How Finalyse can help

Simulation-driven capital floor optimisation

Designed to meet CRR amd CRD regulatory requirements for banks

The highest possible predictive power of your models

Model Validation: are you sure your internal risk parameter estimates are adequate, robust and reliable?

Written by Maël Kerbaul, Senior Consultant; and Abishek Chopra, Principal Consultant.

Introduction

With less than two years to its implementation, Basel IV represents each day a more pressing concern for banks. The 3rd Capital Requirements Regulation (CRR3) is planned to enter into force on January 1st, 2025. CRR3 is the EU translation of the last revision of the Basel standards for banking supervision released in 2017 and commonly referred to as Basel IV (although the Basel Committee continues to name it Basel III). This revision intends to address the shortcomings of the previous pre-crisis package, in particular to “restore credibility in the calculation of RWA’s and improve the comparability of banks' capital ratios.”

To reduce the variability of the banks’ risk weighted assets and restore confidence in the risk models, the revised regulation will largely constrain the use of internal models. One of the most impactful features of CRR3 is the introduction of an Output Floor limiting the benefits of using internal models to 72.5% of the RWA’s resulting from the Standardised Approach calculation, after a phase-in period of five years. This represents a fundamental change in the way banks will consider their regulatory capital with the Standardised Approach becoming an inescapable cornerstone.

The key revisions to the Credit Risk Framework were already described in a previous article: Finalyse: CRR III changes and the impact on credit risk modelling. We will focus here on the impacts and the challenges induced by the necessity of using the revised Standardised Approach in particular for exposures covered by Real Estate.

Please note that, at the time of writing, the regulatory process is still ongoing between the EU Parliament and Council. The final version of CRR3 is expected only around the end of 2023. This article is based on the Commission proposal published in October 2021 and still subject to revisions.

General and Income-Producing Real-Estate

In the revised Standardised Approach, CRR3 keeps the distinction between residential and commercial real estate and creates a new distinction based on the income streams generated by the property. Income-generating real estate mortgages (IPRE) receive a special treatment. These loans are considered more risky as the repayment materially depends on the cash flows generated, while general real estate (GRE) loans repayment rather depends on the borrower ability to repay.

This makes 4 types of exposure secured by immovable property (Art. 124-2):

- General Residential: where the exposure satisfies any of the four below conditions:

- obligor’s primary residence

- exposure to individual secured by income-producing residential housing unit and the total exposure of the institution to that individual does not exceed 4 immovable properties

- associations or cooperative providing primary residence to their members

- public companies or regulated not-for-profit associations offering long-term housing

- Income-producing Residential: all other residential properties that do not meet the criteria above

- General Commercial: where the repayment is not materially dependent on cash flows generated by the property

- Income-producing Commercial: where the repayment is materially dependent on cash flows generated by the property

Loan-Splitting and Whole Loan approaches

CRR3 introduces a more risk sensitive approach based on Loan-to-Value ratio (LTV) instead of the existing single risk weight. Two methods are foreseen for computing the risk weights: a loan-splitting approach and a whole loan approach. Both methods are conditioned to the respect of a list of operational requirements (see below). The loan-splitting approach can be used only for GRE. The whole loan approach is to be used for IPRE and can also be used for GRE upon conditions regarding loss rates for similar exposures in the previous year (Art. 125 & 126).

In the loan-splitting approach, 55% of the property value is recognized as a security over the loans. The risk weight for the secured part of the loan is 20% for RRE and 60% for CRE. The remaining part of the loan is treated as an exposure that is not secured by an immovable property.

