Abdoulaye is a Junior Compliance Officer specialising in regulatory watch, RegBrief preparations and background regulatory research. He is dedicated to staying updated on regulatory changes analysing their impact and preparing concise briefs for effective compliance management. Finally, he is proficient in conducting thorough regulatory research to support informed decision-making and ensure adherence to evolving regulatory standards.

Introduction

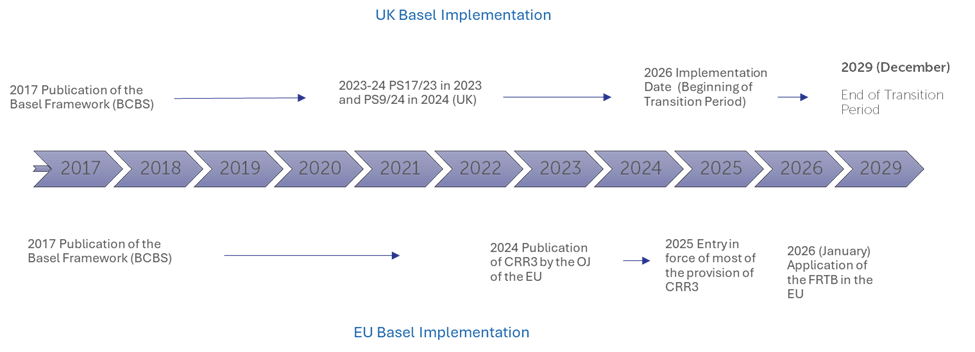

On September 12, 2024, the PRA released its second near-final Policy Statement, PS9/24, titled "Implementation of the Basel 3.1 Standards: Near-Final Part 2." This policy statement outlines the PRA's rules for implementing the Basel 3.1 standards, specifically addressing credit risk, the output floor, as well as reporting and disclosure requirements. It follows Consultation Paper CP16/22, with the first near-final Policy Statement, PS17/23, published in December 2023. The PRA indicates that, based on the latest firm data, it expects Tier 1 capital requirements for major UK firms to remain "virtually unchanged" under the measures set out in PS9/24, with a total increase of less than 1% by January 2030, when the transitional arrangements expire. The final rule instruments, technical standards instrument and final policy statement on Basel 3.1 will be published after the Treasury has made commencement regulations to revoke the relevant parts of the capital requirements regulation that the final PRA rules will replace. The PRA has decided to delay the implementation date for the Basel 3.1 standards by a further 6 months from July 2025 to 1 January 2026, with a 4-year transitional period ending on 31 December 2029. This delay is intended to support a smooth implementation of the package and takes account of feedback from the consultation as well as the implementation timelines of other jurisdictions.

Differences between EU and UK implementation of Basel 3.1

Output floors

Key Difference: The main distinction lies in the specific timelines for the phase-in of the output floor, with the UK's transitional period starting slightly later than the EU's.

| BCBS (2017 reforms) | Basel introduces a new overall floor for modelled RWAs set at 72.5% of standardised RWAs. This applies at the organisation level across all risk types with a five-year transitional period from 2022 to 2027. |

| EU approach (CRR III & CRD VI) | The EU follows the Basel Approach. The new regulation mandates that the capital level calculated using internal models must not be lower than 72.5% of the requirements under the standardized approach. The impact of this rule will also be phased in over time. The output floor will gradually increase from 50% in 2025 to 72.5% in 2029, and transitional measures will reduce the output floor calculation for certain exposures from 2025 to 2032. The output floor will apply to the total risk-weighted assets, not on a portfolio-by-portfolio basis, and will apply at the solo level by default, with an option for national authorities to apply it at the highest domestic consolidated level. |

| UK approach (PS17/23 & PS9/24) | The UK follows the Basel approach with the overall floor for modelled RWAs set at 72.5%. The floored RWAs will be used as the basis for the calculation of buffers, with the capital conservation buffer (CCoB), set at 2.5% of RWAs, and countercyclical capital buffer. The PRA also includes a five-year transitional period, beginning on 1 January 2026 at 55% to 72.5% in 2029. |

Credit Risk – SA

Key Differences: The EU maintains certain support factors and allows country Regulators for a level of flexibility in setting risk weights, while the UK focuses on a more risk-sensitive approach and removes SME support factor, while lowering risk weights for SME exposures.

