How Finalyse can help

Integrating climate change risk into your ORSA, governance and risk-management system

Helping you comply with the regulations as well as optimising your Economic Balance Sheet (EBS)

Designed to incorporate climate-related and environmental risk considerations into your risk management, governance, ICAAP and disclosures

EIOPA Application Guidance: Running Climate Change Materiality Assessment and Scenarios in the ORSA

Written by Paramjeet Singh, Consultant

Evelyn McNulty, Senior Consultant

Frans Kuys, Principal Consultant

Introduction

EIOPA published the application guidance on running climate change materiality assessment and using climate change scenarios in the ORSA in August 2022 (“the guidance”). This is optional guidance which supplements EIOPA’s April 2021 Opinion on the supervision of climate change scenarios in ORSA (“the Opinion”).

Chapters 1 and 2 of the guidance provide an overview of the guidance for the high-level reader. Chapter 3 provides concrete examples for dummy life and non-life companies and is suggested to be further reading for the technical audience. In this article, we focus on the first two chapters of the guidance.

The examples included from sources such as the Network for Greening the Financial System (“NGFS”), the 2-Degree Investment Initiative (“2DII”) and the UN’s Intergovernmental Panel on Climate Change (“IPCC”) climate analysis give the reader a guide as to which publicly available resources can be considered reliable. Furthermore, the examples of tools, data and methods to run the materiality assessment and to model the climate change scenarios make the task ahead for ORSA 2023 seem less daunting.

Climate Change Risk and ORSA

The guidance highlights that the process of incorporating climate change risk is not only about the scenario analysis and its associated challenges. EIOPA expects that the details of climate risk governance, risk management processes and controls will span multiple sections of the ORSA.

EIOPA states that the guidance is intended to be an aid for insurers, rather than a supervisory convergence tool. The examples given are not an exhaustive set and, as always in the context of ORSA, insurers should consider risks and modelling approaches that are relevant to their specific portfolio. Chapter 1 of the guidance lists the various sections of the ORSA where climate change risks could be addressed, which includes the insurer’s risk appetite and standard formula appropriateness assessment.

Materiality Assessment

A key first step for an insurer is to assess the materiality of climate change risks, and if a risk is deemed to not be material, EIOPA expects a justification of that conclusion. In the context of Solvency II, risks are considered to be material where ignoring the risk could influence the decision-making or the judgement of the users of the information. For ORSA, users could include capital management, strategic or business planning teams, or the Board and supervisory body.

EIOPA suggests a combination of qualitative and quantitative analyses of both the asset and liability exposures in the portfolio. In performing the materiality assessment, the interconnectedness of physical and transition risks should be considered. Insurers should not only consider the current experience but also the future impact of climate change.

In terms of the time horizon, EIOPA expects insurers to consider the long-term, which stretches to many decades for climate change risk. However, the guidance states that the time horizon should be consistent with the insurer’s long-term commitments.

