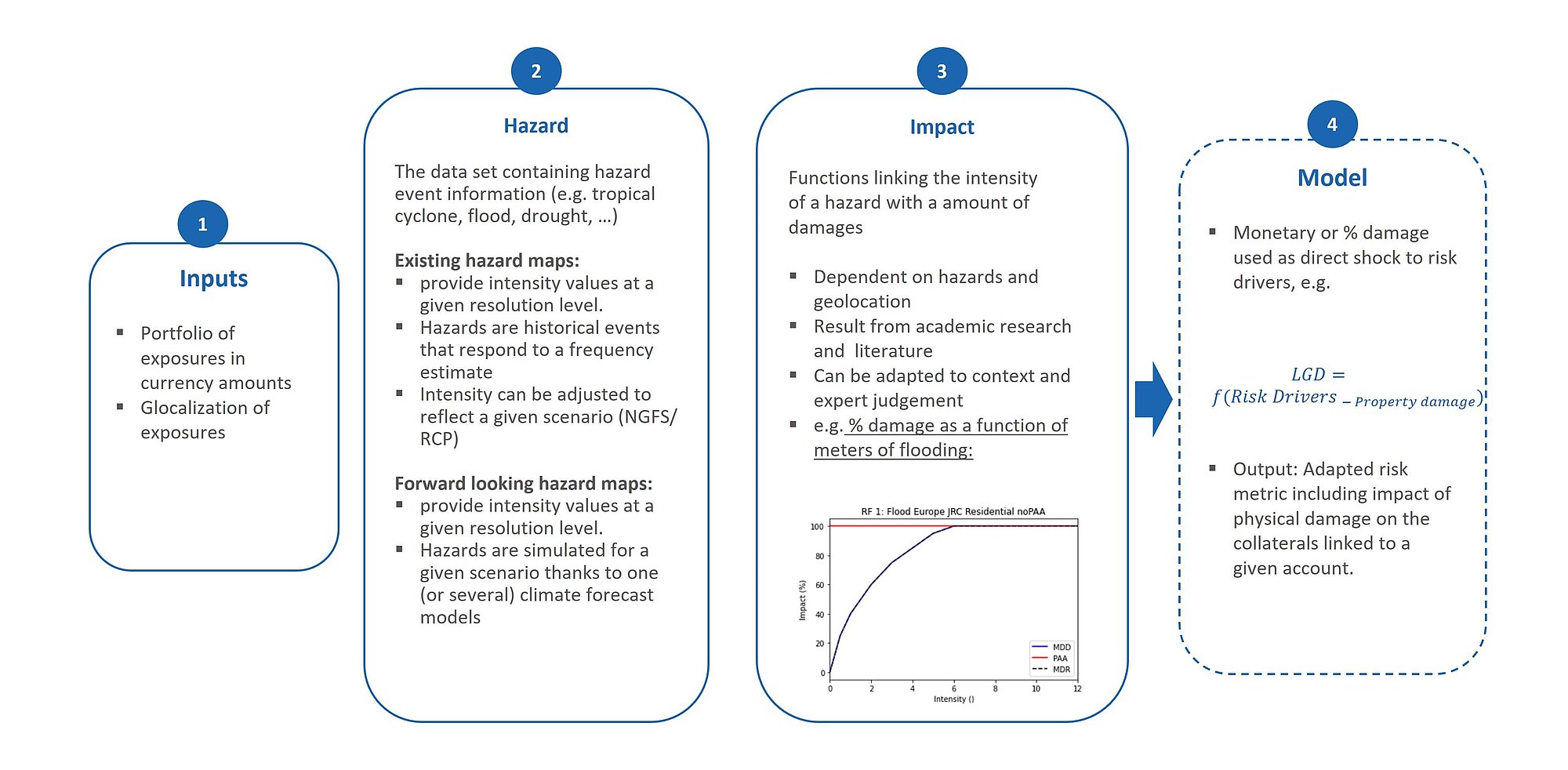

Solutions are also available to produce forward-looking assessments that are both granular and include transparent internal functionalities. Publicly available scenario data, such as that supplied by the Network for Greening the Financial System (NGFS), contains projections of relative change in various indicators (precipitation, Annual Maximum River Flood Depth, etc.) at different degrees of global warming. [3] Detailed maps of historical hazards (e.g. Joint Research Centre data) at different return periods are also becoming available at lower levels of granularity and on a global scale. Furthermore, increasingly elaborate open-source tools are being developed. Hazards, impact functions and risk indicators are based on well documented and verifiable modules. Consequently, a process design involving the combination of existing maps and tools with scenario data (provided by official sources) is a robust way respond to the ECB’s expectations. A high-level schematic overview of the approach can be found below:

Further sophistication in modelling and in data collection will be necessary to estimate the compounded effect of the occurrence of physical risks (e.g. physical damage causing business interruptions and supply chain effects). Yet, the design described above allows for flexibility, granularity and control of the parameters going into the assessment. Moreover, it enables one to link counterparty assets and collaterals to given physical hazards and, if applicable, to factor in any risk mitigation measures applied by that counterparty in a hazard impact assessment.

All in all, the implementation of sound and comprehensive physical risk assessments will depend on initial high-level design decisions. To prevent the creation of multiple separate and resource-inefficient assessments—covering only certain portfolios and/or geographies—banks will need to plan the development of their physical risk measurement practices and strategically allocate resources according to principles such as proportionality and materiality. Preliminary planning and budgeting should allow institutions to disentangle the challenges set by climate risk and, eventually, lead to value creation.

CONCLUSION

The results of the ECB’s 2022 thematic review published earlier last month, provided insights into the maturity of the European banking sector’s practices with regards to the management of C&E risks. Overall, the sector has shown improvements compared to 2021. However, the ECB pointed to some shortcomings in methodological sophistication, the use of granular information on risk and/or active management of the portfolio and risk profiles.

On the topic of climate risk, this article has shown that the high expectations set by the regulator can be broken down into concrete implementation strategies – both in terms of transition and physical risks – without leading to overinflated costs. Strategic allocation of resources and portfolio steering are key in this exercise. Banks need to facilitate the transition to sustainable economies, whilst being able to absorb resulting climate risks. The opinion expressed by this article is that soundness and comprehensiveness of climate risk management practices are heavily intertwined with business positioning and strategy. Appropriate risk management is necessary for capital allocation, but also to generate new opportunities, strategic direction, and income streams.

REFERENCES

[1] 2022 climate risk stress test – Banks’ exposure to climate risks page 29

[2] Spreitzer, D. and Schenk, J. (2019), Reduction of Iron Oxides with Hydrogen—A Review. steel research int., 90: 1900108. https://doi.org/10.1002/srin.201900108 and The Shift Project, Climat, crises: Le plan de transformation de l'économie française

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support