| BCBS (2017 reforms) | Basel introduces changes to wholesale exposures to increase risk sensitivity, reducing reliance on credit ratings and requiring banks to conduct due diligence. For residential mortgages, risk weights now depend on the loan-to-value (LTV) ratio, with two approaches: the whole loan and loan-splitting methods. Property values are maintained at origination unless supervisors require a downward revision. Unrated corporates receive a flat 100% risk weight in some jurisdictions, while others use a more risk-sensitive approach, with 65% for investment-grade corporates and 100% for non-investment grade. Unrated corporate SMEs get an 85% risk weight. |

| EU approach (CRR III & CRD VI) | The EU generally aligns with the Basel approach but introduces some variations. It applies a 100% risk weight for unrated corporates, with a carve-out for IRB firms, allowing a 65% risk weight if the probability of default (PD) is below 0.5%. For SMEs, the EU maintains a 75% risk weight for retail SMEs and 100% for corporate SMEs, keeping the SME support factor. Unlike the UK, the EU retains the infrastructure support factor, which offers lower risk weights for certain projects. For residential mortgages, the EU proposes a loan-splitting approach and allows property revaluation after origination under specific conditions. Additionally, a carve-out linked to the output floor allows a 10% risk weight for loans up to 55% LTV until the end of 2032. |

| UK approach (PS17/23 & PS9/24) | The UK generally follows Basel. It however removes the SME support factor in Pillar 1, replacing it with a firm-specific Pillar 2A adjustment to avoid increasing capital requirements for SME exposures. It retains 85% risk weight for unrated corporate SME exposures in addition to the 75% risk weight for retail SME exposures and 45% for 'transactor' exposures. The 100% risk weight floor for SME exposures secured by commercial real estate is removed, leading to lower risk weights for qualifying exposures. |

| The UK now withdraws the SME support factor. The country is also implementing a more risk-sensitive approach to project finance exposures. | |

| Additionally, the UK follows the Basel approach, introducing a loan-splitting method for residential mortgages. When calculating the loan-to-value (LTV) ratio, the UK proposes that property asset valuations should be based on the value at the time of origination, though this can be updated to the current value if the property is remortgaged. |

Credit Risk- Internal Ratings Based Approach

Key Differences: The EU chooses to implement a 0.05% PD for retail while the UK goes for a more conservative 0.1% PD input floor for retail.

| BCBS (2017 reforms) | Basel removes the Advanced-IRB approach for large and mid-sized corporates with revenues over €500 million, as well as for banks and financial institutions. The IRB approach for equity exposures is also fully eliminated, while the modeling options for sovereign exposures remain unchanged. Basel introduces new input floors for PD, LGD, and EAD for IRB: |

| - Corporate: PD (5bps), LGD (unsecured 25%, secured varies). | |

| - Mortgages: PD (5bps), LGD (5%). | |

| - QRRE (Transactor): PD (5bps), LGD (50%). | |

| - QRRE (Revolver): PD (10bps), LGD (50%). | |

| - Other retail: PD (5bps), LGD (varied). | |

| EU approach (CRR III & CRD VI) | The EU generally follows the Basel approach. CRR3 reduces the scope of the Advanced-IRB (A-IRB) approach. It will no longer apply to large and mid-sized corporates or financial institutions, which are required to use the Foundation-IRB approach instead. Additionally, the IRB approach for equity exposures is entirely removed. CRR3 also introduces minimum input floors for key parameters: PD (0.05% for corporates and retail, 0.1% for QRPE revolvers) and LGD (25% for unsecured corporate loans, 30% for retail). Sovereign exposures are exempt from these floors. |

| Further changes include the removal of the 1.06 scaling factor for RWAs and the elimination of the double default treatment to simplify risk weight calculations. Additionally, LGD for senior unsecured corporates is lowered to 40% for non-financial entities, while specialized lending retains A-IRB, with floors phased in over five years. | |

| UK approach (PS17/23 & PS9/24) | The UK generally follows the Basel approach but with some amendments. Firms must now obtain PRA permission and demonstrate that their models are integral to credit risk management to be allowed to use the IRB approach (use test). They must ensure data used is representative, with adequate historical quality, and have robust processes for model development, validation, and documentation. The UK has decided to retire the SME supporting factor, while the EU has retained it under the CRR3. |

Operational risk

Key Differences: There is no major difference between the two approaches.

BCBS (2017 reforms) | Basel simplifies the framework by replacing four previous approaches with a single SA. |

EU approach (CRR III & CRD VI) | The EU follows the Basel approach with the adoption of single standardised approach. The calculation is solely based on a revenue-linked indicator. It includes: a cap on the net interest margin (similar to the alternative standardized method). A more conservative treatment of fees, using the higher of fees received or paid. |

Separate treatment of gains and losses on financial assets for the banking and trading books. A progressive factor applied to the business indicator, no longer assigning different factors to each activity but instead applying a marginal coefficient per business tier. It neutralizes the loss history for calculating capital requirements for operational risk, CRR3 mandates loss data collection for institutions with a business indicator exceeding EUR 750 million. | |

UK approach (PS17/23 & PS9/24) | The UK follows the Basel approach by replacing the four previous approaches with a single SA. It also uses its national discretion to set Internal Loss Multiplier at 1 |

Credit valuation adjustment (CVA)

Key Differences: UK regulatory approach tends to emphasize immediate and comprehensive risk management, and a more gradual increase in capital requirements.