| LTV <= 55% (secured part) | LTV > 55% (unsecured part) |

General RRE | 20% | Unsecured RW |

General CRE | 60% | Unsecured RW |

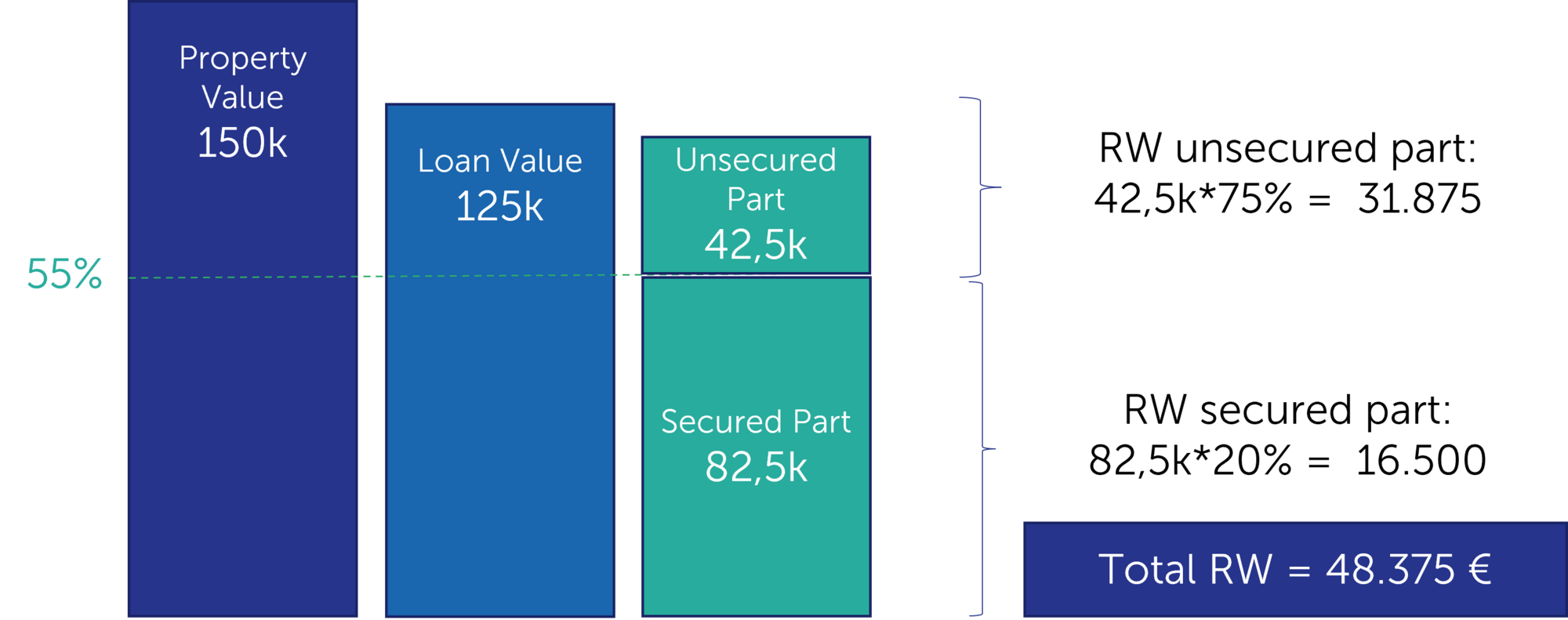

Example 1 – Loan-splitting approach: General RRE loan to an individual borrower of 125.000€ respecting the operational requirements secured by a property valued 150.000€. The secured part of the loan represents 55%*150.000 = 82.500€. The unsecured part of the loan represents 125.000 - 82.500 = 42.500€. The risk weight of 20% applies to the secured part and the unsecured risk weight (75% for retail exposure as per Art. 123) applies to the unsecured part, leading to a RWA = 82.500*20% + 42.500*75% = 48.375€

In the whole loan approach, variable risk weights are applied based on LTV buckets:

LTV bands | < 50% | 50% to 60% | 60% to 80% | 80% to 90% | 90% to 100% | >100% |

Residential Real Estate | 30% | 35% | 45% | 60% | 75% | 105% |

Commercial Real Estate | 70% | 90% | 110% | |||

Example 2 – Whole loan approach: Income producing CRE respecting the operational requirements with a total limit of 600.000€ of which 500.000€ drawn and 100.000€ undrawn commitment, secured by a property valued 850.000€.

LTV = 600.000/850.000 = 71%. The resulting risk weight is 90% leading to a RWA = 90%*500.000 (drawn part) + 90%*100.000*CCF 40%[1] (undrawn part) = 486.000€

For the specific case of land acquisition, development and construction exposures (ADC), a fixed risk weight of 150% is applied. It can be reduced to 100% for residential properties respecting certain conditions (Art. 126a).

Operational Requirements

The operational requirements listed below must be respected when using the loan-splitting or whole loan approaches. If any of the requirements is not met, the unsecured risk weight of the obligor is applied for GRE and a fixed risk weight of 150% for IPRE (Art. 124-1 to 4).

- The property securing the exposure must be fully completed, or under construction with strict conditions (plan approved by authorities, not more than 4 housing units and primary residence of the obligor).

- The institution must have a first lien over the property, or the first lien and any sequentially lower ranking lien on the property. Junior liens might be recognized in certain jurisdictions if legally enforceable and constitute an effective credit risk mitigant upon certain conditions.

- The value of the property must not materially depend on the performance of the borrower.

- Proper documentation on the ability of the borrower to repay and on the valuation of the property.

- The collateral valuations rules set in Articles 208 & 229 are respected (independent and prudent valuation).

Loan-to-Value Ratio

The LTV ratio becomes a central element is the calculation of the RWA for Real Estate. It represents the amount of the loan divided by the value of the property.

