Related Articles

How Finalyse can help

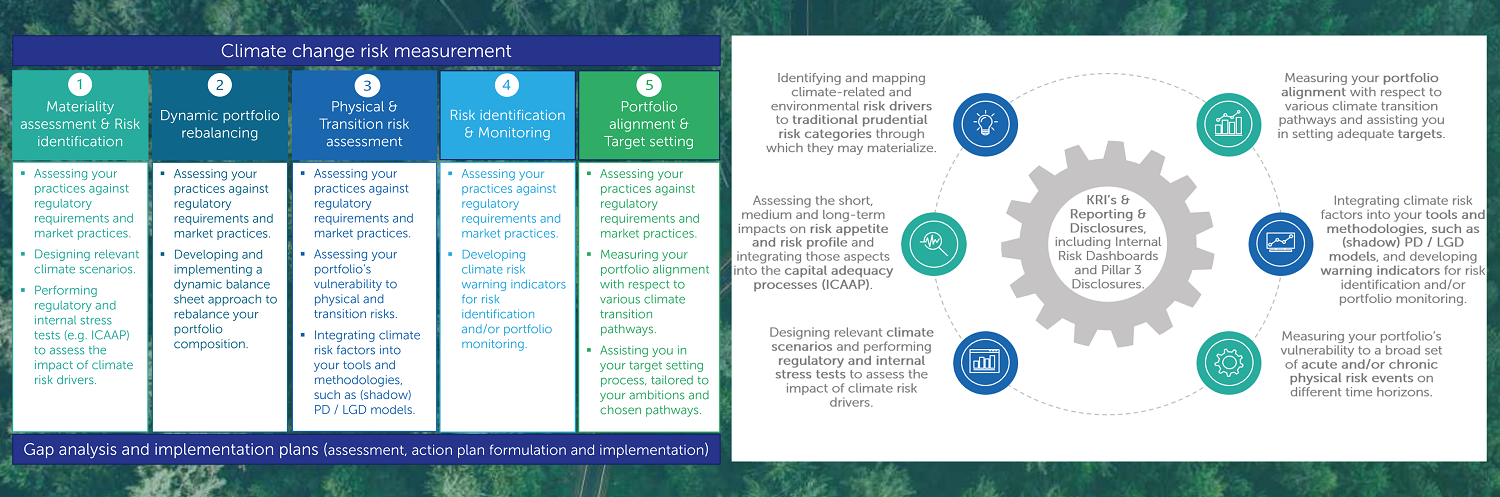

Climate Change Risk Measurement

Understanding the Importance of Climate Risk Management

Amid the urgent need to address climate change, robust risk measurement and environmental risk management are imperative. Banks play a pivotal role in financing sustainable finance and achieving a carbon-neutral economy through adherence to ESG principles.

Regulatory Mandates for Banks: ECB Guidelines and National Bodies

Mandatory climate risk assessment directives from the ECB and national bodies require climate stress testing, scenario analysis, and climate change modelling for effective risk management.

Innovative Methodologies for Effective Climate Risk Management

Innovative methodologies are essential to address the unique nature of climate risks, encompassing physical risk and transition risk identification, monitoring, and reporting.

How does Finalyse address your challenges?

Gap Analysis and Action Plans for Compliance

Climate Stress Testing and Scenario Analysis for Risk Assessment

Strategic Portfolio Rebalancing in Response to Climate Scenarios

Measurement of Physical and Transition Risks in Portfolios

Climate Risk Identification and Monitoring Processes

Portfolio Alignment and Climate Target Setting

How does it work in practice?

Practical Implementation and the ECB’s Guide

Key Areas Outlined in the ECB’s Guide on Climate-Related Risks

ECB's November 2020 guide on climate and environmental risks highlights 13 key areas, including Strategy, Governance, Risk Management, and Disclosures, mandating bank compliance. This mirrors the urgency of addressing climate change, spurring adoption of climate adaptation, ESG, and sustainable and green finance. Yet, mastering environmental and climate risk management remains intricate.

Adapting Risk Management Frameworks for Climate Risks

Adapting Risk Management Frameworks to address Climate Risks entails a focused approach on Risk Assessment, mapping, and integrating Climate Risk Indicators.

Historical Experience in Scenario Analysis and Stress Tests

Leverage historical experience in scenario analysis and climate stress tests to quantitatively assess exposure to transition and physical risks, aligning with sustainability goals.

Banks are urged to conduct comprehensive materiality assessments, risk identification, monitoring, and stress tests, considering diverse transition scenarios.

As Climate-Related and Environmental Risk Measurement requires unique methodologies and longer timelines, financial institutions need to enhance their risk management and measurement toolkits. The ECB's guidelines necessitate progress in climate risk disclosures, climate stress tests, and thematic reviews.

Key Features

Leveraging Finalyse's expertise in Risk Measurement

Achieving adherence to the ECB's Regulatory Compliance

Evaulating Transition and Physical Risk Exposures in Portfolios

Incorporating Climate Risk into Financial Frameworks

Customized Methodology for Unique Institutional Needs

Our subject matter experts

Christophe Caers is a Senior Consultant based in Finalyse Brussels with extensive experience in model development and validation. He has performed full scope validation of several IFRS 9 models from banks operating in the Middle-East. Moreover, Christophe has performed several initial validation exercises on IRB models at a large Belgian bank. Christophe is a certified Financial Risk Manager (FRM).

Meghna Jain is a Consultant based in Finalyse Brussels with expertise in identification and assessment of climate-related risks across portfolios and integrating climate-related risks within the overall risk systems of the financial institution. She has extensive experience with a large European Bank in building scenarios, carrying out environmental risk assessments, setting risk appetites and working with transition risk models for stress testing.