- Exemptions: PRA has revoked CVA exemptions for new trades with pension funds, non-financial counterparties, and sovereigns; these trades will now be subject to CVA capital charges. EU continues to allow certain exemptions for these counterparties.

- Transitional Arrangements: UK has introduced transitional arrangements to phase out exemptions for legacy trades, gradually bringing all trades under the CVA framework. EU has not implemented similar transitional arrangements, maintaining a more static approach.

| BCBS (2017 reforms) | Basel considered CVA to be the most complex risk of them all, thus, it removes the use of the internally modeled approach, replacing it with (i) an SA; and (ii) a basic approach. |

| The Committee has reduced risk weights in the SA-CVA, cutting interest rate delta weights by 30%, foreign exchange by 50%, and high-yield/non-rated sovereigns from 3% to 2%. Vega risk weights are capped at 100%. In the BA-CVA, high-yield and non-rated sovereign risk weights are also reduced from 3% to 2%. | |

| New index buckets are introduced, allowing banks to calculate CVA capital using credit and equity indices, aligning with the market risk framework. Certain SFTs and client-cleared derivatives are exempt from CVA capital requirements, and the margin period of risk for centrally cleared derivatives is reduced. | |

| The SA-CVA multiplier is reduced from 1.25 to 1, with similar adjustments for the BA-CVA, recalibrating CVA capital requirements. | |

| EU approach (CRR III & CRD VI ) | The EU allows for two methods to calculate CVA risk: the standardised method and the advanced method, to reflect complexity and size of the institution’s portfolios. Certain counterparties, such as pension funds, non-financial counterparties, and sovereigns, are exempt from CVA capital charges. This means that trades with these entities do not require additional capital to cover CVA risk. |

| UK approach (PS17/23 & PS9/24) | The UK CVA risk framework introduced three new methodologies for calculating capital requirements: the basic approach (BA-CVA), the standardised approach (SA-CVA) and the alternative approach (AA-CVA). The PRA provides no exemptions for exposures related to sovereigns, non-financial counterparties, and pension funds from the CVA charge. However, this is compensated by a reduction of the alpha factor under the SA-CCR approach from 1.4 to 1 for non-financial counterparties and pension funds, which represents a divergence from both Basel and the CRR. |

Market risk (FRTB)

Key Differences

- Complexity: UK A-SA is more comprehensive, suitable for larger institutions with significant trading activities, while the EU A-SA is simpler and more applicable to smaller institutions.

- Regulatory Oversight: UK A-SA involves stricter regulatory requirements and oversight compared to the EU A-SA. UK pre-application process for banks to be granted approval to use IMA is more rigid .

- Output Floors: EU approach does not explicitly mention output floors in the same context as the UK’s implementation, where standardised approach acts as a floor for capital requirements.

| BCBS (2017 reforms) | Through the FRTB, Basel revises the SA framework to make it more risk-sensitive and mandatory for all trading banks. As part of the reforms, there is a new capital charge for residual risks. |

| In respect of modeling, Basel changes the existing SA and IMA approaches, as well as introduces new concepts: | |

| - Default Risk Charge (DRC): measure capturing jump-to-default risk | |

| - Risk factor eligibility test (RFET): data availability based measure deciding on the risk factor applicability in modelling | |

| - Non-modellable risk factors (NMRF): risk factors for which there is no sufficient price data are subject to a separate capital add-on estimated based on a stress scenario. | |

| - P&L attribution test (PLAT): back-testing method assessing trading desk risk management using comparison between modelled and realized daily profit and loss. | |

| Under IMA, banks are required to measure risk using expected shortfall instead of VaR models. Another change also sees IMA approvals granted at trading desk level with new back testing requirements imposed, and model eligibility subject to PLAT. | |

| EU approach (CRR III & CRD VI) | The application of the FRTB provisions in CRR3 has been delayed to January 2026 to adapt with US implementation of Basel. The EU implementation of FRTB introduces three approaches: |

| - Simplified Standardised Approach (S-SA): Modifies the existing standardised approach for market risk by applying supervisory factors. | |

| - Alternative Standardised Approach (A-SA): This approach uses sensitivities-based calculations and incorporates additional qualitative requirements. | |

| - Internal Models Approach (A-IMA): The internal models approach for market risk now centers on the expected shortfall instead of the value at risk. | |