The valuation of the property evolves under CRR3 toward a more stable method to reduce the cyclical effect of the real estate market. The current requirement for frequent monitoring is kept but upwards adjustments beyond the property value at origination are limited to the historical average over the last three years for CRE and over the last six years for RRE. These limitations do not apply if permanent modifications unequivocally increase the property value, such as improving the property energy efficiency. (Art. 208)

The value of the loan includes the outstanding loan amount and any undrawn commitments (with no CCF applied unlike for EAD calculation), gross of any provision and risk mitigants – except pledged deposit accounts. (Art. 124-5)

Treatment of properties with multiple liens

A new feature of CRR3 is the treatment of liens on a same property securing multiple loans. When senior or junior liens are held by different institutions, that can lead to complex cases that we try to illustrate through concrete examples.

1) All liens held by the institution

This scenario is the most straightforward. In the case an institution grants multiple loans secured by a same property and there is no intermediate lien on that property held by another institution, the different loans should be considered as a single exposure and their amounts added up to calculate the LTV ratio. (Art. 124-5)

2) Liens held by different institutions

a) Whole loan approach (Art. 124-5c)

In the case another institution holds a senior lien and a junior lien is held by the institution, for calculating the LTV ratio for the junior lien, its loan amount must include all other loans with liens of equal or higher ranking. If there is insufficient information on the ranking of other liens, they are considered as pari passu with the junior lien held by the institution.

The “base” risk weight corresponding to that LTV must then be multiplied by 1.25 (unless it corresponds to the lowest LTV bucket, then the multiplier is not applied). The resulting risk-weight after the application of the 1.25 multiplier is capped to the risk weight of the counterparty for GRE and to 150% for IPRE (i.e. the risk weights that would apply if the operational requirements would not met). This capped risk weight is then applied to the amount of the junior lien.

Example 3 – Whole loan approach with multiple liens:

Income producing CRE loan of 300.000€ respecting the operational requirements and secured by a property valued 950.000€. Another institution holds a pari passu lien on the same property for an amount of 400.000€.

LTV = (300.000+400.000)/950.000 = 74%. The resulting “base” risk weight is 90%. The 1.25 multiplier is applied leading to a risk weight of 90%*1.25 = 112.5% and a RWA = 300.000*112.5% = 337.500€

b) Loan-splitting approach (Art. 125-1 and 126-1)

When applying the loan-splitting approach, the part of the exposure up to 55% of the property value should be reduced by the amount of any senior or pari passu liens not held by the institution.

In other words: when the institution holds a junior lien and there are senior or pari passu liens not held by the institution, when the value of all liens exceeds 55% of the property value, the amount of the junior lien held by the institution that is eligible for the 20% risk weight is calculated as: max(55% of the property value – amount of the senior or pari passu liens ; 0). When the value of all liens does not exceed 55%, the 20% risk weight is applied to the junior lien exposure.

