By Yannis Pitaras, Principal Consultant

and Jessica Ukendi, Associate Consultant

Introduction

One of the most interesting changes brought by the 2018 Solvency II review, is the introduction of additional guidelines for the standard formula calculation of the loss-absorbing capacity of deferred taxes.

The stated purpose of these amendments is mainly to standardise the setting of assumptions to be put in place for the projection of future profits and hence reduce the degree of subjectivity in the calculation.

This follows from the fact that practices between Member States in the recognition of the capacity of deferred taxes to absorb present losses are widely divergent.

The European Commission and EIOPA expect these amendments to have a limited impact on the overall capital requirements at EU level (0.9% of the sum of Solvency Capital Requirements before loss-absorption). Another established fact is that only a limited number of undertakings across Europe make use of the adjustment for the loss-absorbing capacity of deferred taxes.

Many stakeholders are of the opinion that this is probably not because insurers are usually not entitled to the LACDT adjustment, but more likely because they are unsure as to whether they meet all the regulatory criteria and apply the approach which would pass supervisors’ scrutiny.

Benefiting from the LACDT

The Loss Absorbing Capacity of Deferred Taxes adjustment is meant to reflect the fact that new deferred tax assets would have to be booked in the event the insurance undertaking incurred unexpected losses, hence resulting in the increase of Own Funds on the Solvency II balance sheet.