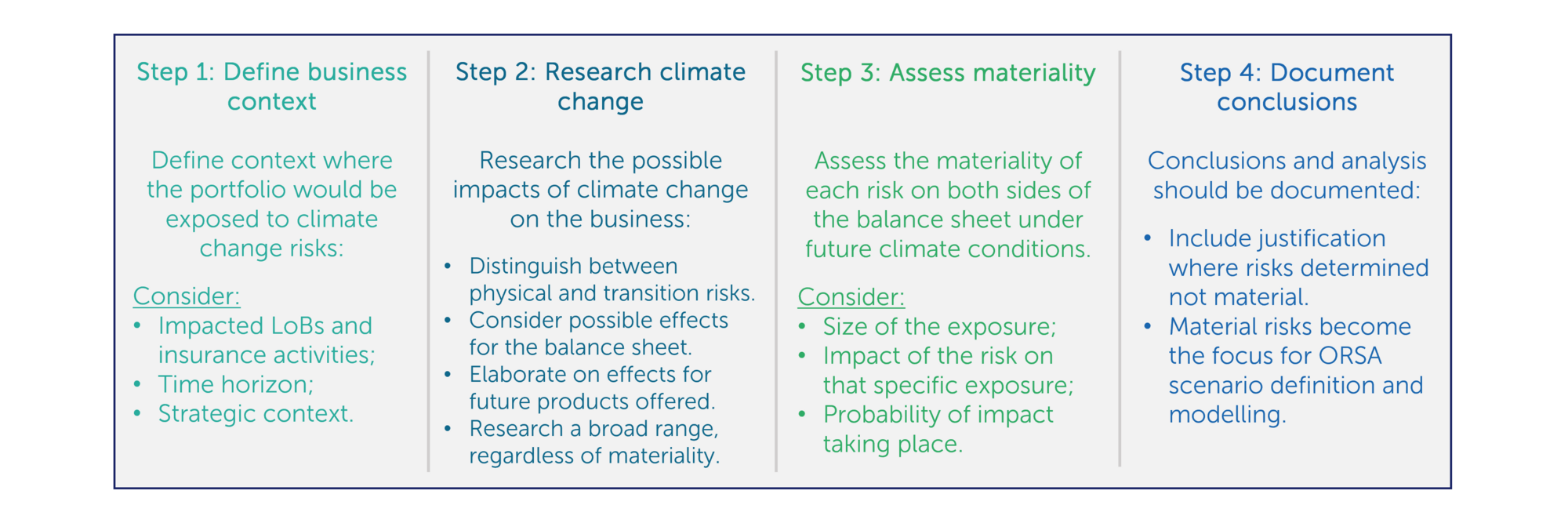

EIOPA suggests the following steps be considered when conducting a materiality assessment:

Materiality Assessment Matrix

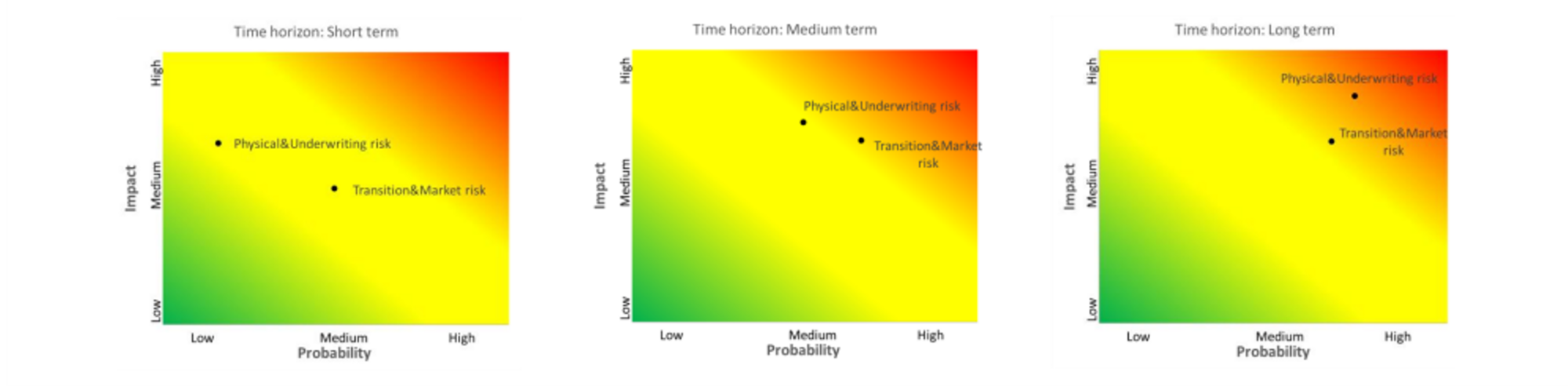

The guidance sets out three key dimensions for the materiality assessment: impact, probability and time horizon. The impact and corresponding probability will vary with the different time horizons. EIOPA suggests that insurers could use the results of their analysis to create a materiality assessment matrix, illustrating how the risk is evolving and which time horizon is more relevant. The guidance gives the following heat map style example:

Climate Change Scenario

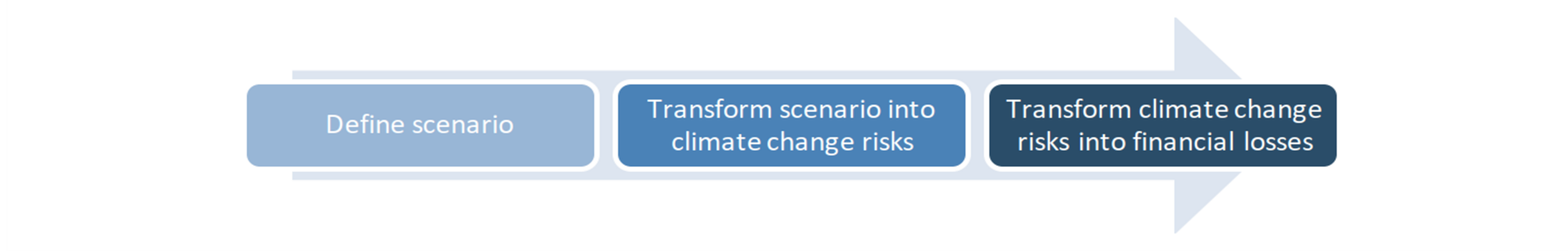

The 2021 Opinion stated that insurers should consider at least two long-term climate scenarios: one where global temperature increase remains below 2oC and one where it exceeds 2oC. In the guidance, EIOPA suggests the following steps for running scenarios:

The high-level scenario must be elaborated on with transition and physical scenarios. This could include for example the speed at which decarbonizing of energy occurs, whether there will be an unexpected shock to the economy or a gradual change (transition) and how emissions and weather patterns (physical) will develop.

The guidance gives examples of how to approach the steps for defining scenarios and transforming these into climate change risks from a transition and physical viewpoint. The focus of the more detailed scenario parameter definition will be guided by which climate risks are material for the particular insurer. The guidance then outlines the potential metrics to be used for evaluating financial impacts.

Transition Scenarios

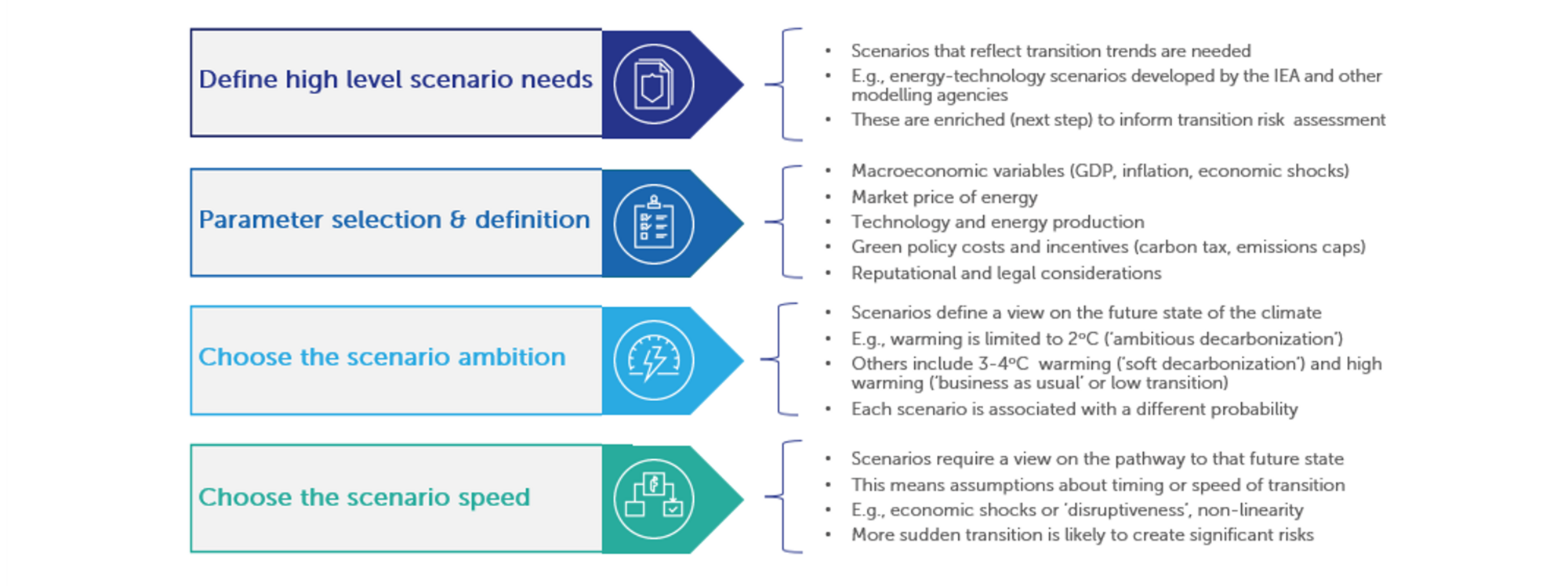

For choosing transition scenarios, the guidance cites the scenario definition method developed by 2DII in 2017 and suggests the following steps:

The transition to a carbon-neutral economy will impact the revenues and expenses of companies, and ultimately their market values, to varying extents. We are already seeing the impacts on the cost of energy caused by supply shortages in the EU. Future pathways for transition and its impacts on markets and the broader economy should be part of the scenario definition.