Example 4 – Loan-splitting approach with multiple liens

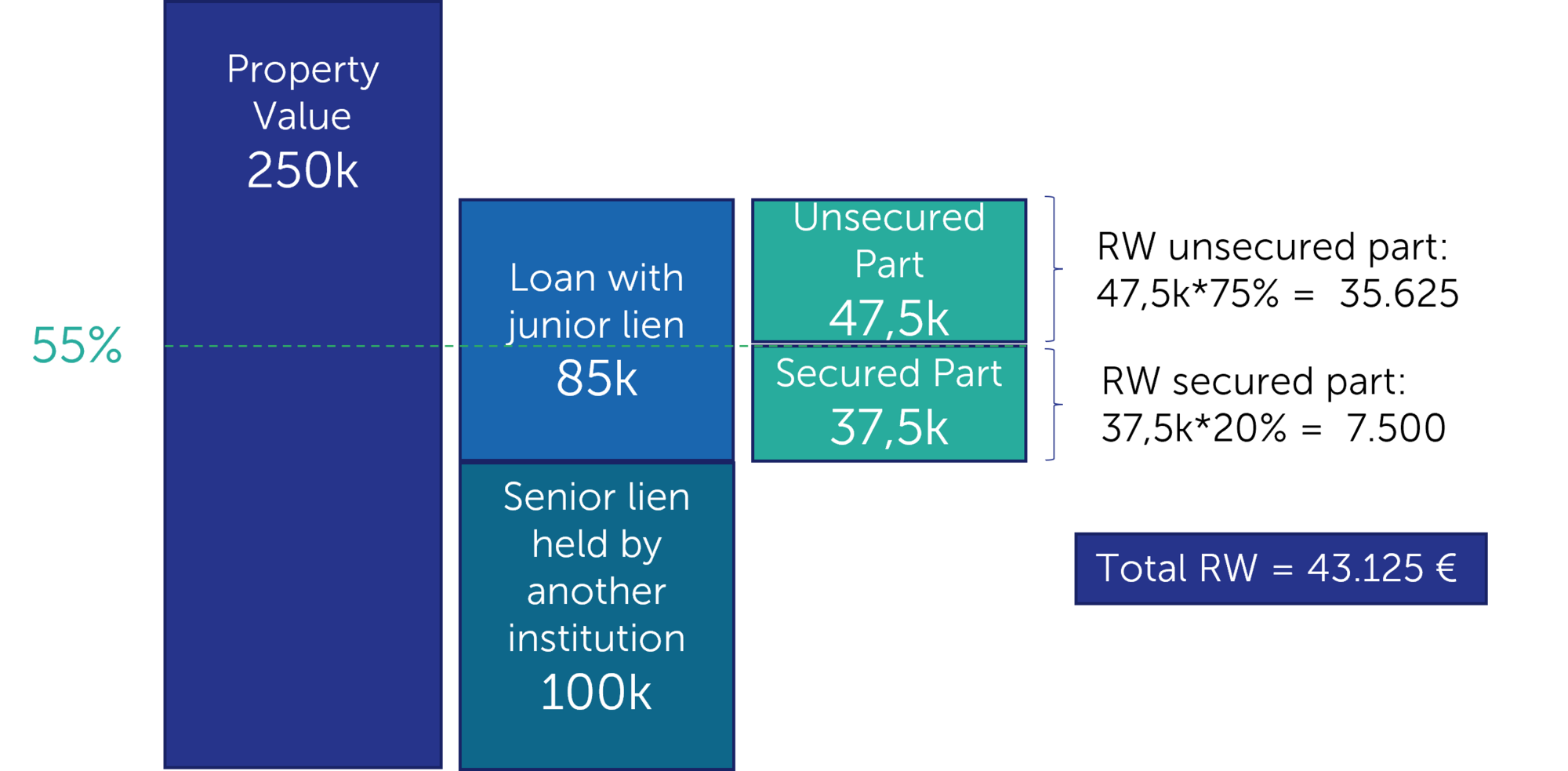

General RRE loan of 85.000€ to an individual borrower respecting the operational requirements and secured by a junior lien over a property valued 250.000€ at origination. Another institution holds a senior lien on the same property for an amount of 100.000€. The secured part of the loan is calculated as max(55%*250.000 - 100.000 ; 0) = 37.500€. The unsecured part of the loan is 85.000 – 37.500 = 47.500€. The 20% risk weight applies to the secured part and the risk weight of the counterparty (75% for an individual) to the unsecured part, leading to a RWA = 37.500*20% + 47.500*75% = 43.125€

Technical Challenges: Extra Data Sourcing

Beside the adaptation of the new models to CRR3 and the necessity to run both internal and SA models in parallel for the IRB banks, the increased sophistication of the revised SA induces a significant increase of the volume of data needed.

In particular, the calculation of the risk weighted assets for exposures covered by Real Estate under the SA requires the sourcing of many new inputs:

- Elements enabling the distinction GRE/IPRE (identification of the obligor’s primary residence, number of housing units financed by the institution for an individual obligor…)

- Flags describing the fulfilment of the operational requirements from Art. 124-4 (might be gathered in a single flag to keep the data model simple)

- LTV based on the new rules for property valuation

- Full liens structure for the properties securing the loans

- Nature of the off-balance sheet commitments as per the new CRR3 definition that differs from the accounting norms

Banks will also need to assess the quality of their data and potentially conduct remediation plans in order to benefit from more favorable rules and reduce their own funds consumption.

These data analyses must be conducted as soon as possible in parallel with the modelling and strategic reflections to limit the impact of the new capital rules from 2025 onwards.

In a previous article Basel IV: data from a bank’s perspective we developed more in detail these data sourcing challenges.

How Finalyse can help

Finalyse has demonstrated proven success in several projects across different geographies for Basel IV and CRR III preparedness. Our seasoned experts will assist in your detailed gap assessment, critical data element identification, impact analysis from technical and business perspectives, descriptive business requirements for implementation at all stages of Basel IV preparedness.

Finalyse implements RWA calculators from different vendors (SAS, Moody’s, etc.) and developed an inhouse simulator for computing SA calculations for your entire portfolio to anticipate the impact of the Output Floor.

Please find our service offering for Basel IV/CRR3 implementation here: Finalyse: CRR III & Basel IV

References

[1] The levels of the Credit Conversion Factor (CCF) for off-balance sheets items like undrawn amounts have been reviewed in the Commission’s proposal in line with BIV and become more granular with two new levels of 40% and 10%. The level of 0% for unconditionally cancellable commitments will be removed after a transition period from 2029 to 2032, although an exception exists to maintain a 0% CCF for certain contractual arrangements for enterprises including SME’s.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support