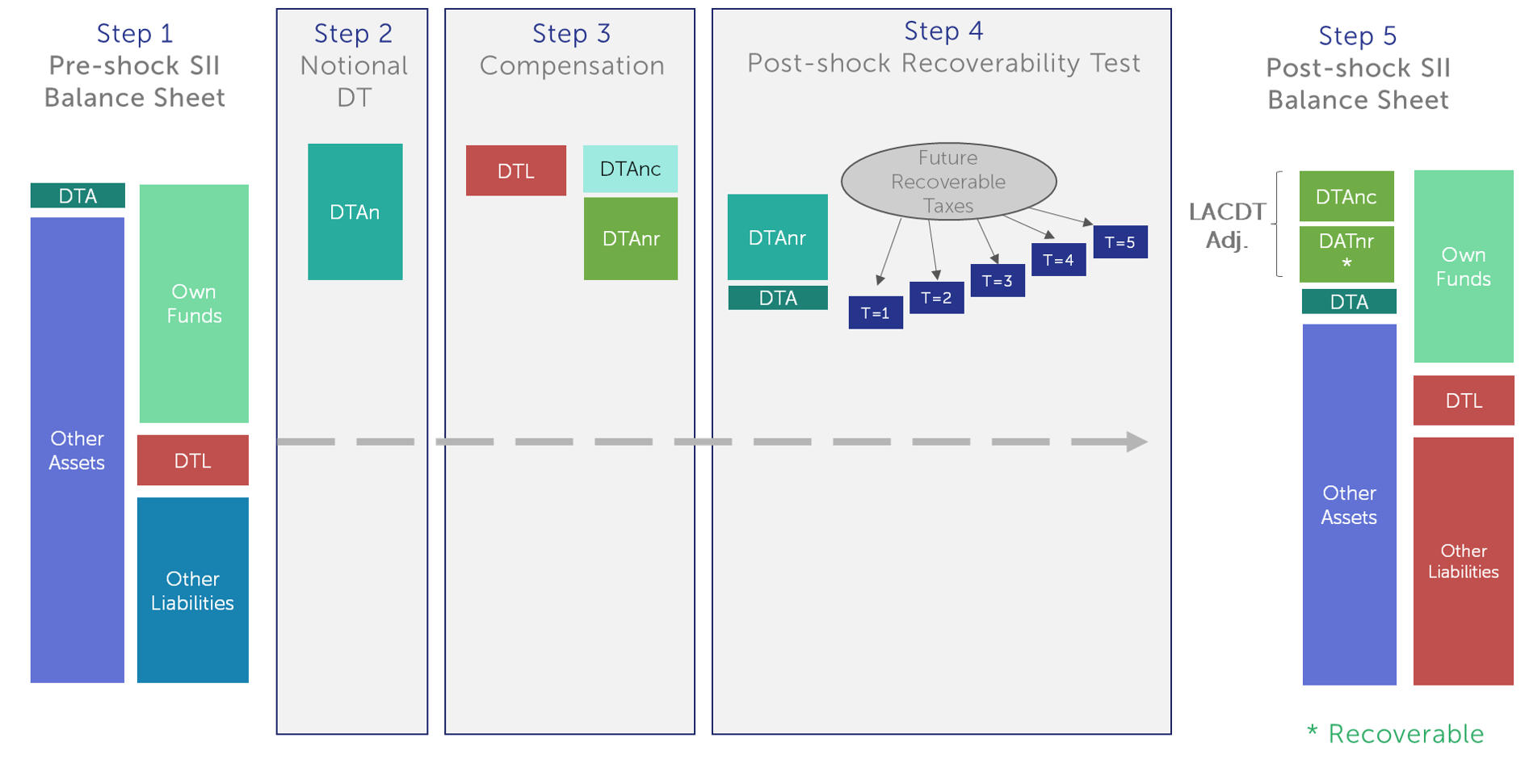

The outline of the typical approach to be followed in order to benefit from the adjustment for the LACDT is as follows:

- Estimate the amount of deferred taxes to be booked on the prudential balance sheet.

- This is not as trivial as it seems as it requires understanding how taxes impact the balance sheet and demonstrating that the so-called recoverability test is passed.

- Calibrate a single equivalent 1 in 200 years scenario (exceptional loss scenario) and assess its impact on the Solvency II balance sheet and on the amount of deferred taxes.

- Demonstrate that the post 1 in 200 years event deferred taxes pass the recoverability test.

- This requires setting assumptions in relation to macro-economic conditions, the insurer’s business plan and possible and realistic management actions after an exceptional loss scenario. Setting these assumptions can prove to be challenging given the poor historical data on how economies, markets and insurance undertakings have recovered a 1 in 200 years event.

- These assumptions serve as the basis for the projection of the post 1 in 200 years event business plan, P&L accounts and Solvency II balance sheets over usually the next 5 years.

Steps for the calculation on LACDT Adjustment

2018 Solvency II amendments to the calculation of LACDT

The amendments first and foremost aim at refraining insurers from being overly optimistic in setting their assumptions when projecting future taxable profits after an exceptional loss scenario.

Indeed, the new text now explicitly states that new business sales projected for the purposes of the insurer’s business planning after an exceptional loss cannot be more favourable than those used for the business planning on a “going concern” basis.

Additionally, the rates of return on the insurer’s investments following an exceptional loss should be assumed to be equal to the implicit returns of the forward rates derived from the relevant shocked risk-free interest rate term structure obtained after that loss, unless the insurer is able to provide credible evidence of likely returns in excess of those implicit returns for the valuation and utilisation of deferred tax assets.

Both of the aforementioned new requirements are not expected to bring significant changes to the way insurers currently project their future taxable profits, but may contribute to confirming their choices when they have chosen to take a prudent approach.

The amendments also include new provisions in relation to the governance around the setting of assumptions after an exceptional loss. Notably, the involvement of the relevant key functions in selecting and assessing methods and assumptions to demonstrate the amount and recoverability of the loss-absorbing capacity of deferred taxes is now a requirement, as well as a description of how the outcome of that assessment is reported to the Board.

The new text also states that the assessment of the underlying assumptions applied for the projection of future taxable profit and an explanation of any concerns about those assumptions, should be carried out in each case by either the actuarial function or the risk management function.

These new Pillar II requirements are now expected to be incorporated in the risk management policy.

Although these new governance requirements are not impacting the amount of LACDT directly, it is thought by many stakeholders that they are quite restrictive as insurers should be able to define themselves the governance that best suits their organisation.

The amendments also aim at increasing transparency in relation to how the adjustment for LACDT is calculated and its relative importance in the insurer’s Own Funds. As part of the SFCR, insurers will now have to disclose the following in relation to the LACDT:

- the amount with which the SCR has been adjusted for the loss-absorbing capacity of deferred taxes, and a description of the deferred tax liabilities, carry-back and probable future taxable profit used to demonstrate likely utilisation

- where the amount of deferred tax assets is material, a description of the underlying assumptions used for the projection of probable future taxable profit after an exceptional loss.

Conclusion

The 2018 amendments to LACDT go in the right direction in terms of ensuring consistency across Member States, but probably fail to provide more certainty to insurers as to whether their calculation of the LACDT adjustment will ultimately pass supervisory scrutiny. Indeed, the part of the legislation relating to the calculation of the LACDT will, to a large extent, still be subject to interpretation by supervisors and, as such, insurers should put all chances on their side by selecting the right approach, establishing the appropriate governance and making sure that their assumptions and calculations are thoroughly documented.

It should also be noted, that these amendments are part of the wider set of changes introduced by 2018 Solvency review. We have written an article outlying all the changes introduced by this review.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support