Written by Maria de los Angeles Periñan Herrera, Consultant

The regulation on the SFT has been published in the Official Journal of the European Union on 23 December 2015. However, the Regulatory and Implementing Technical Standards, which provided much needed clarification on the reporting of SFTs, were only approved in March 2019. As regards the timing of implementation for the counterparties subject to the reporting obligation, SFTR has adopted a phased-in approach. The investment firms should have started reporting 12 months after the publication (mid-April 2020), nevertheless due to the pandemic the market participants were allowed more time to prepare, and the reporting was delayed by another 3 months to finally start in July of last year.

The phased-in approach (every three months) required first the reporting for credit institutions, investment firms, CCPs and CSDs, followed by other financial counterparties (Insurance, UCITS, ManCos, AIFMs) and finally in January 2021 the start of reporting for non-financial counterparties.

The regulation was adopted to provide the regulators and the investors with more transparent view on the securities financing market and to promote a better account of the risk posed by the interconnectedness in the market via short term collateralized funding and the re use of the collateral.

Although it has already been a year since the reporting obligation has begun, the main challenge for market participants persists to be to gather all the information required to populate all 155 fields, this includes information about the transaction characteristics, specificities of the collateral, margins and calculations required for collateral reuse. This is a slightly greater amount of information than requested in the 133 fields of the derivatives’ regulation EMIR. On top of the greater scope, there are other differences that include the use of the XML schema ISO20022 (to communicate the data to the trade repository) and the mandatory delegation, where the financial institution becomes accountable for the reporting on behalf of their non-financial counterparties, which are however still responsible for providing all the relevant information. The financial institution shall send its report to the trade repository to be compliant. This show that familiarity with the EMIR reporting helps but does not necessarily mean an easy path towards SFTR reporting success.

The report of the transaction is divided in two parts, the first part identifies the parties of the contract and defines who is responsible for reporting. However, the greater challenge is in providing the information requested on the second part where it is necessary to fill detailed data on the loan and collateral. There are around 99 fields which are either mandatory, conditional, or optional depending on the type of transaction to be reported. It is important to be careful and understand the structure of the report, the information requested first is related to the loan, the information requested later is required to provide the data on the collateral. However, in both sections, the field names are similar, so it is important to take caution to make sure that the data is sent in the correct order.

One of our first client for the SFTR reporting was particularly distressed by gathering and compiling all the information required under the technical standards as it was not possible to obtain everything from a single source. There was also a notable confusion as regards providing the data about the collateral, particularly when reporting securities lending. This situation mainly presented itself when the collateral involved in the transaction was not cash but another security, in such cases it is required to provide all the information about the security and the information on the security received as collateral. As mentioned, it is imperative to understand the order in the report to be able to differentiate between data on the security lent and the data on the received collateral. In SFTR, the securities lending requires more mandatory data.

There are other two XMLs messages that need to be provided if the transaction has been cleared (traded via CCP) or if the collateral is reused. This could also present a challenge as they increase the number of reportable fields up to all 155. The information required on margins for cleared transactions is likely already gathered to comply with other regulations and should therefore pose no additional effort to acquire. However, the information about collateral reuse will be more challenging as it is a new requirement containing a key information of the risk of the SFT and shall be calculated to allow its monitoring by the competent authorities.

Some examples of the risk involved in collateral reuse are the contribution to the increasing leverage of market participants, the interconnection of transaction chains with the same collateral and the stress that can be produced to market stability if there is a drop in value of the securities involved as collateral. Due to this and based on the Financial Stability Board metrics, market participants entering short term non-cash collateralized funding shall report the extent and details of their collateral reuse, they should provide the exact measure if they can or an approximate measure that can be calculated with the formula provided in their documentation.

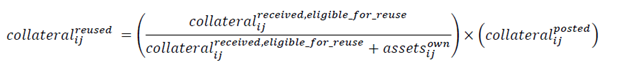

According to FSB documentation, market participants highlighted that it will be extremely difficult to extract the information necessary to compute the exact measure as they don’t generally distinguish between own securities or securities originated from another collateralized transaction when posting collateral. This said, the easiest way to proceed when reporting will be by using the formula that approximates the amount:

Source: FSB – Non-Cash Collateral re-use measures and Metrics.

The intuition behind this FSB formula is that the collateral reused is a proportion of the collateral that an institution has received as eligible for reuse compared with its own assets. The formula also implicitly assumes that the probability of a security being posted as collateral is independent of weather it comes from its own assets or another collateralized transaction.

It is important to note that the reporting obligation only applies to SFTs, the collateral securities posted or received from other transactions should not be considered. When reporting, market participants are supposed to only provide the estimate that results from the application of the formula at ISIN level. This can make the calculation more difficult as it must be separately treated for each security.

To conclude, it is possible to say that the reporting of Securities Financing transactions presents a higher degree of difficulty for market participants than similar regulations such as EMIR, not only because there is a slightly greater number of fields and details to be reported but also due to the new requirements related to the reuse of collateral. Although the regulation has been out for quite a long time compared to the timing of the reporting implementation, it can still take some time for the market participants to adapt and gather all the new information requested, also it can be more challenging for non-financial institutions that do not have the infrastructure and specialized workforce to dedicate to this matter.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support