| UK approach (PS17/23 & PS9/24) | Three approaches are included by the PRA, which are aligned with the EU implementation: Simplified Standardized Approach, Advanced Standardized Approach, and the Internal Models Approach. The UK implementation broadly aligns EU, with minor discrepancies. |

| - CIU Treatment: Exchange-traded CIUs will now be considered as listed equities, reducing capital requirements. | |

| - ASA Eligibility: The scope of eligible third parties for ASA calculations has been expanded. | |

| - RRAO Scope: The PRA has clarified the scope of instruments subject to the Residual Risk Add-On (RRAO). | |

| - MA Changes: The 75% minimum coverage requirement for stress period risk factors has been imposed at a portfolio level, and sovereign default risk modeling has been standardised. | |

| - NMRF Enhancements: The PRA has introduced changes to make the calculation of NMRFs more flexible. | |

| In the letter published on 27th June 2022 PRA outlined a detailed pre-application process for banks to follow, which is more rigid compared to the EU’s approach. |

Off balance sheet

Key Differences: The EU takes a more lenient approach, allowing institutions to continue applying a 0% CCF to these commitments until the end of 2029, while the UK strictly follows Basel and does not provide for a transition period.

| BCBS (2017 reforms) | Basel introduces a revised definition of commitment, based on contractual arrangements entered into by firms. It proposes a new 10% CCF for unconditional cancellable commitments. For direct credit substitutes (including standby letters of credit serving as financial guarantees for loans and securities), a 100% CCF is also introduced. Finally, Basel provides for an optional derogation – whereby national rule makers could exempt certain uncommitted commitments from such requirements |

| EU approach (CRR III & CRD VI) | The EU availed itself for the exemption provided for by the Basel Standards, allows institutions, to continue to apply a 0% CCF to specific contractual arrangements for corporates, including SMEs, that are not classified as ‘commitments. CRR3 also introduces a transitional period until 31 December 2029 whereby institutions are permitted to apply a 0% CCF to unconditionally cancellable commitments. |

| UK approach (PS17/23 & PS9/24) | The UK broadly follows Basel. It has decided to maintain its proposal not to exercise the national discretion provided for in the Basel 3.1 standards and to apply the 10% CCF for unconditional commitments. The PRA will introduce the 10% CCF with immediate effect from January 2026. It finally sets a 40% CCF for “other commitments”. |

Disclosure (Pillar 3)

Key Differences: The EU has more comprehensive and stricter Pillar 3 disclosure requirements for ESG risks, driven by its focus on sustainable finance, while the UK's approach is still developing and currently less prescriptive in this area.

| BCBS (2017 reforms) | Pillar 3 requirements introduced by the BCBS in the new Basel framework primarily focus on enhancing the transparency and comparability of banks' risk profiles through improved disclosures. |

| More granular risk-weighted asset (RWA) disclosures: Banks are required to provide more detailed breakdowns of their RWA calculations, particularly distinguishing between those calculated using internal models versus standardized approaches. This aims to reduce opacity and improve comparability across banks. | |

| Capital ratio disclosures with and without capital floors: Banks must disclose two sets of capital ratios, one including the impact of capital floors and one excluding them. This provides insight into the extent to which capital floors contribute to a bank's overall capital adequacy. | |

| Introduction of new disclosure templates: New templates have been introduced to standardize the presentation of required disclosures, facilitating easier comparison and analysis across all institutions. | |

| EU approach (CRR III & CRD VI) | With CRR III, the EU updates almost all Pillar 3 disclosures requirements, aligning them with new Pillar 1 RWA calculations and reducing the administrative burden for smaller banks. All institutions must submit disclosure reports to a public EBA platform, to improve transparency and data comparability. Small and non-complex institutions may have their disclosure information generated from existing regulatory reports like COREP and FINREP, reducing their workload. Finally, new requirements include disclosing ESG risks and exposures to shadow banking and crypto assets, except for small and non-complex institutions not publicly listed. |

| UK approach (PS17/23 & PS9/24) | The UK follows the Basel approach. To maintain proportionality, the PRA provides that large and listed firms should disclose at the minimum frequency introduced in the Basel reforms with the same material content and format to the disclosure templates. |

Summary

Despite significant time and resources dedicated to the implementation of Basel Framework in the UK, full alignment still requires a substantial effort. Mastering the new standardised approach for credit risk, navigating the revised market risk framework, and accurately calculating the output floor, the interconnectedness of the revised risk frameworks, the impact on capital planning and stress testing, and the need for robust IT infrastructure necessitate a comprehensive approach. With years of experience in implementing Basel 3.1 across Europe, Finalyse can help you accelerate UK implementation across policy, governance, modelling, data, and technology change.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support