The guidance states that the scenarios developed by the NGFS are particularly relevant. These include the following:

| Scenario | Description | Impact on physical & transition risk |

|---|---|---|

| Orderly Transition | Early policy action, temperature increases remain below 2°C | Physical and transition risks minimised |

| Disorderly Transition | Late policy action, temperature increases remain below 2°C | Early physical risks, high transition risks |

| Too little, too late | Manifestation of physical risks spurs a disorderly transition, and temperature goals not met | Physical and transition risks are high and severe |

| Business as usual / “Hot house world” | No additional policy action and the transition is insufficient to meet temperature goals | High physical risk |

Insurers could leverage the information from publicly available resources, such as the NGFS when setting the future transition and economic pathways in their ORSA scenario definitions.

Physical Scenarios

Physical scenarios consider the impacts on climate systems from emissions and human activity. The guidance outlines the Representative Concentration Pathways (“RCP”) and Shared Socioeconomic Pathways (“SSP”) scenarios which were used by the UN’s IPCC in their fifth and sixth assessment reports, respectively.

The RCPs represent four pathways for greenhouse gas (“GHG”) concentration levels by 2100, a proxy for global warming. The SSPs model how socioeconomic conditions may change and how different levels of climate change mitigation could be achieved, using the RCP as target emissions outcomes.

The RCP pathways are as follows, where the numbers represent the concentration levels in 2100:

| Scenario | Description |

|---|---|

| RCP8.5 | High emissions – no policy change and high GHG concentration |

| RCP6.0 | High to intermediate emissions – GHG peak around 2060 before declining by end of the 21st century |

| RCP4.5 | Intermediate emissions – ambitious emission reduction with GHG emissions starting to decline by 2040 |

| RCP2.6 | In line with the Paris agreement 2°C goal – GHG emissions to peak by 2020 and then decline to achieve net negative by 2100 |

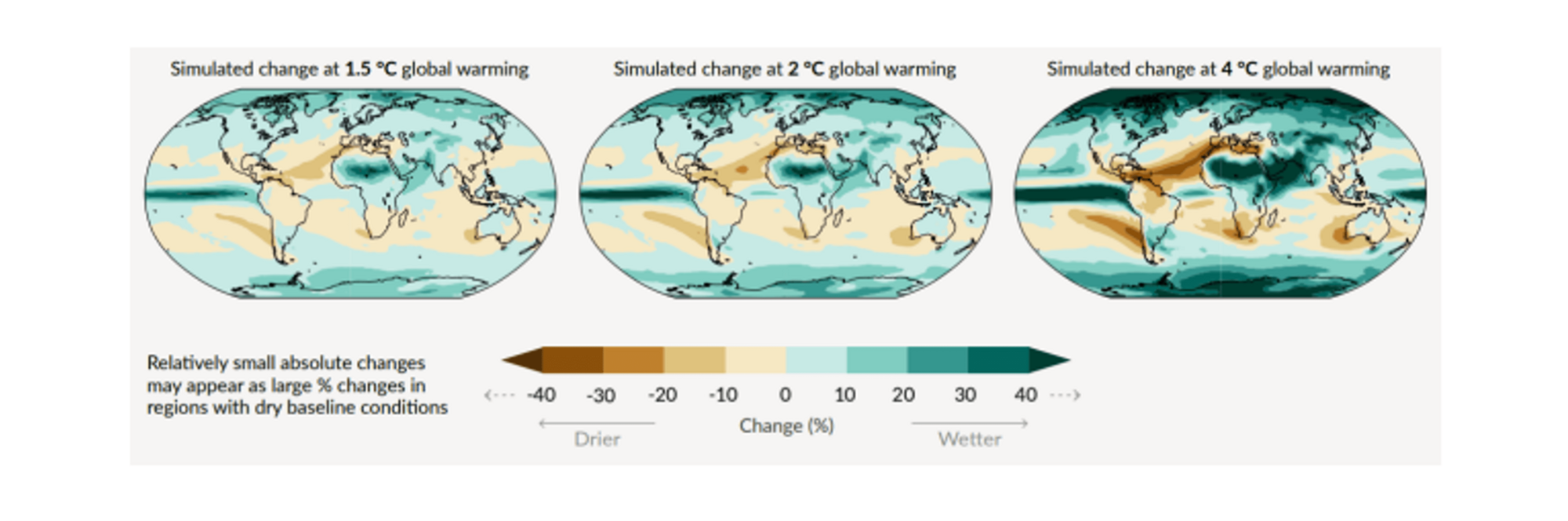

Scenario definition will involve transforming the emissions pathways into pathways for climate variables for different time horizons and geographical areas, such as temperature, winds and rainfall. The guidance briefly outlines the use of general circulation models (“GCM”) for this purpose and includes the following illustrations of the GCM results used by IPCC in their assessment reports from the modelling exercise named CMIP6:

Insurers could leverage information such as the CMIP6 results used by the IPCC when setting the future climate and weather scenarios in their ORSA scenario definitions.

Metrics for Evaluation

In order to assess the impact of climate change risk on financial losses, metrics for measuring the risk must be defined. The guidance includes a list of suggested indicators which aim to capture the major risk drivers behind the financial impacts of the scenario, as follows:

| Type of Indicator | Indicator | Type of Climate Risk |

| Balance Sheet | Solvency Capital Requirement | Physical & Transition |

| Excess of Assets over Liabilities (change of) | Physical & Transition | |

| Assets over Liabilities (change of) | Physical & Transition | |

| Stressed value or price change for each identified asset | Only Transition | |

| Relative change of total technical provisions | Only Physical | |

| Profitability | Loss Ratio | Only Physical |

| Overall impact on the firm’s profit & loss | Physical & Transition | |

| Technical | Gross / ceded / net aggregated losses | Only Physical |

| Main exposure (Sum Assured) | Only Physical | |

| Total assets subject to transition risks | Only Transition | |

| Annual Probability of occurrence | Only Physical | |

| Direct | GHG emissions of investments | Only Transition |

Conclusion

In the guidance, EIOPA reminds us that the overall purpose of the ORSA is for insurers to perform their own risk assessment which is relevant to their own portfolio. An important first step is understanding how relevant and material climate change is to the specific portfolio of the insurer. Insurers are expected to incorporate climate change risk considerations into the governance and risk management framework.

Building knowledge within the insurers is important, and EIOPA expects methods and models to evolve over time. While the examples given should not be taken as an exhaustive list, the reference to the publicly available information from sources such as the NGFS and the IPCC assessment reports give insurers a guide as to where to start when researching the impacts of climate change risks. These resources could be leveraged by insurers when defining their ORSA scenarios.

In this article, we have discussed the high-level reader chapters 1 and 2. Chapter 3 of the guidance goes much further, with 100 pages of technical reading (circa 20 for life and 80 for non-life). This gives great scope for learning to those new to the topic of climate change risk. It goes into detail on the granularity of data and assumptions, the availability of modelling tools and selecting the right tools and data to use, and the payoffs between using pre-defined climate scenarios versus insurers defining their own.

How Can Finalyse Help You?

Finalyse has extensive experience and expertise in risk management for insurers and can assist you in the development and implementation of a climate change risk management framework. Our team of talented insurance professionals can support you in the following areas:

- Risk Management integration for climate change risks, including performing a gap analysis, developing a roadmap for integration and updating relevant policies and procedures.

- Risk identification and materiality assessment on your asset and liability portfolios, including defining data requirements, performing the materiality assessment and hosting workshops to facilitate the process.

- Climate change scenario definition in line with regulatory requirements, including setting the high-level narrative and climate pathways, and defining more granular demographic and macroeconomic assumptions.

- Modelling and impact quantification to translate climate projections into financial and underwriting impacts, including the mapping of climate risks to traditional prudential risks and deciding on the modelling approach for the short and long term.

- Strategy and business planning to incorporate climate change considerations, including possible management actions, business model changes, and identifying future opportunities and product innovation.

- Benchmarking on topics such as the use of qualitative vs. quantitative assessments, simplified projection options and publicly available tools, and providing insightfrom our dealings with EIOPA and local regulators.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support